Golden Era for the Precious Metal

The tailwinds and possible setbacks for the gold rally.

Whether you’re enjoying the headlines or not, tariffs are the talk of the town again this week—with maybe an exception to a welcomed conversation on U.S. inflation to change things up. There’s no avoiding the constant headlines and their impact on global markets. Metals are under the spotlight this week as aluminium and steel got hit with 25% tariffs from Trump. The levies are set to come into effect on March 12th with no exceptions being made to “simplify” the rules.

However, it is not aluminium or steel that has created the most chatter in the market, it has been gold claiming another new high.

Gold has emerged as one of the hottest major commodities, setting new records almost daily as the trade war escalates. With the prospect of reaching $3,000/oz on the horizon, we continue to have a generally optimistic outlook for bullion in the first half of the year. However, it’s important to consider what factors could trigger a pause in this rally, even if just for a brief moment.

The Tailwinds

Before gold began to flow out of London and into the U.S. last week (arbitragers were exploiting a price gap with Comex futures contracts), its movement was following a fairly predictable trend, appreciating alongside the number of Fed rate cuts the markets were anticipating. However, the impressive 10% gain in bullion this year has occurred even as the Fed has held steady, indicating that gold has deviated from this earlier relationship.

Some of its recent price increase can also be attributed to speculation regarding a potential revaluation of gold by the U.S. from its current stated value of $42.22 an ounce, a figure that has remained unchanged since 1973. While such speculation might appear unlikely to some, virtually anything is possible in today’s political climate. There’s no ruling it out.

Gold is usually an inverse of the dollar. When the dollar is strong, then by necessity it will take fewer dollars to buy gold. This also doesn’t work this time. The DXY is close to its 2022 high. Our bias is that a dollar unwind is near, which further acts as a tailwind for gold’s ascent.

Tariffs and the desire to protect from the likely coming confusion in foreign exchange markets are doubtless factors, too.

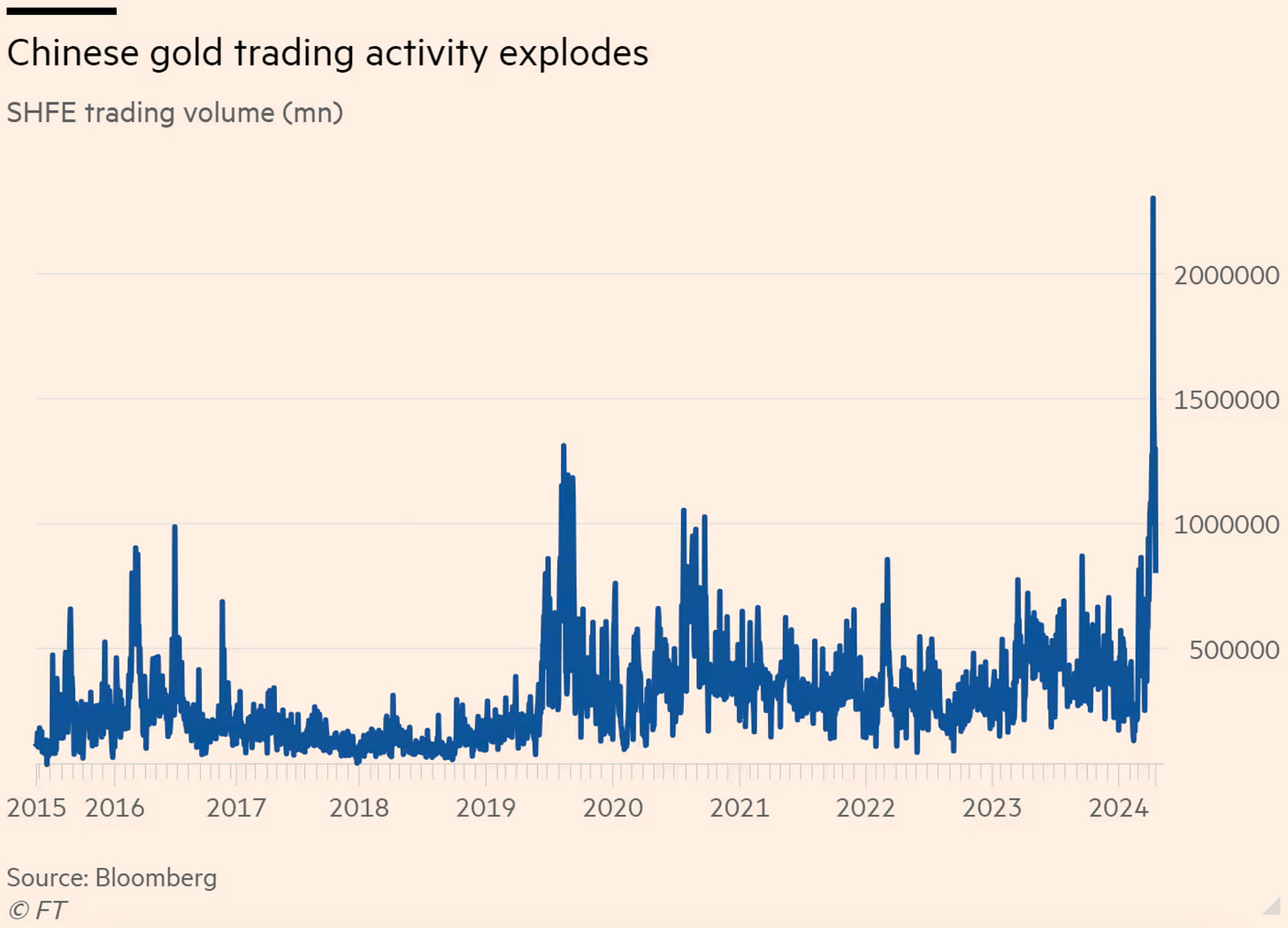

Chinese speculators have also placed significant bets on rising gold prices. This trend suggests that Asian traders are starting to outpace their Western counterparts in shaping the bullion market.

Long positions held by futures traders on the Shanghai Futures Exchange (SHFE) surged to 295,233 contracts, representing 295 tonnes of gold. This figure marks an almost 50% increase since late September, just before geopolitical tensions escalated in the Middle East. Earlier this month, the market even reached a record bullish position of 324,857 contracts, according to Bloomberg data dating back to 2015. Notably, one trading firm, Zhongcai Futures, has built a substantial position in SHFE gold futures, equivalent to just over 50 tonnes—valued at nearly $4bn and amounting to more than 2 percent of the Chinese central bank’s gold reserves.