It's Official, Traders Expect Higher UK Interest Rates Than The US

With year-end rates pricing a 4.80% UK base rate versus 4.55% in the US, we explain why this makes sense and how to trade it.

Latest UK inflation data shows it over double that of the US for March.

Interest rate traders repricing expectations now see a higher year-end rate in the UK than the US.

Based on the forecast being correct, we present our favoured ways of expressing this view.

Earlier this week, the UK March inflation data was released. At 10.1%, it was lower than the previous month of 10.4%, yet came in above expectations of 10% on the nose.

The concern here is that UK inflation is remaining stubbornly high. What makes this more noticeable is when analysing the core inflation figure, which strips out volatile items such as fuel costs. For March, it hit 6.2%, the same as February and an increase from 5.8% from January.

Some would try and argue the problem away, saying that at a global level we’re seeing inflation not subside in a way that many expected. Granted, this is true to an extent when comparing us to the US at a relative level. But as the below chart shows, the level of inflation in the US (gauged by the HICP measure), it HALF of what it is here in the UK.

It’s a global problem, but there clearly should be much more concern about it for UK policymakers, central bankers and investors.

Rate pricing shifting post inflation release

Over the course of this week, the focus has been on the rates market as traders try and surmise how the Bank of England will get inflation closer to the 2% target rate over the coming year.

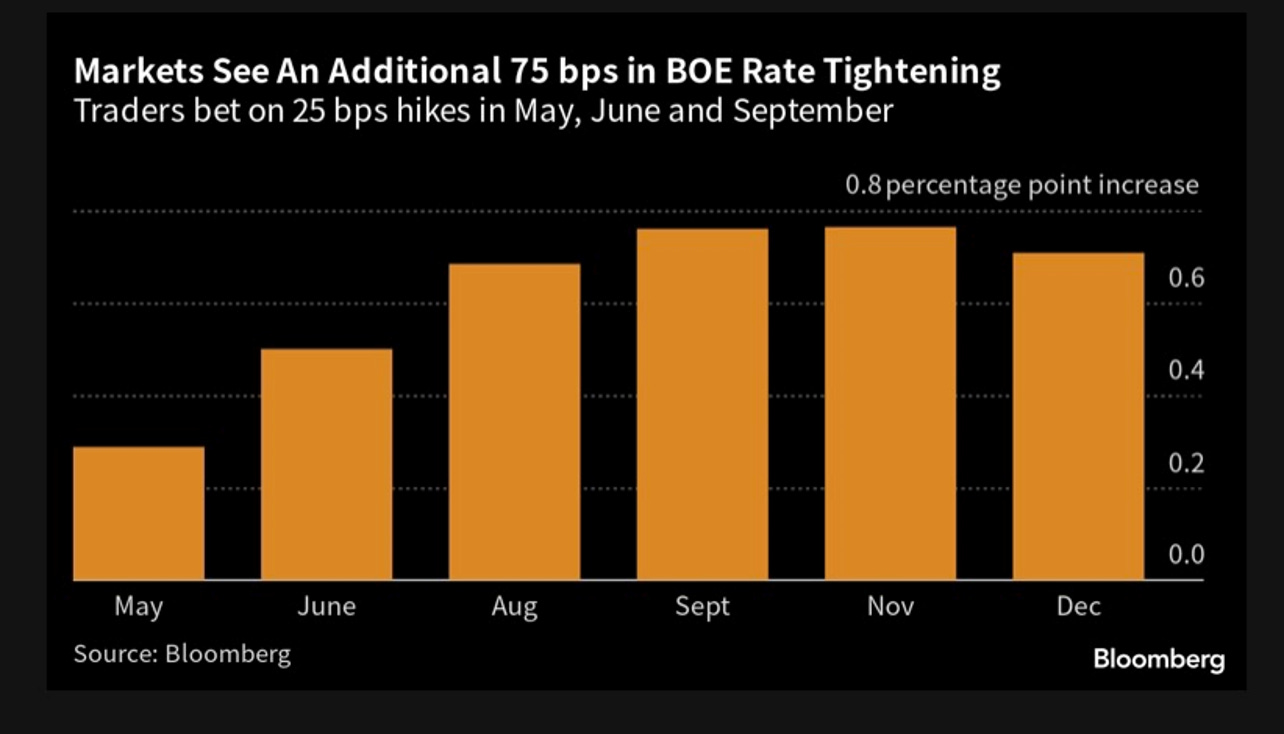

The simple answer is to raise interest rates further. This has now been priced in to the UK yield curve, as the below chart highlights.

On top of a 25bps hike forecasted for May, an additional 25bps hike in June and finally September is priced in, with a year-end rate of 4.80% projected.

This contrasts to the current market pricing for the US, which is forecasted to increase by 25bps in May to a banding of 5-5.25%, but then have cuts later this year to finish at 4.55% by year-end.

While these are just forecasts at the moment, it provides a flip in that investors should be able to find a higher yield in GBP rather than USD, which traditionally hasn’t ben the case.

A poisoned chalice

We feel the shift in rate pricing this week is fair and makes sense. Yet before we offer some trade ideas to express this view, there’s a big caveat to make.

UK yields might be higher than the US over the flagged timeframe, but remember the underlying reason for this. It’s because UK inflation is too high and not under control. This likely falls into the stagflation camp (no economic growth but high inflation) which isn’t a positive.

It could put pressure on the FTSE 100 and FTSE 250 to move lower, as corporates experience lower profits from higher input costs. The cost of living crisis could linger for longer, worsening UK trade data and hurting GBP.

While we aren’t in this situation yet, we note that there’s a good reason why EM currencies don’t massively appreciate in value despite sky high interest rates - the reward still isn’t enough to compensate for the inflation and rocky economic performance of the developing nation.

How to trade it

We present three ideas for different scenarios. The first is for those that feel the rate shift is overdone, and that UK rates won’t hit 5% later this year.

The simplest way is to buy a 6-month SONIA future. These rate futures product is actually widely available even to the retail market from most popular providers. SONIA futures price is calculated as 100 - the expected X-month interest rate. So based on the below curve, the 6 month futures price would currently be around 95.1.

If you feel the rate won’t be this high, you’ll buy the futures contract. Then if the base rate goes to 4% by this time period, the futures contract will rise to 96, netting a profit of 0.9 per contract.

The second idea is for those that feel the current pricing is fair. This makes use of an iron condor strategy that we ran through in detail on Twitter yesterday.