Learnings From Earnings

Takeaways from Q3 results so far.

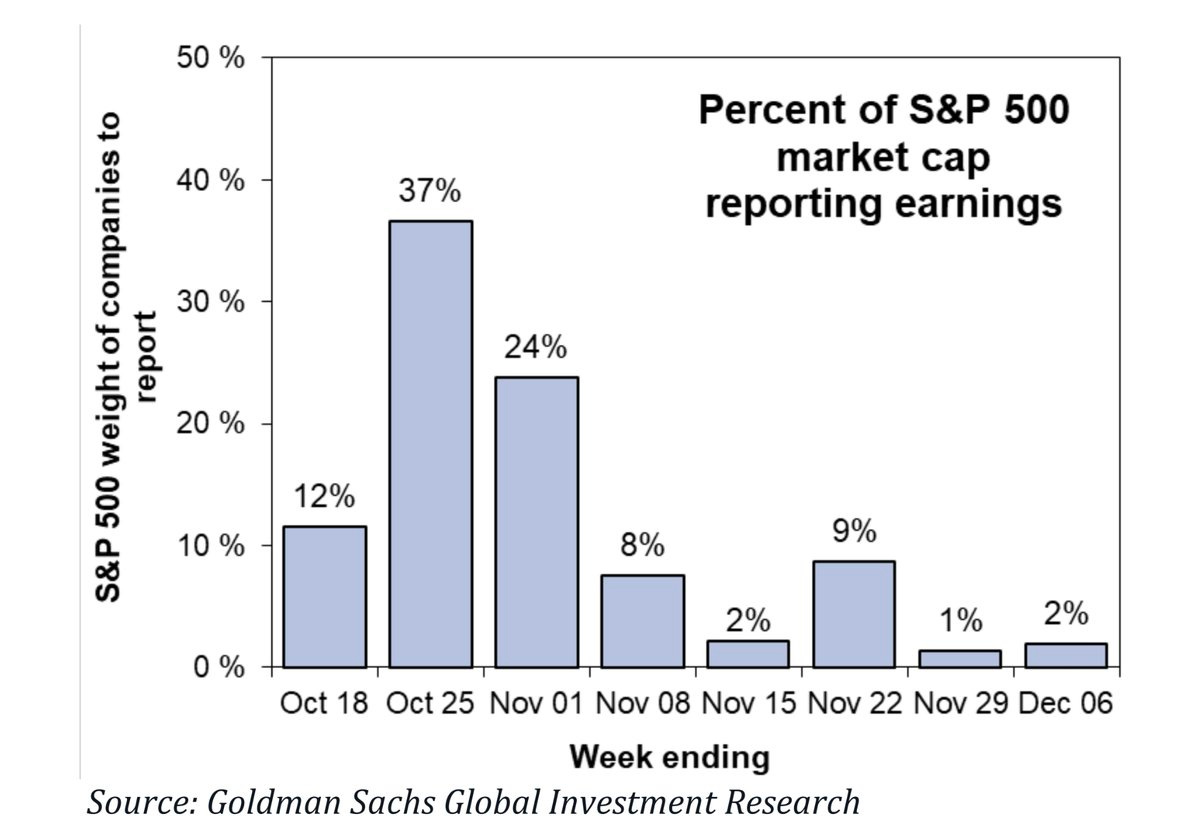

By the end of trading today, 73% of the S&P 500 will have reported their latest quarterly earnings. Although some are still to go (see below), this week and last week have been the busiest in terms of financials and news flow.

It’s easy to get lost in the constant Bloomberg news ticking headlines, so for your (and indeed our own) benefit, we wanted to run over some of the most interesting and valuable takeaways we’ve seen from some key companies from the past week or so, along with our take on things from here.

The Helicopter View

To begin with, let’s take a look at things from a high level. We felt that coming into earnings season, the bar was actually set rather low. A mixed bag of economic data gave some differing views on the health of the economy. For some, even growth names related to AI might struggle to post enough of an earnings beat to keep the sector rally intact.

Yet, as we write, the overall picture still looks rather rosy. We flag up two charts to illustrate this, originally put out by Barclays:

The left-hand chart shows that even as sales beats have moved lower, earnings per share (EPS) growth is improving. In fact, 80% of those that have reported have beaten. That’s impressive. Even with revenue beats being harder to come by, the fact that EPS is increasing shows that the cost-cutting from the past year appears to be paying fruit in being able to keep a lid on costs.

The right-hand chart shows a bias towards a positive share price reaction to earnings releases vs the broader index. Not only this, but note the size of the reaction, greater than 1%, which makes it the largest positive skew since the start of the pandemic.

AI Musings

As regards AI, the earnings season noises thus far have been more mixed. For example, take Microsoft results from Wednesday. It reported fiscal Q1 2025 results, with double-digit percentage gains for revenue and EPS, as well as beating expectations from the Street:

Yet, notice the cloud-based revenue, which helped to lead the charge. This contains figures from its Azure service, which is the key generative AI initiative. Revenue here grew by 34% year-over-year.

Fantastic, you might think. It’s true, but the problem was with the forward guidance. Microsoft said it expects year-over-year growth for Azure to slow to 31-32% and for 18-20% growth in the cloud segment more generally. This might not sound like a big deal, but it’s a key reason why the share price is down 5.7% on Thursday, as we write.

AI-fuelled growth should have a large percentage gain in coming quarters rather than the opposite.

Next, let’s turn to another MAG7 constituent, namely Alphabet.