'He Controlled More Bond Money Than Anyone In The World'

We review the life and career of The Bond King himself, Bill Gross

Back into our regular Sunday flow, we take a look this week at Bill Gross. The PIMCO co-founder is very well respected in the investing world for his role in trading fixed income securities. Given the volatile movements in this asset class over the past year, we thought it a good time to take a look into Gross’ mentality and career in this space.

Who is he?

Bill Gross, born William Hunt Gross on April 13, 1944, was raised in Middletown, Ohio. He showed an early aptitude for mathematics and finance, which led him to attend Duke University, where he earned a bachelor's degree in psychology in 1966.

Following his undergraduate studies, Gross pursued further education at the UCLA Anderson School of Management, where he obtained an MBA in 1971.

Gross's career in the financial sector began at Pacific Mutual Life in 1971, where he worked as an investment analyst. However, his trajectory took a significant turn in 1971 when he co-founded Pacific Investment Management Company (PIMCO) alongside James Muzzy and William Podlich.

Initially, PIMCO operated as a subsidiary of Pacific Life Insurance, but Gross and his partners managed to transform it into an independent and influential investment management company.

Under Gross's leadership, PIMCO became renowned for its expertise in fixed-income investments, particularly in bond markets. Gross developed a reputation as the "Bond King" due to his ability to navigate and capitalize on market trends. His investment strategies, including the Total Return Fund, helped PIMCO attract a vast client base, making it one of the largest and most successful asset management firms globally.

At it’s peak, Gross is said to have controlled more bond money than anyone in the world.

He left PIMCO in 2014 to join Janus Henderson, before retiring from active management in 2019. He still invests personally.

Success with PIMCO

In 1971, PIMCO was founded with just $12m in assets. The latest estimate we could find puts the current AUM at $1.74trn.

Gross personally focused on growing and managing the Total Return fund from 1987 to 2014.

Over this period, he returned an average of 7.9% per annum. For reference, the Barclays US Aggregate Bond Index averaged 6.8% annually over the same period.

This return came despite the fund growing in size dramatically, making it harder to garner such returns in later years. The below chart from Quartz shows the remarkable run it went on in that from 1987 until the GFC in 2008, Gross virtually had zero net monthly outflows from the fund. Rather, money just kept pouring in. This is shown below:

The sharp outflows can be noted when the writing was on the wall about his departure.

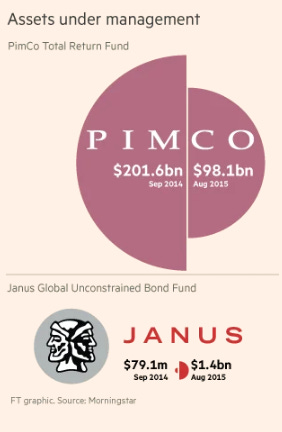

Perhaps one of the most telling signs of his influence in the bond market is shown by the change in AUM’s at PIMCO and Janus Henderson following his departure from one to the other:

A quick reminder: you can become a premium subscriber for just £10 a month. This gives you full access to all of our content, including our flagship Monday trade ideas right through to our stock screeners.

To make the offer even sweeter, we’re offering a 14-day free trial as well. It wouldn’t be fair to ask you to pay without first letting you see what value we offer.

Investment Strategy

We pin Gross’s success on a few different factors:

Focus on Fixed-Income Assets: Simply put, Gross just focused on bonds. He wasn’t multi-asset in his investing style, which worked to his advantage. His strategies often revolved around rotating in and out of various types of bonds, including government bonds, corporate bonds, and mortgage-backed securities.

Yield Curve Analysis: Gross is known for his focus on the yield curve, both in terms of what it tells him about the broader macro environment and also any dislocations that he could exploit.

Active Portfolio Management: He’s an advocate for active portfolio management, constantly adjusting his investment positions based on changing market conditions. His hands-on approach involves monitoring economic data, interest rate movements, and geopolitical events to make timely investment decisions.

Interest Rate Forecasting: Given the impact on bond prices to movements in monetary policy, it makes sense that Gross was smart in this area. He closely followed central bank policies and interest rate trends, leveraging this insight to adjust the duration and composition of his bond portfolios.

Contrarian Investing: Gross has occasionally adopted a contrarian approach, deviating from consensus market views. For example, he jumped onboard buying Government debt post-2008 after thinking (ultimately correctly) that quantitative easing would inflate prices of such securities.

Quotes to live by

Gross has written several books over the decades and given countless interviews, providing us with a deep pool of comments that either made us laugh, pay attention, or just make us think deeper. Here are some of our favourites:

'If companies don't know that they can run out of money, they won't be thinking of ways not to run out of money'

'Do you really like a particular stock? Put 10% or so of your portfolio on it; make the idea count. Good ideas should not be diversified away into meaningless oblivion'

'People have different impressions of themselves, and where reality lies is somewhere in between'

'Bond investors are the vampires of the investment world. They love decay, recession — anything that leads to low inflation and the protection of the real value of their loans'

'When you're underperforming the index, you go home at night and cry in your beer. It's not fun, but who said this business should be fun. We're too well paid to hang our heads and say boo-hoo'

The Bond King