How High And How Fast?

The BoJ are the last central bank with negative rates and are now preparing to raise.

Policymakers at the Bank of Japan are currently in the midst of a series of complex policy debates as they prepare to raise interest rates for the first time since 2006. The central bank has already indicated that it is almost ready to end the era of cheap money, with the first rate increase expected in March or April.

However, they still have some challenging decisions to make, such as whether to raise rates to zero or directly into positive territory, what to do about the bank's extensive bond portfolio, and, most crucial of all, how to signal the path of interest rates beyond the first increase without causing any disruption for global markets and Japanese lenders.

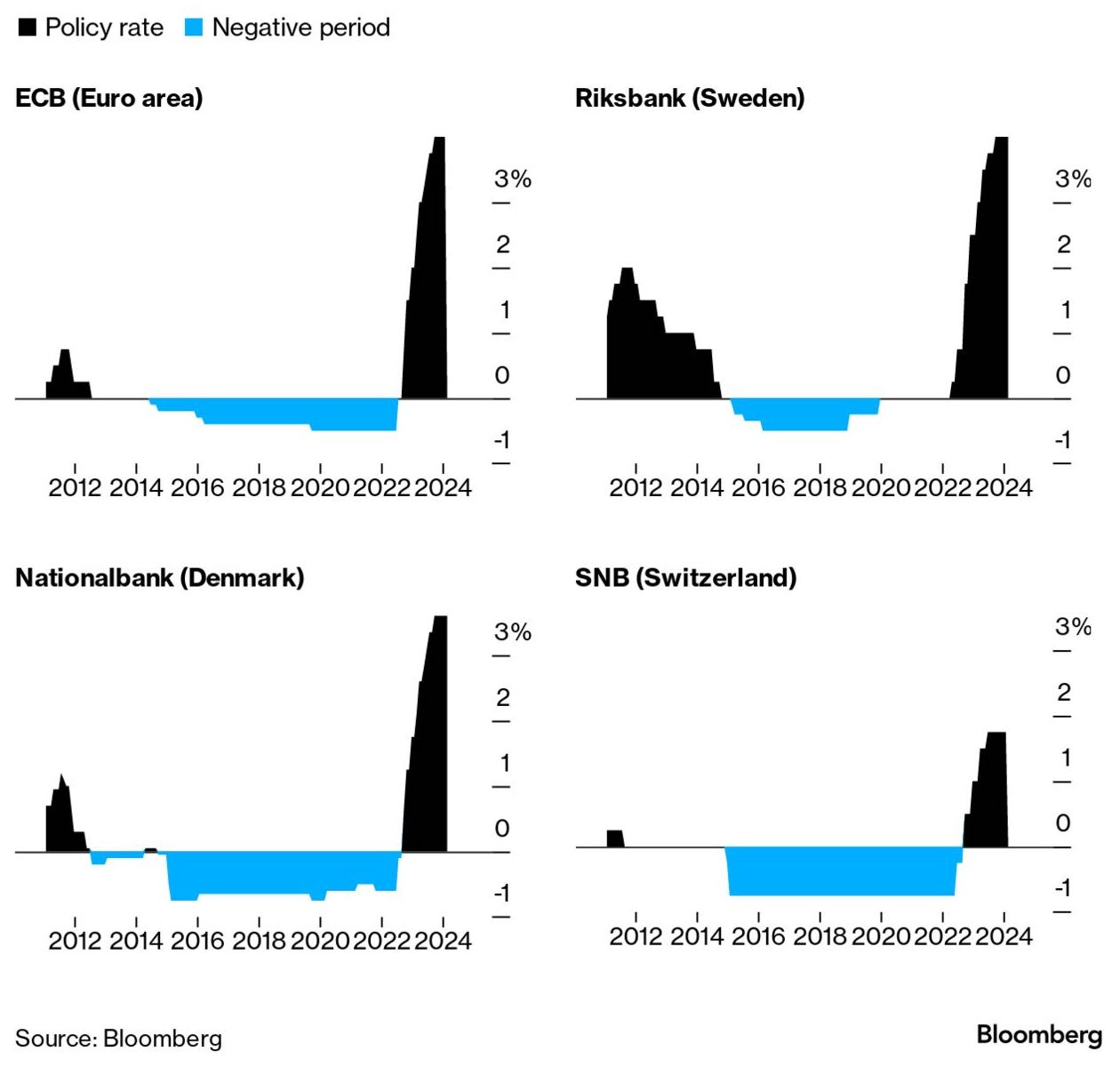

In late 2020, several central banks, such as the European Central Bank, the Swiss National Bank, and the Bank of Japan, had interest rates in the negative zone. However, inflation started to rise, and the ECB moved out of negative territory. In September 2022, the SNB hiked its rates, leaving the BOJ as the last central bank with sub-zero rates.

When and how fast?

They are expected to increase the rate by 20 basis points to 0.1%. In a recent speech, BoJ deputy governor Shinichi Uchida suggested that this decision would raise money market rates from slightly below zero to a range between zero and 0.1%.

The Bank of Japan also faces a complicated decision about whether to abandon its three-tier system of interest rates, which it established eight years ago to encourage interbank trading and limit the impact of its negative interest rate policy on bank earnings.

While it may seem logical to return to a zero-interest rate policy without tiering, it won't be easy to do so. According to BoJ expert and chief economist at Totan Research, Izuru Kato, removing the tiering system would result in a lack of incentives for banks to trade in short-term money markets unless the BoJ reduces its excess reserves by shrinking its balance sheet.

One possible solution would be for the BoJ to maintain a two-tier system, as the Swiss central bank did when it returned to a positive policy rate in 2022, in order to avoid a decrease in interbank trading.

In terms of technical decisions, the BoJ's approach to policy normalisation will differ from that of the US Federal Reserve and the European Central Bank. This is evident from the series of rate hikes carried out by the latter two institutions in 2022 in order to combat inflation.

Markets players are still divided on how gradual the pace of rises will be. Yamawaki and UBS expect the policy rate to stay at zero or 0.1 per cent until 2025, while Morgan Stanley anticipates it rising to 0.25 per cent by July.