"I Just Really Like To Find My Own Ideas"

How contrarian thinking and high conviction paved the career of Michael Burry.

Burry was running his own money long before he rose to fame during the financial crisis of 07/08.

His CDS trade in the mortgage market netted huge profits, something that was featured in the film adaptation of The Big Short.

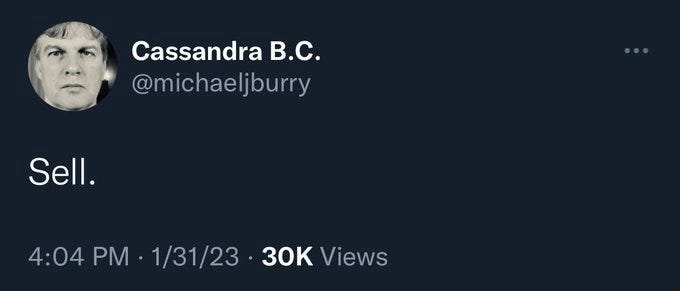

Burry still trades but keeps a low-profile, except from occasional bold tweet.

Michael Burry is an American physician, investor, and hedge fund manager who gained fame for predicting and profiting from the 2007-2008 financial crisis. Born on June 19, 1971, in San Jose, California, Burry demonstrated an early aptitude for mathematics and an interest in finance.

Burry's career began in medicine. He attended the University of California, Los Angeles (UCLA), where he earned his undergraduate degree in economics. He then pursued a medical career, earning an M.D. from the Vanderbilt University School of Medicine in 1997. Burry completed his medical internship at Stanford Hospital and later worked as a neurology resident. However, his passion for investing led him to change his career path.

In the late 1990s, Burry became interested in value investing, inspired by the writings of Benjamin Graham and Warren Buffett. He started his investment journey by managing his own portfolio, focusing on small-cap value stocks. In 2000, Burry founded Scion Capital, his own hedge fund, with an initial $1 million investment primarily funded by his family and friends.

Burry's unique investment strategy involved deep research and analysis of individual stocks and markets. He emphasised contrarian thinking and sought undervalued opportunities that others overlooked. One of his notable characteristics was his ability to identify and capitalise on market inefficiencies.

Burry gained widespread attention for his prescient prediction of the U.S. housing market collapse in the mid-2000s. He meticulously analysed mortgage-backed securities (MBS) and recognised the underlying flaws and risks in the subprime lending market. In 2005, he began purchasing credit default swaps (CDS) on these MBS, effectively betting against the housing market.

Despite scepticism and ridicule from many Wall Street insiders, Burry's bet paid off handsomely. When the housing bubble burst in 2007-2008, Scion Capital made substantial profits, estimated to be in the billions of dollars. His success drew comparisons to legendary investors like Warren Buffett and earned him a reputation as one of the savviest investors of his time.

Burry's story gained widespread recognition through Michael Lewis's book "The Big Short: Inside the Doomsday Machine" and its subsequent film adaptation. Christian Bale portrayed Burry in the film, further solidifying his reputation as a financial maverick.

Following his success during the financial crisis, Burry shifted his focus to private investments and managing his personal wealth. He closed Scion Capital to outside investors in 2008 and returned their funds. Burry invested in various sectors, including agriculture, water rights, and renewable energy. He continued to make contrarian and unconventional investment decisions, often attracting attention and raising eyebrows in the financial community.

In recent years, Burry has remained relatively low-profile. He has occasionally expressed concerns about potential market bubbles and excesses in certain sectors, including the stock market and cryptocurrencies. His tweets and public statements have sometimes caused market fluctuations, underscoring his ongoing influence in the investment world.

“I think a lot of funds get their ideas from Wall Street. I just really like to find my own ideas. I read a lot. A lot of news. I just follow my nose. A lot of times it's a dead end, but sometimes there's value there.”

Despite his successes and keen intellect, Burry has faced personal challenges. He has been diagnosed with Asperger's syndrome, a form of autism which can present difficulties in social interactions. Nonetheless, he has channelled his unique perspective and analytical prowess into successful investment strategies.

Michael Burry's story exemplifies the power of deep research, contrarian thinking, and an unwavering commitment to one's convictions. His ability to anticipate major market shifts and profit from them has made him a legendary figure in the financial world. While the future holds uncertainties, Burry's legacy as an astute investor and his impact on the financial industry will likely endure.

Hey man, love your work, would you be interrested in doing a cross post ?