Is Oil Set For $100?

For now, there is not much risk to oil supply. However, markets are cautious about the potential of tensions expanding elsewhere in the Middle East.

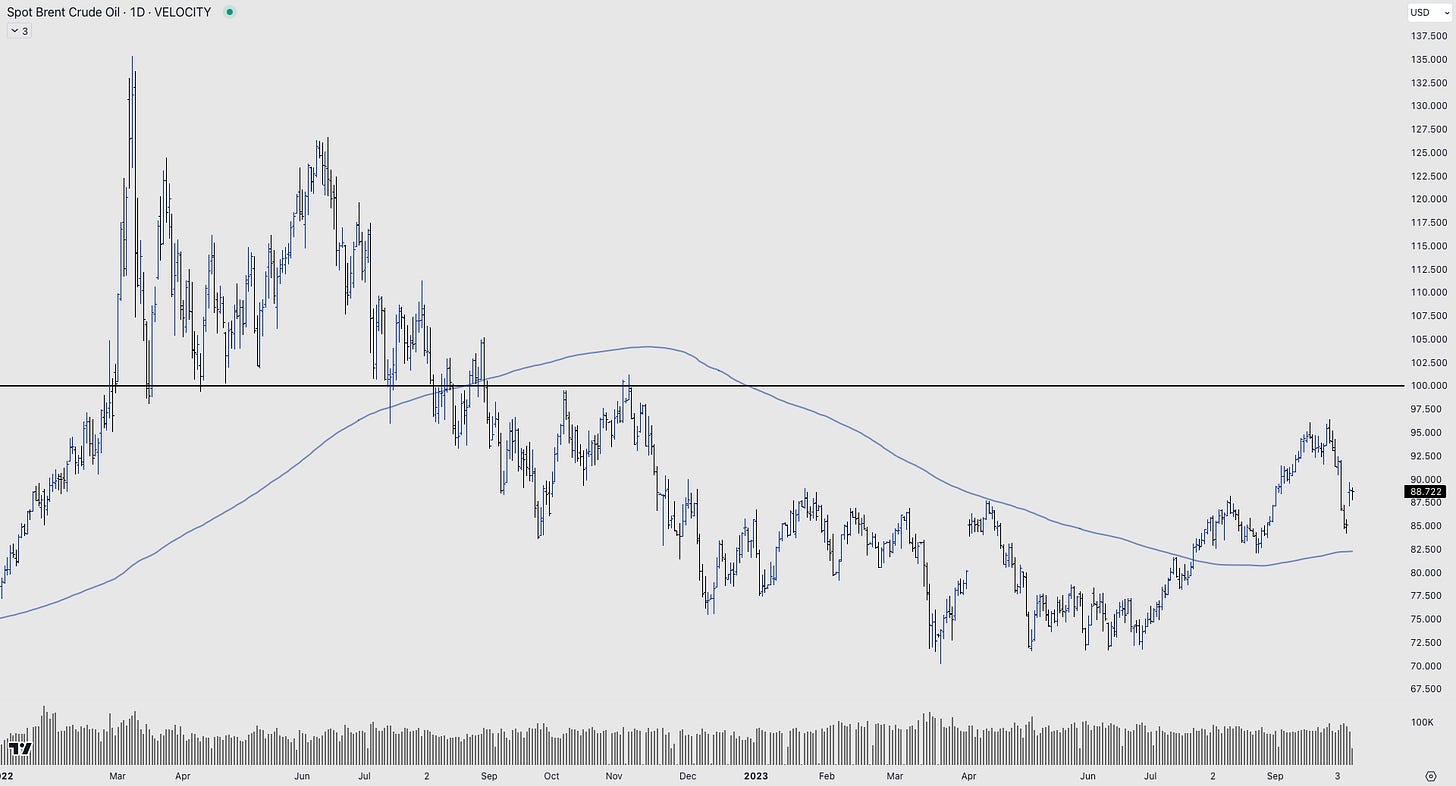

Brent crude, the international benchmark, is on the rise again. Just as oil had started to pare gains from Q3, the surprise conflict in Israel has increased concerns about the possible supply knock-on from the war, sending prices higher.

Let’s clarify one thing to start out: Israel and Palestinian territories are not oil producers. However, the Middle Eastern region accounts for almost a third of global supply. The concerns about the continued effects in the region are the reason behind the price surge of oil over the weekend.

Iran’s Part

Iran has become a major source of extra crude this year, alleviating otherwise tightening markets, but additional American sanctions on Tehran could constrain those shipments. Iran said they were not involved in the planning of the attacks, but they did pledge their support for Palestine.

Caroline Bain, chief commodities economist at Capital Economics, said, “The US seems to have turned a blind eye to a steady increase in Iranian production, that... is going to be more difficult for the US to ignore going forward from here,” she said.

It should be expected that the demand for oil will exceed supply in the final three months of the year, and therefore, prices will continue to rise.

Strait of Hormuz

Any retaliation against Tehran could endanger the passage of vessels through the Strait of Hormuz. About a fifth of the global supply would be held hostage if passages are disrupted. The Strait of Hormuz is crucial for the main oil exporters in the Gulf region, whose economies are built around oil and gas production.

More Volatility To An Already Volatile Market

The market saw further bouts of volatility following the assaults after already experiencing significant movements over the previous month. Brent was on track to reach $100 a barrel by the end of September as Saudi Arabia and Russia's measures tightened supply. However, prices took a severe tumble last week due to worries about consumer demand and financial flows.

Early on Monday, the Brent options markets saw a frenzy of bullish activity, with call options that profit from rising oil prices beating bearish put options by more than three to one.

Several banks have shared potential further impacts for Brent Crude Oil:

Citigroup said the hostilities reduce expectations that Saudi Arabia will cut or eliminate its 1 million barrels-a-day of output curbs. Risks are also growing that Israel will attack Iran, analysts including Ed Morse said.

Morgan Stanley said that they thought the impact of the conflict would be limited. For now, they don’t expect a spillover into other countries, meaning there will be a muted longer-term impact on crude prices.

Societe Generale SA said heightened geopolitical tensions could add a $5-$10 risk premium to crude prices.

RBC Capital Markets said Israel will likely escalate a long-running shadow war against Iran, but Tehran’s response to such a move will be less clear.

There Is A Second Factor For Oil

China.

The Chinese government is considering raising its budget deficit for 2023 as the government prepares to unleash a new round of stimulus to help the economy meet the official growth target.

In the rest of this article, we’ll take a look at:

The effect of China’s latest budget on the commodity markets.

The other securities that are gaining favour after the weekend’s conflicts.

The historic moves in oil following Israel-Palestine conflicts.

Actionable trade ideas.