Golden Age of Macro Whiplash

How we’re thinking across equities, bonds, and FX during the macro headline chaos.

Without trying to sound like a broken record, we’re hitting your inboxes with a second note on tariffs this week. What happened over the last 36 hours can only be described as a rollercoaster, and assets act accordingly.

In a sweeping decision, the US Court of International Trade ruled that the administration had improperly imposed wide-ranging tariffs on dozens of US trading partners, declaring the legal justification for the levies under the 1977 International Emergency Economic Powers Act (IEEPA) invalid.

The ruling targets Trump’s “Liberation Day” tariffs, which included 30% duties on Chinese goods, 25% on imports from Canada and Mexico, and 10% across a broad swath of global products. The court gave the government ten days to begin unwinding the measures, pending appeal.

For markets, the signal was clear: a major leg of Trump’s unilateral trade apparatus has been structurally weakened, and the implications extend far beyond tariffs.

But just as quickly as the relief narrative emerged, it was thrown into doubt. On Thursday, a federal appeals court issued a temporary stay, pausing the trade court’s ruling while considering a longer-lasting hold on the decision. In parallel, the Justice Department seeks to freeze additional rulings that found portions of Trump’s China tariffs unlawful.

In its filings, the government argued that the trade court’s decision infringes on the president’s authority over foreign affairs and risks damaging ongoing diplomatic negotiations. If lower courts fail to reverse the order, the White House has signalled its willingness to take the case to the Supreme Court.

The appeal will unfold over the coming weeks, with the next major milestone set for June 9, when the current stay order is scheduled to be revisited. In the meantime, the tariffs and the fiscal assumptions built around them remain in limbo.

If this sounds like déjà vu, it should. We’ve entered a new phase of American economic governance, one defined not by coherent policy frameworks but by overlapping legal challenges, emergency authorities, and executive improvisation. The result? A slow-drip deterioration in the machinery of economic statecraft, where each court order erodes the illusion of control.

Policy Volatility, Meet the GDP Print

This week’s market action captured the tension. Equities took the ruling as a green light for risk-on positioning. Treasuries wobbled initially. The dollar opened higher, then gave back gains. Throw into the mix a GDP print that saw the US economy contract in Q1, and the macro picture begins to look less like a trend and more like a standoff between policy volatility and market resilience.

The US economy contracted in the first quarter of 2025, a move widely anticipated by economists and markets alike. Inflation-adjusted gross domestic product (GDP) fell at an annualised rate of -0.2%, slightly better than the consensus forecast of -0.3%.

While the headline confirmed a loss of momentum, it came with important caveats. The contraction was largely driven by front-loaded imports ahead of the April 5th tariff implementation, a timing distortion that subtracted from growth in the near term, even as underlying activity showed more durability. Business investment and inventory accumulation both held up well. Consumer spending slowed, but not catastrophically so.

In short, this wasn’t a recession signal. It was a policy distortion. And the GDP report reads more like a statistical casualty of tariff anticipation than a wholesale deterioration of real economic strength.

Still, the print underscored the degree to which economic data is now being shaped and, in some ways, distorted by policy improvisation. As the Trump administration pivots between trade strategy, legal combat, and fiscal rearmament, the economy is left absorbing shocks from rules that change faster than companies can adapt to them.

For those interested, our notes from the Q1 GDP print are included in the PDF below.

