How To Position For A Trump Win

Ideas and thoughts as the Trump precedency probability rises.

Last week, former President Trump and current President Biden went head to head in the first US election debate. This comes ahead of the election on November 5th.

For those that haven’t watched the highlights, we’d recommend watching the highlights before reading on.

The fall out from the debate has been large. Regardless of your political views, it was clear that Biden struggled in his mental clarity, which isn’t surprising given his age of 81. On the other hand, Trump’s brash nature and high conviction on key policy issues has given Republicans new impetus in the hope of putting their man back in the White House.

Today we’ll run through the aftermath of the debate, and then go over some takeaways and trade ideas of how to position for the increasing likelihood of a Trump victory come the end of the year.

Before we get into the article, you can become a premium subscriber with us for just £10 a month. This provides you full access to our weekly articles without a paywall, including our flagship Monday trade ideas and full access to what we are buying and selling in our Global Asset Portfolio.

The debate and the aftermath

The debate between Trump and Biden was marked by angry exchanges and frequent interruptions.

One of the key topics for both us and the broader public was the economy, where Trump criticized Biden's policies for fuelling inflation, while Biden defended his economic recovery efforts.

Healthcare was another major point of contention, with Biden advocating for expanded access and Trump attacking the cost and efficacy of Biden's plans. On climate change, Biden proposed targets for net-zero emissions by 2050, whereas Trump remained sceptical about the extent of human impact on climate change, emphasizing clean air and water instead.

The debate also touched on social issues and foreign policy, reflecting stark differences between the candidates. Biden pushed for social justice reforms and strengthened international alliances, while Trump maintained his "America First" stance.

The discussion on COVID-19 was heated, with Biden accusing Trump of mismanaging the crisis to prioritize the economy, and Trump defending his response as effective.

We also can’t pass over a summary without commenting on the exchange between the two of them on their golf game and who was better at the sport.

Overall, the debate's tone was contentious, characterized by personal attacks and a lack of substantive policy discussion. However, a key takeaway many had was that Biden’s cognitive abilities are fading and that his ability to debate is simply not as strong as it was.

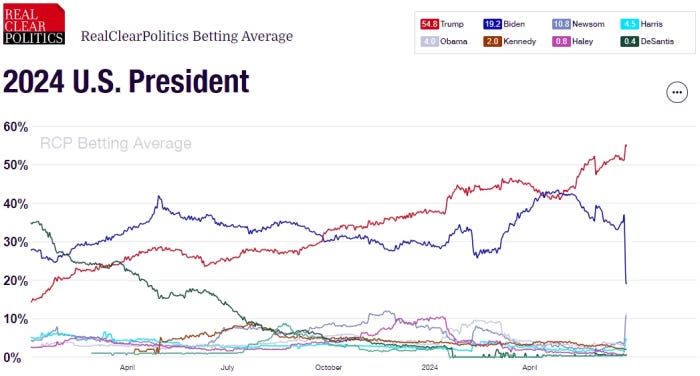

This was reflected in the betting odds after the event, shown below:

Note that although Trump didn’t gain a huge amount, Biden lost a lot of ground. This has sparked a fresh debate this week about whether he will pass the baton on to someone else to run as the Democrat candidate. For example, the percentage chance of Kamala Harris becoming the nominee has jumped to 37%, tightening the gap between her and Biden.

Take these betting odds with a pinch of salt though, after all there’s an 8% probability of Michelle Obama as we stand…

Ultimately, we feel the Democrats are doomed either way. They either stick with Biden (who the debate showed cannot take down Trump) and stand the likely risk of losing, or flip to another candidate and then get lambasted by Republicans for pulling out the President. From our perspective, we think the likelihood of Trump winning is becoming more and more likely.

So how can we position for this outcome via the markets?

FX

Long US Dollar vs MXN, CNH

A Trump victory would likely see him implement more America First policies. This would include a tougher stance on immigration, along with tariffs on imports from other countries (e.g China).

We feel this would be supportive for the US Dollar, with a lack of selling pressure coming from more costly imports and the potential for a looser fiscal stance seeing higher for longer interest rates (more on that later).

When pairing up where we’d get short, the obvious candidates to us would be the nations that either trade a lot with the US or that have a high migration rate to the country. Therefore, we point the finger at Mexico and China, and use the peso and the yuan as currencies to get short.

As a risk, it’s hard to isolate just this theme and put it on via a currency trade as a high conviction play. There’s so much more that goes into influencing how a currency trades than just the above. But in terms of an expression, this seems fair in our eyes.

USDCNH might be preferred as shorting USDMXN comes with a cost of carry. Options ideas might also be worth considering on this if you can engineer something not too expensive.

Investors could also look to isolate just the dollar leg of this trade via the DXY. Should we get a break above 107.00, a move back towards 114.00 in the medium term wouldn’t be outside of the realms of possibility.

Rates

Buy Steepeners

Another theme that we’re hearing about in conversations that we think is valid relates to a steeper US yield curve. Let’s work backwards on this idea.

Trump has historically favoured tax cuts and increased government spending to stimulate economic growth. A looser fiscal stance, characterized by higher spending and lower taxes, can boost consumer spending and business investment, driving economic expansion.