Higher For Longer... But We're Talking About Equities

Was last week's rally just noise, or is it a turning point for global equities?

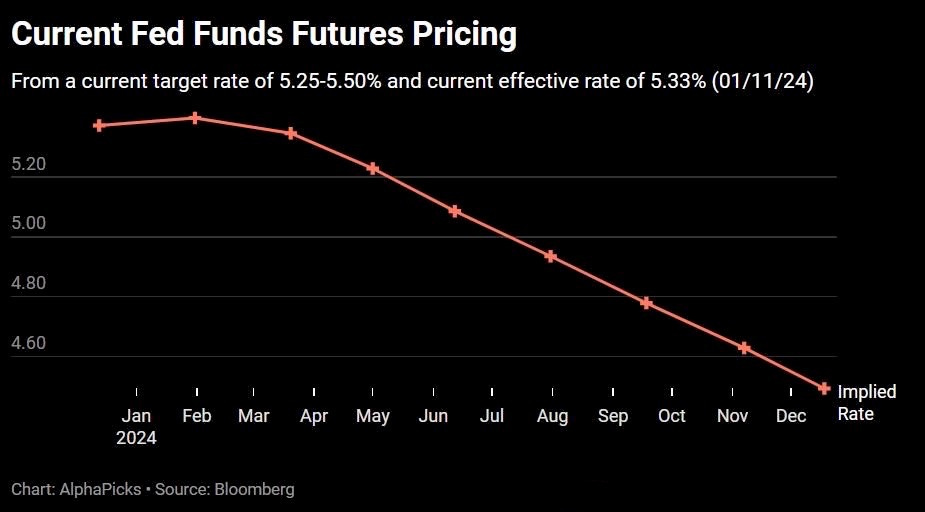

We’re talking about equities when we say “higher for longer” because markets do not believe the Fed when they say it about rates.

The sentiment shift was heard loud and clear last week. The week of 23.10 - 27.10 saw the S&P 500 trade at five-month lows, the FTSE trade in the bottom quartile of its 52-week range, and the Stoxx 600 trade just 0.7% from YTD lows. The week of 30.10 - 03.11 saw a 5.8%, 1.8%, and 3.4% rise, respectively.

The Fed took a dovish stance, which allowed markets to rethink “higher for longer” and price in lower rates (chart below). This stance will likely be followed by other central banks, which allowed global equities to rally.

Last Week: A Turning Point

There are several key points to indicate a turning point last week: yields, growth, and the dollar.

Firstly, bonds.

There has been a change of heart in global bonds and yields.

Over the past month or two, sovereign bond markets have experienced a slight panic, with US Treasuries at the centre of it. However, that has altered as US projected debt issuance has fallen short of expectations, and the Fed and other central banks have shown little interest in continuing to raise interest rates.

It now looks as though a peak of at least short-term significance came on 19 October for bond yields - or rather for US Treasuries, as both gilts and bunds had topped out earlier this year.

Secondly, growth.

Cathie Wood's "disruptive innovation" ETF made a 20% move higher last week. The fact that ARKK is currently bouncing indicates a change in mood. The market believes that rates have peaked and that a decline may occur sooner than the Federal Reserve is attempting to suggest.

Growth is often a quickly discarded asset in times of economic uncertainty. But there's a point to be made that it is quickly adopted when markets are ready to go risk-on.

Thirdly, the dollar.

The hope that the Fed is done raising rates was bolstered greatly on Friday by news that the US economy added fewer jobs than expected. In turn, that helped to derail the US dollar's recent strong run, as you can see from the chart above.

The US dollar is the most important price globally. When rising, monetary policy tightens for everyone. When falling, conditions ease.

In the rest of this article, we’re going to analyse world indices — the potential upside they have into year-end and what 2024 has in store.

A 7-day free trial can be accessed here.