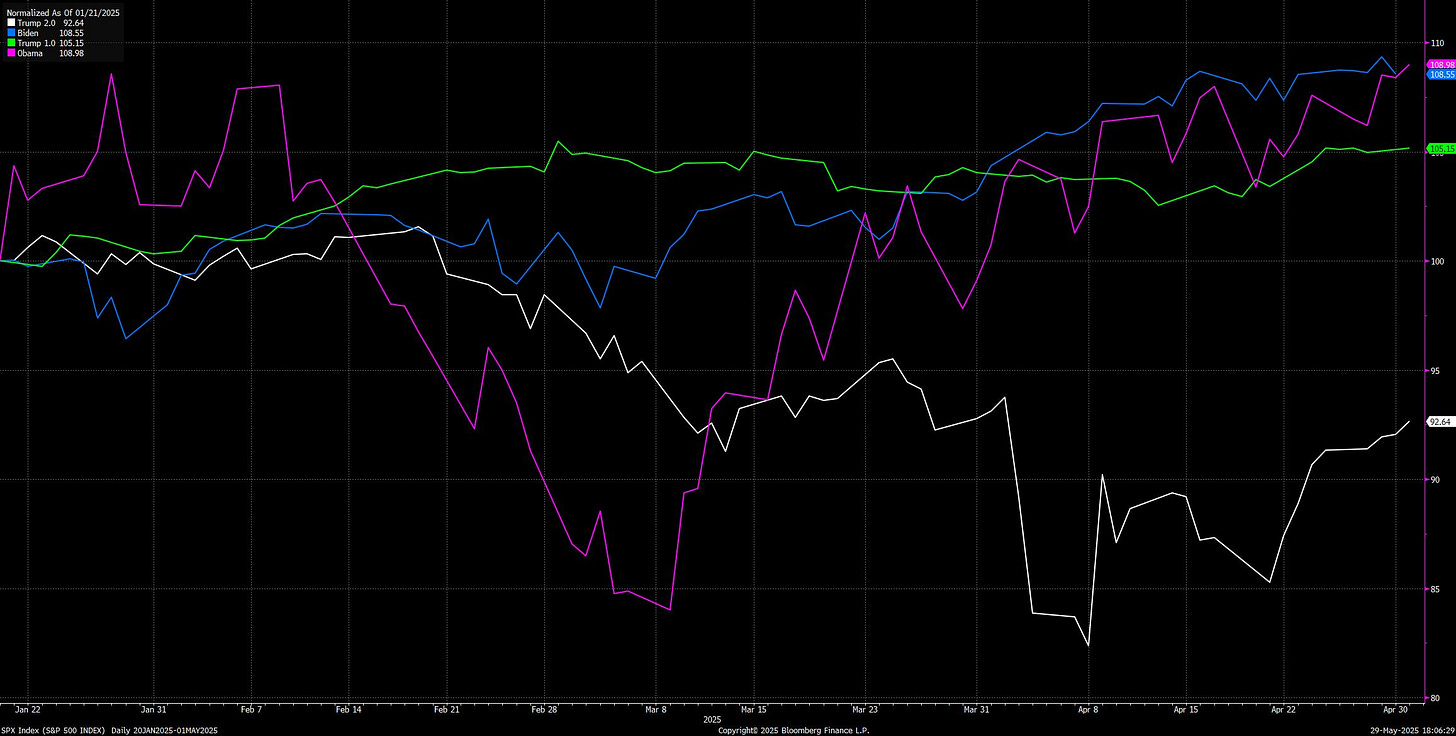

As shown in the chart pack: Q1 under Trump 2.0 posted the weakest equity performance through the first 100 days of any recent presidency.

Market Reaction + Outlook

Equity Indices

Equities were quick to embrace the trade court ruling, with the initial reaction skewing risk-on as tariff headwinds appeared to weaken by the day. While legal uncertainty remains, markets are leaning into the possibility that the most punitive elements of Trump’s trade regime may not survive intact.

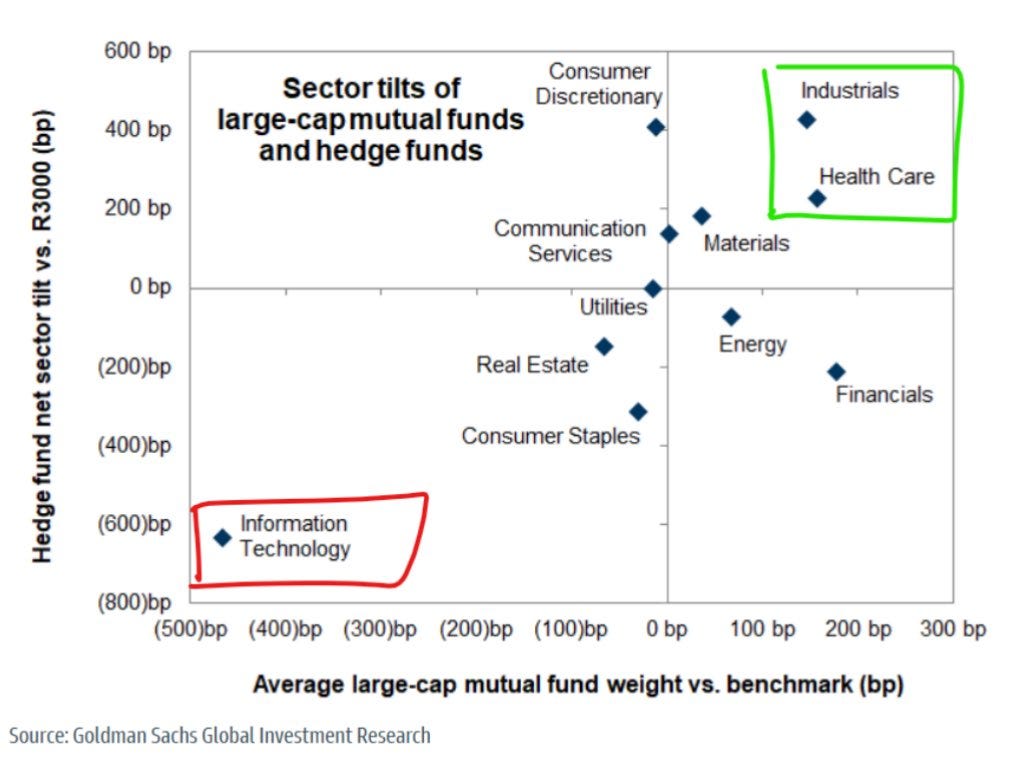

That backdrop and a powerful tailwind from the AI trade (punctuated by a blowout earnings report from NVIDIA) continue to support risk appetite. The narrative leadership from tech remains intact, and while positioning is catching up, funds remain heavily underweight (h/t Lord Fed for the below chart).