SOFR options are arguably the purest expression of monetary policy risk in global markets. While SOFR futures have become the benchmark for short-term US dollar interest rates, options on these futures allow traders to express views on the distribution of outcomes, not just the level.

They are where rate-cut hopes get repriced in seconds, and where convexity lives. When the market wants to place a low-cost, leveraged bet on the Federal Reserve doing something unexpected, this is the first stop.

In this primer, we’ll run through:

- SOFR Futures

- SOFR Option Specifications

- Pricing and Vol Dynamics

- Key Participants

- Trading Strategies

- Risks and Considerations

The Underlying: SOFR Futures

SOFR (Secured Overnight Financing Rate) futures are contracts that reflect the compounded average of daily SOFR overnight rates over the contract’s period. Typically, these are traded as three-month contracts, but other tenors exist.

Quoted as 100 minus the implied interest rate, e.g. 95.00 = 5.00% implied (the IMM Index form)

One tick = 0.0025 (0.25bp) = $6.25 per contract

Deep liquidity out to ~3 years (e.g. Z5, H6, M6)

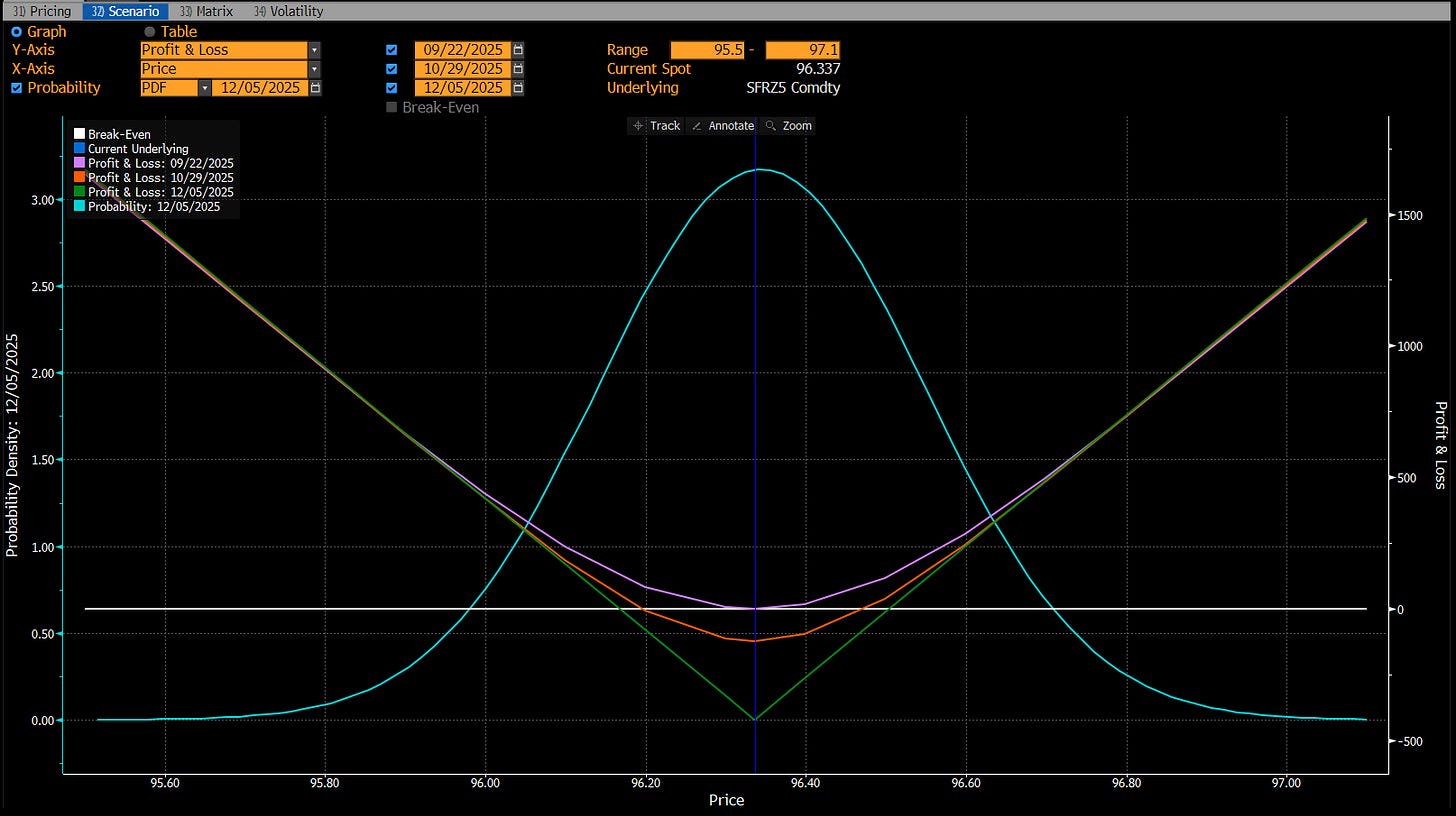

For example, the SFRZ5, trading at 96.33, is the December 2025 SOFR futures contract, showing the market implying a rate of 3.67%:

Options trade on these futures, not directly on SOFR itself.

If you want a deeper rundown on SOFR itself, you can read our previous primer on STIR Trading.

SOFR Option Specifications

SOFR options are listed on CME and are structured as American-style options on both three-month and one-month SOFR futures contracts.

They can be exercised early and settle into the corresponding futures contract on expiration (for standard options). Each option represents the right, but not the obligation, to buy (in the case of a call) or sell (in the case of a put) the underlying futures at a predetermined strike price.

Remember that due to the IMM quoting, if you expect interest rates to fall more than currently expected by the market, you’d buy a call. If you expect them to rise, you’d buy a put.

Strike prices are listed in fixed increments, usually 25bps apart, although strikes closer to the prevailing futures price are often listed in finer increments to meet demand for at-the-money liquidity.

Option premiums are quoted in futures ticks, with one tick the same as the underlying futures contract. This makes the premium translation between price and dollar terms straightforward for traders managing risk across both options and futures books.

Expiration dates are scheduled either weekly or monthly, with each option expiring on the Friday immediately preceding the start of the underlying futures delivery month. This creates a clean handoff: once exercised or expired, the position simply rolls into the active futures contract, allowing traders to manage duration risk without operational frictions.

