Hit With A Double Blow

More bad news for the German economy.

Europe was supposed to be in the headlines this week for the scheduled ECB meeting, where policymakers are due to reduce rates by 25bps. However, it is now facing a double blow from carmakers in the bloc’s largest economy, Germany.

As attention shifts, albeit briefly, from the U.S. to the Euro area, some key aspects need to be highlighted. The ECB’s descent from 4.5% rates has the potential to strain the Euro, and there are headwinds for the DAX and Stoxx 600.

A little midweek musing is needed.

ECB

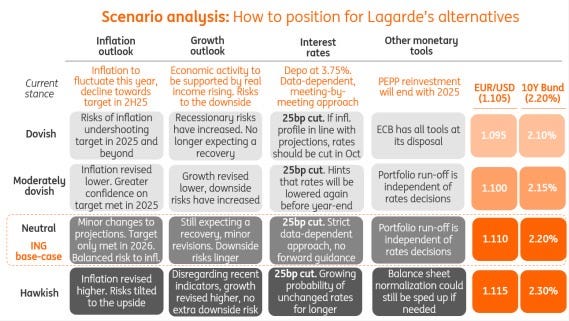

While there isn’t much variance in expectations for this week’s meeting (25bps is priced in), there still remains some uncertainty about rate cuts to come.

Data in Europe has been faltering, which may lead to the central bank lowering rates faster than markets currently believe. This week’s meeting could prove an essential catalyst for the market to start thinking about larger cuts.

The major knock-on for this will be seen in the Euro pricing lower if further cuts are measured.

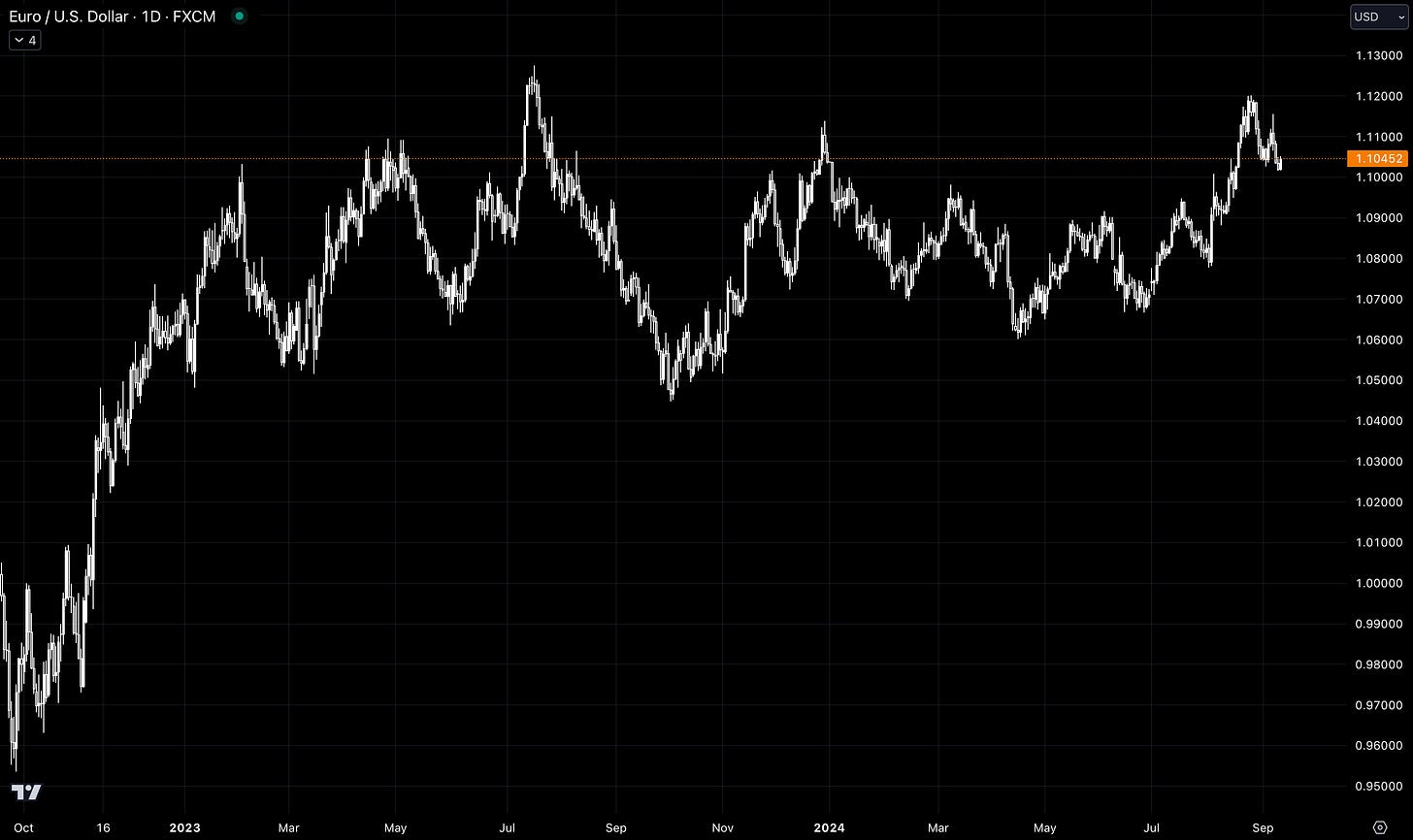

Euro-dollar parity was a call from Morgan Stanley earlier this week. That may seem a little stretched with the pair at 1.104 currently.

Scenario analysis from ING is worth noting ahead of Thursday’s meeting.

Stoxx 600

The Stoxx 600 wasn’t immune to the August weakness, falling 7.3% across three trading days. However, the recovery staged after this event proved even better than that of the one seen across the pond, as the index reached a new high.

Now, we must look at reality. France remains in a political stalemate, and Germany’s automobile sector—which comprises 10.76% of the DAX—is on its knees.

Let’s take a look at some different sectors.

Automakers

Volkswagen is ending job protections that auto workers in Germany have enjoyed for three decades as part of a cost-cutting push, after last week announcing plans to potentially close factories in the country for the first time ever.

VW’s plans may result in unintended additional costs for the company. Ending the guarantees triggers higher wages under previous collective bargaining pacts.

They’re in a sticky situation, but as is the case with the biggest companies, there is an unlikelihood that this materialises into anything catastrophic. The German government won’t stand on the sides and watch their giant fall.

Now BMW, a rare bright spot among Germany’s industrial stalwarts, has had its wings clipped by Continental, another example of a century-old company struggling through the transition to EVs. The carmaker expects earnings to fall significantly below last year’s €17.1 billion ($18.9 billion) while forecasting its auto-making operating margin would be as low as 6%, compared to a previous low of 8%.

An interesting chart that came across the screen yesterday: German automakers versus EuroStoxx. Maybe there’s a short trade in the sector…

Luxury

It feels sensible to move straight into the luxury sector but with a focus on a luxury automotive name… Ferrari.