It's Time For Meta To Grow Up As It Turns 20

From Zuckerberg's dorm in Feb 2004, Meta has come a long way, with further still to go.

Over the past couple of weeks, Meta has popped into our news feeds for several different reasons. The links between some of them are tenuous at best, but we thought the time was right to offer our views on the company, the share price and where we see it heading in the future.

Firstly, the headlines:

The birthday

Zuckerberg launched Facebook on February 4, 2004. It was initially aimed at students at Harvard to connect with each other, but the success saw it swiftly rolled out to other colleges in the States.

It grew out quickly, although not without teething problems. Yet when the firm went public back in 2012 at $38, we think few could have imagined the sort of price appreciation over the next decade:

At 20, Facebook is now a much different company from what it was, even when it went public in 2012. For a start, it’s now called Meta, a name brand change made back in October 2021.

The focus of the firm has shifted aggressively towards the Metaverse and artificial intelligence. It also has a broader product offering from Facebook, now including:

Facebook

Instagram

WhatsApp

Messenger

Quest 2

Reality Labs

Another change from the recent past has come with regard to the paying of dividends. Since the IPO, the firm hasn’t paid out income to shareholders, using it instead to fuel growth. Yet this is changing as Meta grows up…

A first dividend payout

The quarterly press release with financial results was released at the start of the month.

One of the points noted was the confirmation of a $0.50 dividend per share:

Today, Meta's board of directors declared a cash dividend of $0.50 per share of our outstanding common stock (including both Class A common stock and Class B common stock), payable on March 26, 2024, to stockholders of record as of the close of business on February 22, 2024. We intend to pay a cash dividend on a quarterly basis going forward, subject to market conditions and approval by our board of directors.

Given that Zuckerberg owns nearly 350 million shares, this would stand to pay him a cool $700m per year.

It’s interesting to note that he only takes a $1 annual salary from the company, although the $27m in expenses last year attributed to everything from his security to private jet usage show that he isn’t a complete Saint. Further, it’s not uncommon for founders to not take money as a salary but rather benefit from dividend income and share price appreciation.

For those who see the dividends as a red flag, we disagree. Some would argue that this shows Meta is running out of ideas, choosing to start paying out income to keep shareholders happy.

Yet the payment doesn’t amount to much. The dividend yield is a pitiful 0.4%, and the $5bn allocated to dividends doesn’t touch the sides of the $43.9bn of 2023 free cash flow.

We do see this as future-proofing the stock as the firm reaches maturity and is a sign that the business is growing up.

The announcement of the dividend wasn’t the only focus of the earnings report, as the 20.3% rally the following day suggests…

A record single-day surge

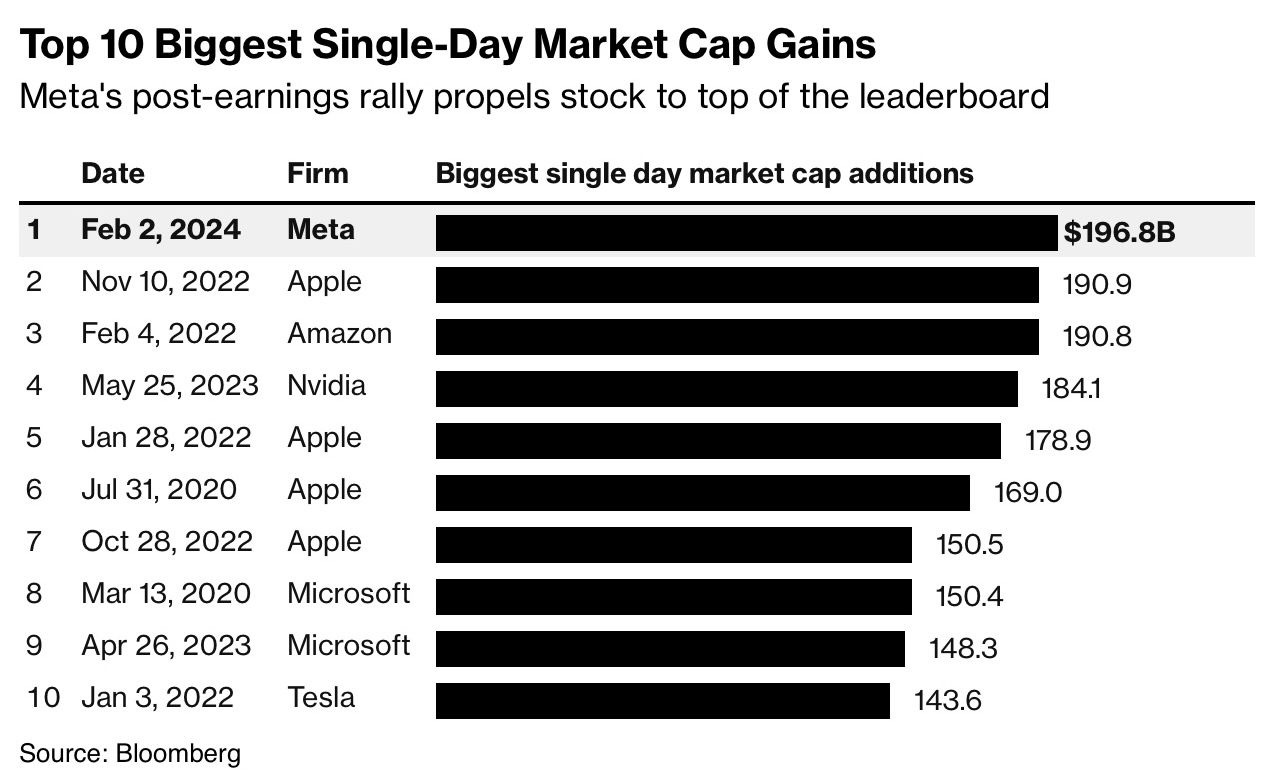

The jump following the release of results added almost $200bn in market cap for Meta, the largest ever:

There were several drivers that supported this jump. The dividend payment was one. Another was a broadly strong set of financial results.

Yet a key factor for us was the continued push and allocation of capital towards AI. We feel that even though other tech companies speak of AI and are trying to adopt it quickly, Meta is at the front of the race with this.