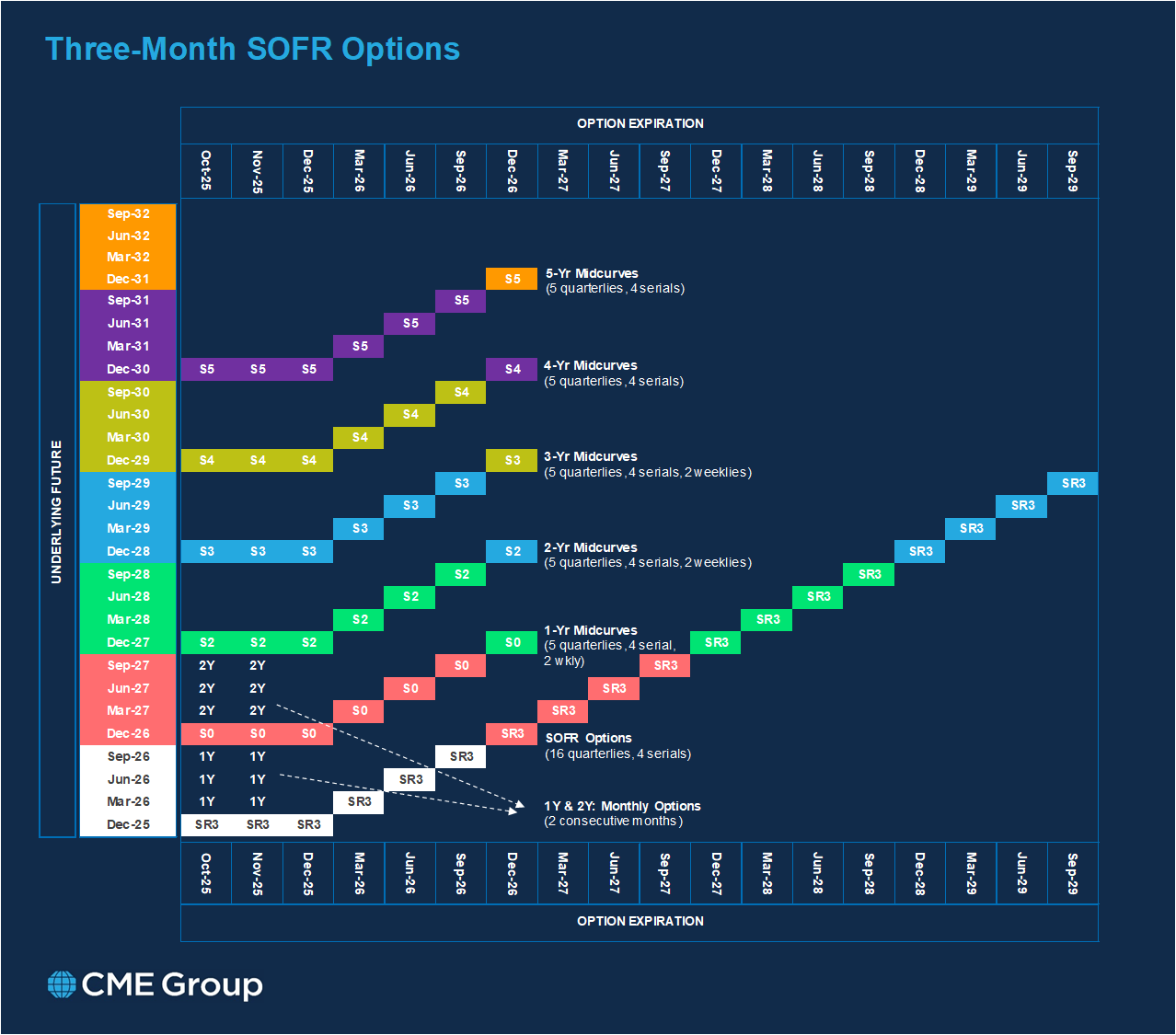

However, you can also trade mid-cuve options, which have an expiry date well in advance of the futures contract. For example, you could buy a December ‘25 expiry mid-curve call on a March ‘26 SOFR future.

When exercised, SOFR options settle into the corresponding futures contract. Those futures are themselves cash-settled at expiry against the compounded SOFR index; there’s no physical delivery of an underlying bond. This structure eliminates delivery risk and makes the product clean for hedgers and speculators.

Below is a useful visual depiction of available options based on expiry dates relative to the underlying three-month SOFR future settlement dates.

Pricing & Volatility Dynamics

SOFR Options are priced a bit differently from what most equity or FX traders are used to. Instead of quoting implied volatility in the usual lognormal terms (percent moves), they’re quoted in normal volatility, measured in basis points.

That distinction matters a lot. Normal vol describes the expected absolute move in interest rates, not the percentage move in price. For example, a 50bp normal vol on a one-year SOFR option means the market expects rates could swing about 50bp over a year, not 50% of their level.

This approach makes sense for short-term interest rate markets. Rates can sit close to zero or even go negative, where lognormal models break down because percentage changes become meaningless. Normal vols stay stable and well-behaved at any level, which makes risk management cleaner. It also means option Greeks like delta and vega behave more intuitively: vega is linear to rate changes, not proportional to price returns.

The big takeaway is that when you see SOFR option vols rising along the curve, it’s signalling that traders expect a wider range of possible rate outcomes—not that they expect wild percentage returns. It’s a direct measure of policy-rate uncertainty in basis points, which is exactly what matters for this part of the market.

