ItDoesNotWork - Why WeWork Was Doomed To Fail

Down 99% from the October 2021 IPO, WeWork shares accurately paint the picture of the business that simply got it wrong.

Charismatic founder Neumann built a flawed company for personal gain.

Low interest rates fuelled a valuation that was far too high which was shown up during the pandemic.

We flag up another similar company that could be an attractive short trade.

WeWork is back in the news this week with the release of the half-year results through to the end of June 30th. Revenue for the period was $1.69bn, up modestly from the $1.58bn from the same period last year. A shrinking net loss also is reason for applause. Yet the stock fell by 40% on the simple statement that there’s “substantial doubt” that the company will be able to continue in business.

What went wrong?

Starting with Neumann

Back in 2010, Adam Neumann co-founded WeWork. He was (and still is) and eccentric character. The Wall Street Journal enlightened the world on him back in 2019, and although the original piece is behind a paywall, here are some of the points:

It’s little surprise then that Neumann was asked to step down as CEO in September 2019, before the company went public. Other revelations have come out, including his use of company funds and dubious loans.

The point being flagged up here is WeWork was being run by an incompetent boss that used the business to fund his life, rather than growing it into a sustainable company. This period from 2010-2019 was the time when the damage was done. By the time the business went public in 2021, there was no way back.

Pumped by private equity

In the world of low interest rates that dominated 2010-2020, investors were keen to pump start-ups full of money, prioritising growth over profits.

This was fundamentally flawed, and looking back was a huge red flag. For example, in August 2019, WeWork laid out how it lost $2.9bn in the past three years and $690m in the first half of 2019.

Yet later that year, it was able to raise billions in funding. Not only this, but the value placed on the business rocketed higher. The below graphic from an FT piece in late 2019 shows how the value jumped from $21.2bn in 2017 to $43bn in 2019. This made it third on the list of largest jumps in value.

Should a business making that kind of financial performance really justify such a lofty valuation? We don’t think so. So even before the IPO happened, the true value of the business was much less than investors bought in at.

From that angle, once the truth about the sustainability of the business was found out, losses were inevitable.

Crippled by the pandemic

One factor that was out of WeWork’s control was the onset of Covid-19. However, it did show up the fragility of the operating model.

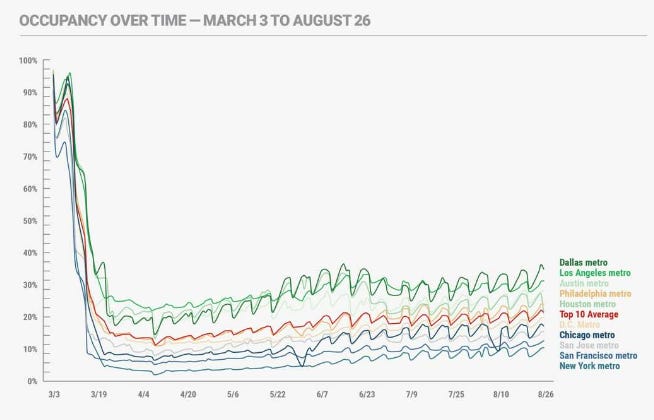

The below chart shows how swiftly US workers flipped to working from home during March 2020 - August 2020:

Occupancy rates fell like a stone. Granted, rates have moved back higher over the past couple of years as pressure has normalised. Yet the flexibility and benefits of remote working mean that many employers are reducing office space requirements.

Being in an office (WeWork or otherwise) simply doesn’t have the demand level that it did pre-2020.

Even here in the UK, headlines like the below are becoming more and more common, with an excerpt from the article included.

“A study by estate agent Knight Frank and another by international management consultants McKinsey and Co, find that at lease 50 per cent of all large, multinational companies are planning to reduce their office space as their workforces’ needs and preferences have altered radically in a matter of a couple of years.”

Ultimately, this has a direct negative impact on WeWork. The structural shift since 2020 mean that in our books, it’s destined to fail.