Part of the content that we put out at AP is designed to be educational. Yet we feel there’s also an area where things can be both educational and interesting. The bulk of our readership base is related to global markets in some form, but at varying degrees of expertise.

Based on several requests, we’re starting a primer series for a variety of different financial instruments, based on our experience of trading the products. We’ll point out the common mistakes as well as the little wrinkles to make note of, all of which we hope will make users more informed and close the knowledge gap in areas where information isn’t that readily available.

First up we break down pricing and trading FX Options.

An FX option (FXO) is a derivative placed on underlying foreign exchange (FX) pairs. The FXO gives the holder the right, but not the obligation, to exchange a specified amount of one currency for another at a predetermined exchange rate (the strike price) on or before a specified expiration date.

FXOs are commonly used for hedging against adverse currency movements or for speculative purposes. There are two main types: call options, which give the right to buy a currency, and put options, which give the right to sell a currency. The pricing of FX options depends on factors such as volatility, the interest rate differential between the two currencies, and the time until expiration.

As a disclaimer, FXOs are complex instruments that have the potential for unlimited losses and should only be traded by experienced investors with a full understanding of the risks involved. The prime does not constitute advice or any recommendations to enter into a specific FXO.

When To Trade Using Options

Options have a different risk/reward profile than trading at spot. This can sometimes make them more attractive to take on a position with.

For example, you might have a view that GBP/USD will head higher over the course of the next few months. Yet when assessing where to place your stop loss and take profit level, a spot trade might only get you a 2:1 RR profile.

However, buying an OTM GBP call might be cheap enough that if the market reaches your target level within the period, you could be looking at a 3:1 or 4:1 RR profile.

Another reason why we like to use FXO in some cases is due to the known upfront loss. This makes the product appealing if we are carrying risk over central bank meetings, tier 1 data releases or other macro risk events. On other products, such as spot, there’s the risk of being slipped on your stop. This means that a fast movement through your stop loss could mean that you get filled at the next available price, which could be significantly different.

This risk doesn’t exist with FXO. Rather, if you are buying a vanilla, you have a known and quantifiable loss via the upfront premium.

Finally, FXO can be a great way to harvest yield. In the low vol environment over the past year in FX, there has been good income to be made from selling options over relatively short tenors and capturing the falling volatility (in the difference between the implied vol which you sell at compared to the realised vol). It’s hard to capture this kind of trade via other products, or at least not as cleanly as can be done here.

How To Price

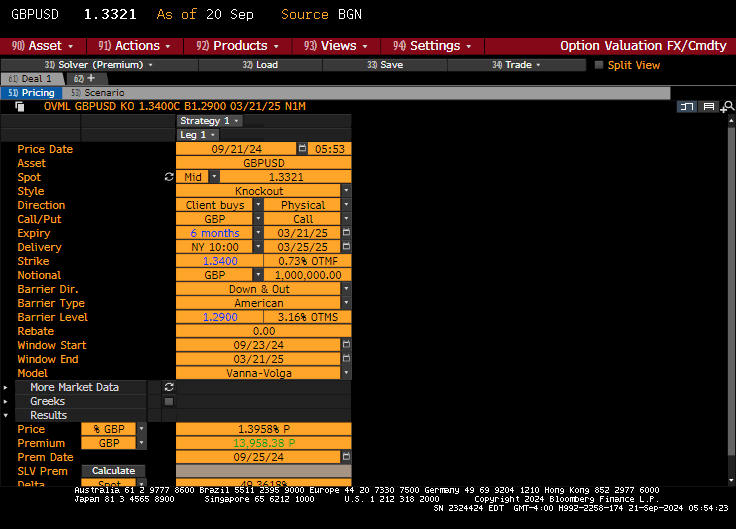

Below shows the Bloomberg pricing screen, which you can toggle to after loading GBP/USD as a security and then going to the OVML function:

There are a host of different fields that a user can change and ones that need to be understood to correctly end up with the specifications you want. We are going to assume we want to buy a 6-month vanilla GBP call with a 1.3400 strike.

Let’s start from the first line and move selectively down.

Price Date - by default is when you price (we did this yesterday).

Style - a vanilla call is, by default, a European style, meaning it can only be exercised on expiry. When we talk about it being vanilla, it’s a straightforward call or put option with no added features on it.

Direction - you either buy or sell the option, with physical delivery meaning that whatever notional we agree to is the amount of currency that could be bought or sold at the strike level.

Call/Put - don’t forget that a GBP call is the same as a USD put.

Expiry/Delivery - in FX, usually there’s a two day difference between the option expiring and the delivery of funds, although this can be longer if non-working days are included (i.e a weekend).

Strike - we select 1.3400, with the field next to it showing how this strike compares to an at-the-money forward contract. In this case, our strike is higher than the 6 month forward price.

Model - If any of you want to trade using a different model than Black-Scholes, crack on.

Price/Premium - now this is what really interests us. The price of the option (i.e the upfront premium) can be specified in a variety of different ways. Typically we look at it as a percentage of the base currency notional. So in this case, GBP %. From this we can see that the 1.3400 strike call would cost us 1.66% in premium to purchase. Given our notional is £1m, the premium paid is shown underneath of £16.5k.

In this example, if we increased the strike of the Call and kept the other parameters the same, the premium cost would decrease. If we moved it lower, it would increase.

The premium is key as it tells us the kind of move in the spot market we’d need to see in order to breakeven. At a basic level, GBP/USD needs to move to 1.3622 (1.66% above 1.34) in order for this trade to breakeven. If we don’t think that can happen over the next 6 months, this isn’t the right play.

