Gold Down, Silver Up

Reasons for a catch up in the precious metal space.

Financial markets have made some interesting moves in recent weeks, which provide a glimpse into the inner workings of trades, cross-asset correlations, and sources (or lack of) liquidity.

We spotted another one on Wednesday, with gold starting to move lower at the same time as silver began to catch a bid. Given that the historical correlation between these two precious metals has been strong and positive, the inverse nature might surprise some.

Today, we discuss some of the reasons that could be linked to the move and some broader thoughts on the outlook for precious metals going forward.

Spread trades

Recently, people have been in one of two camps for gold. Either you’ve been long or have added long exposure. Or you’ve thought that gold is looking slightly overdone in the short term and could be due for a tactical pullback.

Yet taking an outright gold short trade is risky. A way to reduce this risk is to be short gold via a spread trade. A spread trade involves simultaneously buying and selling two related financial instruments to profit from the difference in their prices rather than from the directional price moves of the individual assets.

You’re not betting on one asset going up or down; rather, you're betting on the price relationship between two assets changing in your favour. As such, spread trades can help reduce risk, since gains on one leg of the trade may offset losses on the other.

So if you wanted to express a gold lower view via a spread trade, you could have put this on via shorting gold and buying silver (aka being short XAU/XAG). In fact, last weekend we actually discussed this as a team.

It appears this spread trade did attract interest from other parties, which would explain the opposite move in gold and silver over the past few days.

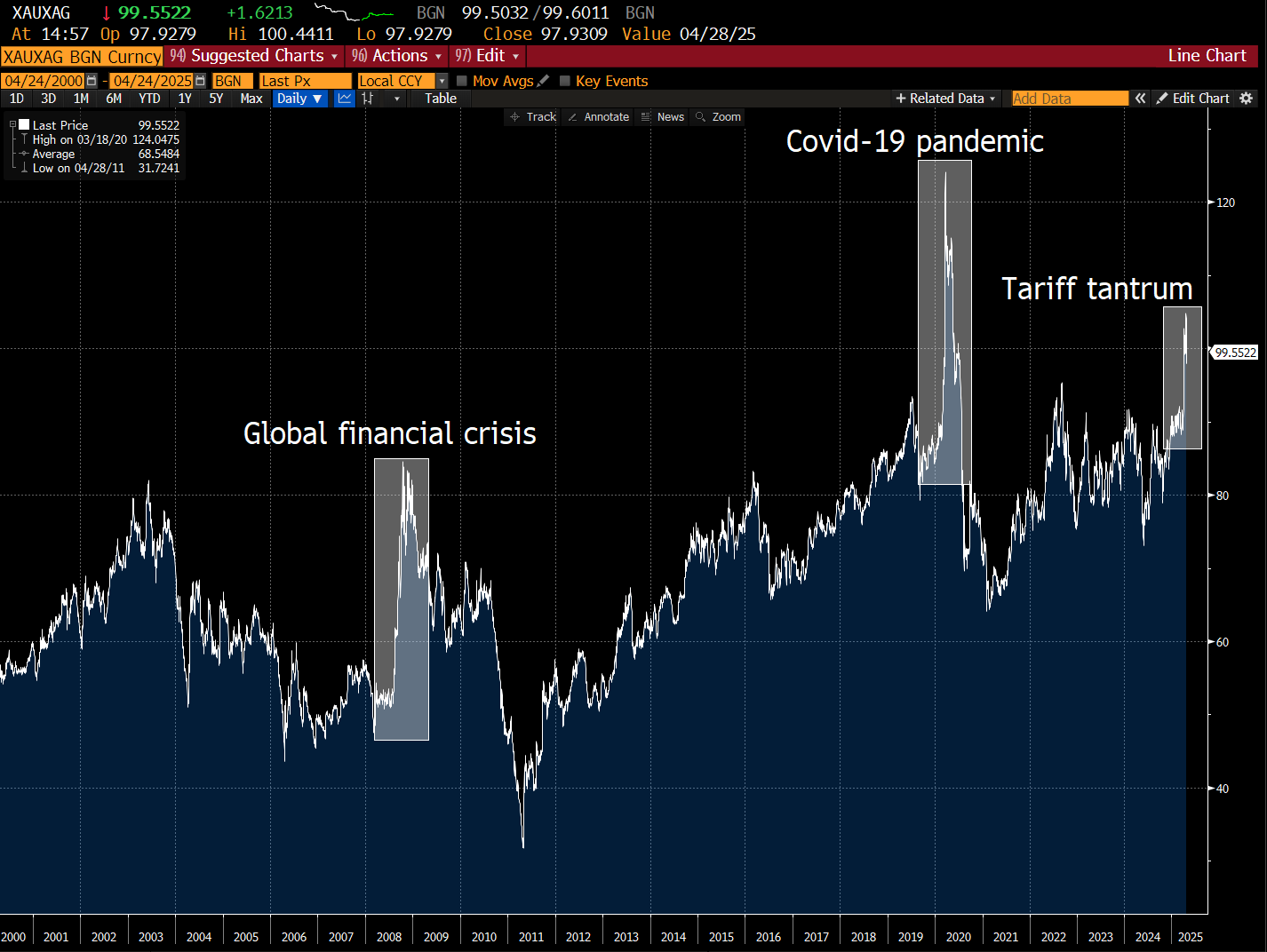

This becomes even more apparent when considering how much the spread has blown out in XAU/XAG in recent months. The below pull shows the ratio between the two assets since the turn of the century:

We’ve seen some comments about the spread being wider than during the GFC. This is technically true, but even before the period recently (that we call the tariff tantrum), the spread was almost at peak GFC levels, so we don’t read much into this.

Interestingly, we’re at the highest level since the pandemic, which in turn was the highest ratio for over two decades. We’ll get into reasons why the trend higher in the spread has made sense, but when taking this as a snapshot of the price action this week, it’s clear that gold is either overstretched or silver needs to play catch-up to make the ratio compress slightly.

Investors putting on this spread trade acted to pull XAUXAG lower.

High beta silver

Another factor at work could be more of an emerging trade for the coming weeks. Let’s say you’ve sat on your hands for the year concerning getting long gold. The move has happened, and you want to find ways to catch up.

Getting long silver (up a relatively modest 12.5% YTD versus gold) could be seen as a catch-up idea. Investors taking profit on gold may cycle into silver to retain precious metal exposure at what is perceived to be a better value. Further, for those who don’t feel comfortable shorting gold (even in a spread trade), getting long silver is another way to express either stagnation in gold or a change in the wind.