Vol Surface Dynamics

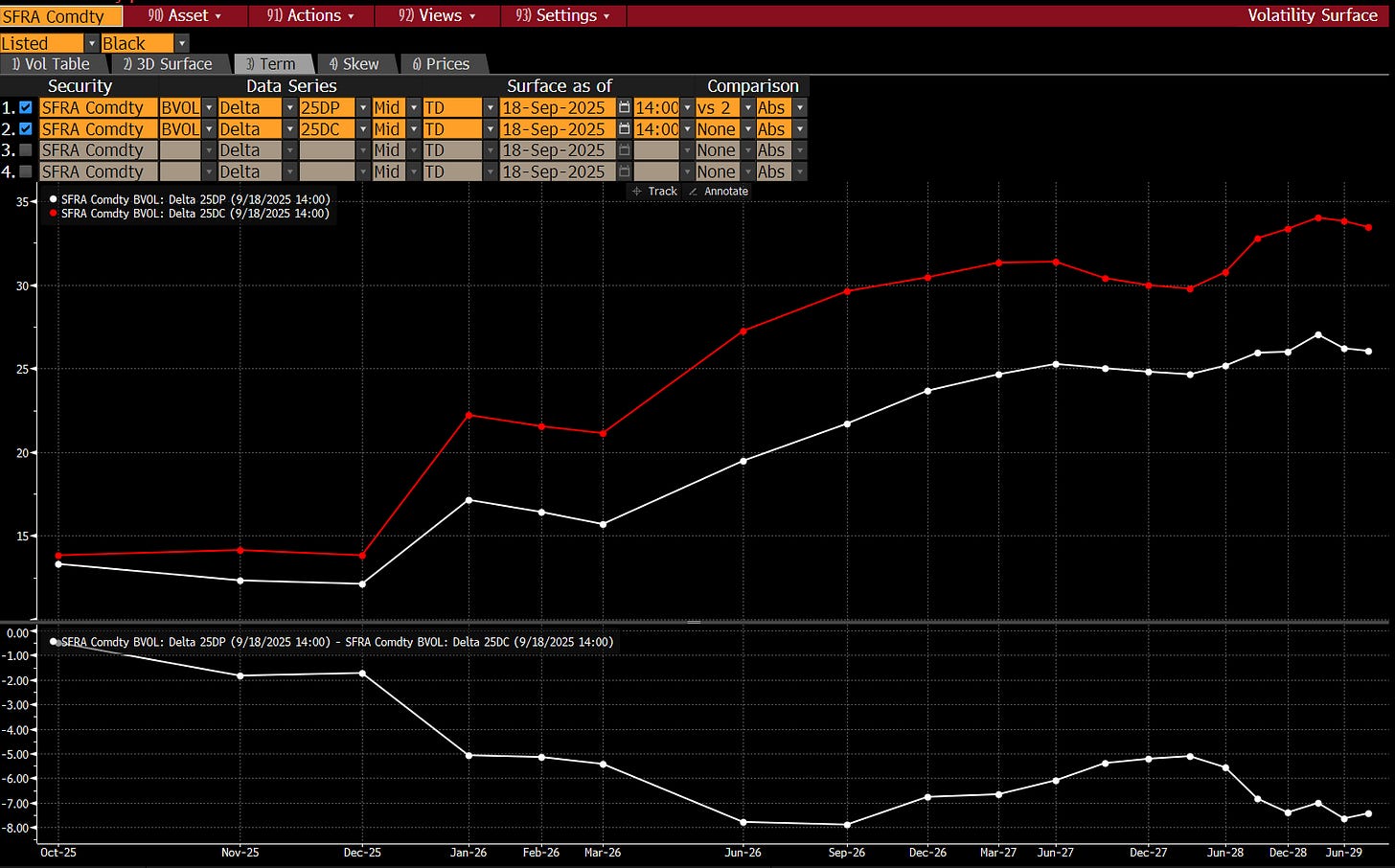

Consider the below vol term structure, with 25 delta puts in white and 25 delta calls in red. The skew is shown in the bottom pane.

Even without trading, we can get valuable information from this. What we’re looking at is not a single tenor’s continuous vol curve, but rather a sequence of expiries stitched across the SOFR strip (whites, reds, greens, blues). Taken together, they show a familiar pattern: implied vols are higher in deferred contracts than in the front, a patchwork term structure that reflects the market’s pricing of greater long-term uncertainty. Medium-dated vols pick up sharply, and skew leans to calls.

In rates, skew is usually such that receivers (rate puts, calls on price) are richer than payers, because crash scenarios map to sharp rate cuts. That’s why implied vol shows ‘negative skew’ even though it manifests as calls (lower rates) trading above puts.