Delta/Hedge - we aren’t going to touch on the Greeks too much today, as they deserve their own primer. Yet noting the delta is important. The delta of an option is the rate of change of the option price relative to a change in the underlying.

Put another way, the delta is the percentage probability at the outset that the option finishes in-the-money. So, from this example, we have a 42.47% probability of success. You can edit this field to solve for the strike, for example, if you wanted to buy a 25-delta strike.

The hedge function shows the £ notional that you would need to use if you wanted to become delta-neutral. So, in our case, we are looking to buy GBP at a strike price of 1.34 and sell it at a higher price. To hedge our delta we would sell GBP at spot to begin with, and sell 42.47% of our GBP notional, £424.7k.

How To Structure

Structuring an FXO usually involves either building multiple options together or using non-vanilla styles. The universe of FXO is extensive and simply serves to capture a specific view of a trader.

For example, in our flagship Monday trade ideas this week, we outlined buying a GBP/USD 2-week straddle structure, which involves buying both a put and a call option at different strike levels for the same expiry date. We felt that the premium for both was actually cheap relative to the risk events over this period (i.e the Fed, BoE meetings). This structure allowed us to not have to take a view on the specific direction of GBP/USD, but rather the volatility of the pair. We didn’t care if it went higher or lower as long as it had a decent move in one direction. As it happens, it did, putting the trade in profit.

Below is another example of how an idea can be structured with FXO, using our earlier example of a vanilla 1.34 strike call. Below, we show the screen with one modification, adding a knock-out feature:

A knock-out is a feature that causes an option to cease to exist if it trades past a certain price level/barrier. So in this case, we change style type to knock-out, which then adds the below fields of barrier direction, type and level.

The direction here is down-and-out, meaning that if the spot market moves down and triggers our lower strike, the option doesn’t exist. The type is American, meaning that it can be triggered at any point during the six month time period. Finally, the level is where we want to place the barrier. We have selected 1.2900.

Now if we go back to the bottom to check out the premium, you’ll note that it has reduced from 1.66% for the vanilla to 1.40% with the knock-out. This is because the feature is a potential negative for the option buyer. If we buy this option and the market briefly touches 1.2900 before rallying to 1.3800, we wouldn’t be able to profit from this as our trade would be knocked out. Therefore, the cost of buying this to begin with is less than the normal vanilla.

If an investor wanted to cheapen the price of a vanilla, adding this feature is one idea. Further, if you didn’t believe the market would go down to the barrier level, adding it might not be a large risk.

Knock outs can also be placed above the strike price. In this case, we would refer to our 1.3400 call option as having an up-and-in feature. Again, this would cheapen the price of the overall structure, as the call would only go live if a higher barrier level, e.g 1.3700, was triggered.

The bottom line with structuring is that there are countless possibilities for building a trade that gives you much more specific details to express a particular view.

Understanding The Smile

When looking at pricing an FXO, the volatility smile is one of the key things we look at. Here is the smile curve in white for the 6-month GBP/USD expiry, alongside the 3-month equivalent in yellow:

First let’s break down what we are looking at here. On the Y axis we have the implied volatility of the option, which is a factor that goes into the price of a FXO.

On the X axis, it shows us the level of delta of the option. In the middle is at-the-money, so basically, a 50-delta strike. As we move to the right, we have Call options (C), moving more and more out-of-the-money. The far right is a 5-delta call, so clearly something with a high strike. The left-hand side is the same style but with puts (P).

Implied volatility generally is higher for OTM strikes. This is driven by investor behaviour and market perception, where the probability of extreme moves (either up or down) is perceived to be higher than what normal distribution would suggest. As a result, the curve of the volatility skew is what gives the diagram it’s name as a smile.

The smile can give us some interesting information. For example, both the 3m and 6m expiry have a skew towards the left. This means that puts are more in demand than calls over these timeframes. This could indicate that investors are cautious about a move lower in GBP/USD. Although this wouldn’t have to change our view (of buying a 1.34 call), it does provide a quick and easy finger on the pulse of where the skew is.

We can also observe that 3m ATM vol is higher than 6m. This is interesting. It could suggest that the market expects higher price fluctuations in the short run due to immediate risks. As such, the implied volatility for the shorter-dated 3m options is higher. The longer-term 6m tenor may have lower implied volatility because you can average out potential volatility over a longer period, reducing the immediate impact of shorter-term events.

For our specific 6m trade idea, we can note that the implied vol is virtually unchanged from ATM strikes through to 25 delta. This means that our 42 delta 1.3400 strike is in the right ballpark for us not to suffer from any spike in implied vol. If there was a spike for whatever reason, observing the smile could allow us to move our strike to a different level.

If you have enjoyed the first iteration of our Primer series, then please leave a like and share this article. We’re always open to feedback to improve our content, so drop us a DM if you have any thoughts you want to share or if there are any particular assets/instruments you want to see featured in the future.

This is an excellent primer, much better than what most Inv Banks publish.

Why was it cut (ended) at the smile, I felt it wasn't finished and the rest of the trade implementation (and analysis) was left hanging, is the article longer/finished in the paid version?

The step by step Bloomberg screens is what NOBODY does (except the guys at Bondistan :) ).

I suggest to give us the subject or name of the upcoming primer, also when will it be launched, that way we keep an eye on dates and set time apart to read diligently (the first digestion takes time).

Excellent, keep on!

Excellent piece, looking fwd to more 🍷