Is Tesla Demand Drying Up?

Price cuts put demand into question, but margins are on Tesla's side. Earnings preview and trade ideas.

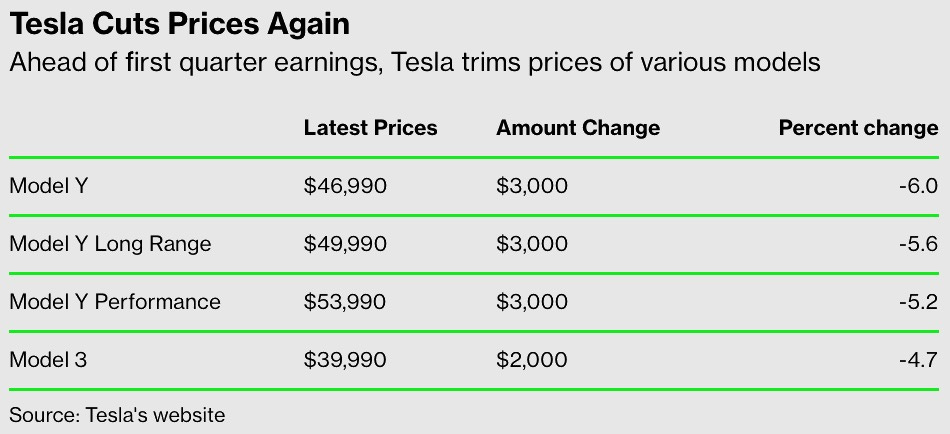

Price reduction on highest volume models

Profit margins key figure for earnings

How to trade earnings

As earnings season goes full steam ahead, there are a few names that will draw special attention. One of those names is Tesla.

On the eve of its Q1 earnings report, the company comes out with some very important news. Elon Musk, the company's CEO, has once again reduced the price of its highest-volume models, showing that he is willing to risk the electric car manufacturer's profitability in order to increase demand.

To Tesla’s benefit, the high-profit margins that the company has means they are able to make this price move without affecting profitability. Something that rival EV makers, such as Ford, Lucid and Rivian, may not be able to do.

Backlog dry up?

Tesla first made price cuts in January of this year. Musk said on an earnings call that orders were running at almost twice the rate of production. But the company was unable to sustain that supply-demand dynamic — deliveries rose about 4% from the fourth quarter, and Tesla produced almost 18,000 more cars than it handed over to customers.

Despite a second round of discounts to the Model S and X in early March, Tesla delivered just 10,695 of those vehicles in the quarter, the lowest since the third quarter of 2021.

This latest decision will likely lead to some Wall Street estimate cuts, with evidence suggesting that Tesla’s order backlog may well have dried up.

All will be waiting to see the Q1 figures released this evening, Wednesday, 19th April.

So, what are the Q1 estimates?

Adjusted EPS estimate: $0.86

Revenue estimate: $23.37 billion

Free cash flow estimate: $3.27 billion

Automotive gross margin estimate: +23%

Gross margin estimate: 21.2%

Capital expenditure estimate: $1.76 billion

Cash and cash equivalents estimate: $21.37 billion

Margins are a key focus of the first-quarter call, with analysts looking to see if Tesla can stay above their 20% gross margin target. However, some margin will have been sacrificed so they can meet their volume targets.

Tesla currently has 26 buys, 16 holds, and 6 sells among Wall Street analysts.

The average price target is $207.84, which represents a 14.5% upside compared to pre-market prices (at the time of writing).

The implied 1-day share move following earnings is 7.4%.

How to play earnings

Trading specifically over earnings is always a gamble. There is no knowing what way buyers and sellers will take the stock after release. Often, price can swing in both directions. We see Netflix as an example of that yesterday. The share price fell 12.5% in after-hours trading, but swiftly recovered. In pre-market, prices are down just 0.8%.

There are a few ways in which you can have an edge and also limit your risk if you decide to trade earnings…