This suggests hedgers and speculators are less worried about sharp Fed hikes (tail risk priced out), and more worried about persistent or renewed downside in rates.

Key Market Participants

In the past, SOFR options were traded primarily in the institutional market. However, this is changing, with a growing interest from the sophisticated retail segment emerging. Of course, notional volumes are still heavily skewed towards institutions.

Hedge Funds

These funds use the options space to express directional policy views or tail hedges. They give traders exposure to short-term funding costs, effectively acting as a clean and liquid proxy for Fed policy expectations. So the fund might use them offensively to express directional views on how many cuts or hikes the Fed might deliver.

The appeal of using options instead of the futures contract lies in their convexity; small moves in implied policy can generate outsized gains in well-structured option trades. For example, a hedge fund anticipating a more dovish pivot than markets currently price can buy calls on SOFR futures, capturing upside if rate cuts accelerate. Conversely, selling volatility through SOFR options can monetise elevated hedging demand when markets are nervous. This makes them powerful tactical tools, especially around key data releases and Fed meetings.

Banks/Dealers

Banks and dealers1 are the ones who keep the market running. They’re not just passive intermediaries; they’re the primary liquidity providers, market makers, and risk warehousers. When asset managers, hedge funds, or corporates want to buy convexity or hedge policy risk, it’s the dealing desks at tier 1 banks who quote the prices, take the other side, and manage the flow.

These desks operate as volatility hubs: they run large books of SOFR options, dynamically hedging the gamma and vega they absorb, and using swaps, futures, and other options to offset risk across the curve. Their constant two-way quoting keeps bid-ask spreads tight, which is what allows the market to handle size. It’s also why implied vol surfaces in SOFR are smooth (most of the time), because they reflect dealer pricing models as much as end-user demand.

While many of these desks are housed within banks, it’s worth noting that several of the largest designated market makers are independent trading firms. In fact, non-bank players often take down as much, if not more, flow than the traditional bank dealers. Together, they make up the core liquidity provision that keeps SOFR options tradable at scale.

Because these banks are effectively long liquidity and short optionality most of the time, they shape how the market reacts to shocks. When volatility spikes, dealers can pull back or reprice aggressively, which amplifies moves. And when volatility fades, they step back in, tightening spreads and rebuilding inventory. In short, banks and dealers are the backbone of the SOFR options market.

Asset Managers

SOFR options are becoming an increasingly useful tool for asset managers, who approach the market from a very different angle than dealers. They use options to shape the risk profile of their portfolios. For large fixed-income managers, SOFR options offer a clean way to hedge policy-rate exposure without having to unwind core bond holdings. A well-placed payer structure can protect against a rates selloff, while receivers can cushion the impact of surprise Fed cuts.

These players are typically slow-moving but size-driven. They come into the market with large notional needs tied to duration targets, liability matching, or regulatory capital requirements. Because of that, their flows can move implied volatility: when they build protection, vols tend to richen, and when they unwind, dealers are left long gamma and vol softens. They also tend to prefer longer-dated tenors, which adds depth and liquidity to the back end of the curve.

Corporate Treasury Desks

Although not a big player, there’s steady participation from corporate treasury desks, though their role is more episodic and purpose-driven than the flow-driven presence of banks or asset managers. Treasuries use SOFR options as a risk management tool. Their exposure comes from floating-rate debt, commercial paper programs, and planned funding needs, with options that give them a way to cap or floor borrowing costs without locking in fixed rates outright.

When a treasury desk fears rising short-term rates could hit interest expense, they’ll often buy payer options to set a ceiling on costs. Conversely, if they’ve got excess cash and want protection against falling reinvestment yields, they may pick up receiver options. These flows are typically chunky and infrequent, tied to funding cycles or major corporate events like acquisitions or large bond issues.

Because they operate on long decision cycles and focus on downside protection, corporates aren’t a constant source of liquidity. But when they show up, they matter.

