Key Takeaways From The Top Banks Q3 Earnings

Goldman figures out where it wants to go, Citi have a large restructure, J.P Morgan still sits top of the tree...and more.

Over the course of the past week, we’ve had a host of earnings reports out for major US banks. Given the global reach of these institutions, it gives us a good feel for the sector as a whole.

The banking sector is a really interesting place at the moment for investors to mull over.

On the one hand, the rise in interest rates has provided a surge in the net interest margin. This refers to the spread made by the banks in the difference between what’s paid out on deposits versus what’s charged on loans.

Add in the mix the volatility in global markets, particularly in the fixed income space. This has provided Trading divisions with the potential to reap much higher revenue from their client bases.

However, investment banking has been in the mud for the past few quarters. In fact, we’re now in a position were the seven quarter pandemic boom has been completely offset by the seven quarter slump. This has provided a large counterbalance to any positives. Write downs on other parts of the asset books has been another headwind.

So when we look at the share price performance of the major banks (below), we can note that none of them are in a bull trend higher over the past two years…

NB CITI DARK BLUE, GS YELLOW, MS LIGHT BLUE, JPM ORGANGE

Let’s review three of the major banks…

Goldman Sachs

The bar was already set fairly low for GS, given the disappointing noises coming from the bank for most of this year. The pivot to withdraw from the consumer space has been the largest punch in the stomach.

Q3 net earnings of $2.06bn were down around a third from the $3.07bn figure from the same quarter a year ago. Earnings per share dipped to $5.47 per share, below analyst forecasts.

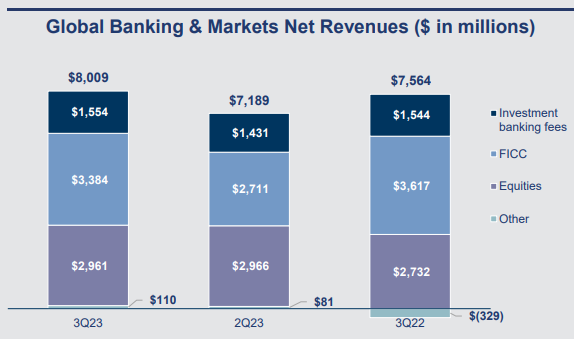

The main focus for investors was getting an update on the investment banking division, which is key for GS. We flag up the below graphic to give some perspective:

Versus a year ago, revenue in that space is flat, but it was a modest jump from the previous quarter. The bounce back in deal making clearly hasn’t happened just yet.

Another point we flag up is the area where Goldman are pinning their hopes on - asset and wealth management. These areas are less volatile than IB and Trading, but so far the bank isn’t doing that well.

It announced that it’s selling speciality lender GreenSky, with other write downs meaning the division was little changed in terms of QoQ revenue growth. It’s significantly down versus a year ago.