Trading Strategies

Besides hedging, SOFR options are used for a range of directional and volatility-driven strategies:

Vanilla Calls/Puts

The bread-and-butter trade for retail and macro funds alike has been outright vanilla options on deferred contracts. The logic is simple: if you think the Fed is going to be cutting rates faster than the curve implies, buying calls a few quarters out gives you cheap convexity. It’s a levered way to play the easing cycle without taking duration outright, and the upside looks outsized if the policy pivot comes early. The reverse can be applied if an investor feels rates will stay higher than anticipated, buying puts in the process.

Calendar Spreads

Timing matters, and that’s where calendar call spreads come in. Traders buy calls in one expiry while selling calls in a later one, effectively betting the easing cycle kicks off earlier than priced. If the Fed moves a quarter or two sooner, that front-end call explodes in value while the back-end short leg bleeds. It’s a way of monetising not just the direction of rates, but the timing of policy shifts. Turning a vanilla option into a spread trade also limits the premium outlay to begin with.

Straddles/Strangles

For those less interested in direction and more in fireworks, straddles and strangles are the go-to. A straddle (buying a call and put at the same strike) or strangle (buying out-of-the-money call and put) is a pure volatility bet. Rates can move up or down; you just need them to move enough. These trades have spiked in popularity around FOMC meetings, jobs reports, and CPI releases, where realised volatility often overshoots implied. For traders conditioned by equity earnings straddles, SOFR options are a natural extension into macro vol.

Risk reversals

Finally, risk reversals are all about skew. In SOFR options, puts have historically been cheaper than calls, reflecting the market’s bias toward easing. Traders who think the market has the skew wrong flip the trade (selling expensive calls to fund cheap puts or vice versa). It’s a way of taking a stance not just on direction but on how the market is pricing risk asymmetry. In practice, these are favoured by more sophisticated retail accounts and smaller prop shops looking to capture mispricings in implied skew.

Risks & Considerations

There are numerous disclaimers and risks that should be included in a Primer discussing options on futures contracts, but we have decided to expand on a few that are definitely worth noting.

Theta Decay

Time value bleeds fast in short-dated contracts, and with SOFR options now listed in weekly cycles, traders often underestimate how quickly premium erodes if the expected move doesn’t arrive on schedule. It’s why a perfectly “right” Fed call can still lose money if the timing is off on the expiry for the option.

Liquidity Pockets

Another overlooked issue is liquidity. While the front-month, near-the-money strikes trade deep and liquid, venture too far out-of-the-money or into deferred expiries and depth thins quickly. Spreads can widen, fills can slip, and unwinds can cost more than expected. For retail traders stepping into this market, that risk is amplified. There’s no Robinhood-style order book smoothing here.

M2M Swings

It seems obvious, but P&L can swing violently with every tick in implieds. A book of short-dated calls or straddles looks cheap on entry, but can be subject to large intraday swings. It’s the classic “convexity cuts both ways” problem.

Implied vs Realised Vol

SOFR options often price in hefty event premiums, especially around FOMC or NFP weeks. If realised volatility underdelivers, traders are left overpaying for insurance that never pays out. In practice, this is the single biggest drag on speculative P&L in the product.

Discipline around entry levels and understanding when implied vol is already “rich” is what separates the winners from the churn. Inexperienced traders often buy cheap out-of-the-money options, only to watch them expire worthless as the Fed moves slower than expected.

Key Takeaways

SOFR options are the market’s sharpest instrument for trading Federal Reserve policy risk

They offer convex payoffs but demand precise timing and sizing

Volatility dynamics (skew, term structure) reveal market expectations and fear

Hedge funds, along with banks and dealers dominate flow

Like all options, theta decay, IV crush and M2M swings are key risks to be aware of

SOFR options are a tactical tool, not a passive hedge. They are where monetary policy conviction meets market leverage, with the market becoming an area of increasing focus for both retail and professional investors alike.

We hope you enjoyed this primer and insights on SOFR options. Please leave a like to show your support. As always, comments and opinions are welcome in the comments.

AP

“Dealers” is used broadly to mean the designated market makers in SOFR options. Some are bank-affiliated desks, others are non-bank trading firms. But in practice, they all function as liquidity providers and risk warehousers.

Love these primer series, especially helpful as an aspiring finance professional! Keep up the great work!

Another good installment. I’ve not used payer and receiver in SOFR options before. I need to understand that better.