Let's Talk About The 'R' Word

Is the US/UK/EU going to enter a recession this year? We scan the data and offer our view.

UK - unlikely to post any meaningful growth, but tail risks are quite low

US - inverted yield curves and worrying job data raises red flags

EU - in a much better place than six months ago, risks are manageable

After coming out of the pandemic, growth rates around the world have differed substantially. Inflation levels is another metric that has a large variance between developed nations. When factoring in other economic indicators, the chances of a recession vary depending on which area of the globe we’re looking at. So let’s take a brief look at our home (the UK), the home of the majority of our readership base (the US), and the Eurozone.

An economy is technically considered to be in a recession when it records two consecutive quarters of negative GDP growth.

UK

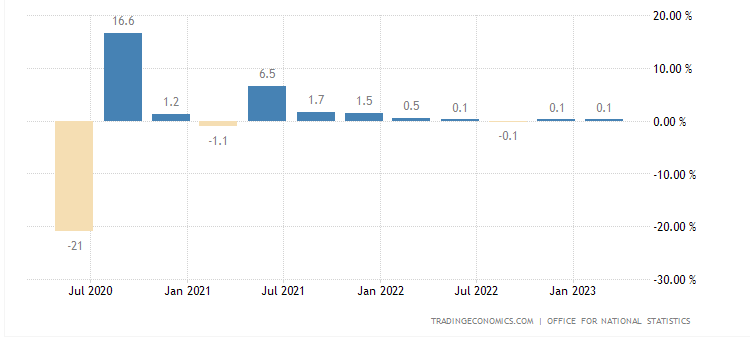

First up, let’s consider the UK. The quarter-on-quarter (QoQ) growth rate is shown below, and it doesn’t make for great reading. The latest figures out this week showed a preliminary reading for Q1 2023 of +0.1%.

For the past year, the economy has been between +0.1% and -0.1%. Granted, it hasn’t recorded two negative quarters on the bounce, but it’s hardly a convincing figure to be only JUST in positive growth territory.

The Bank of England currently has a forecast that the economy will grow 0.25% in 2023. This was an upgrade on its prediction earlier this year of a 0.5% contraction.

With inflation still running above 10% and interest rates yet to peak (in our opinion), the outlook isn’t rosy. However, when we look at the jobless rate holding steady and retail sales being lacklustre (but not disastrous), we feel the chances of a recession are less than 50%. Therefore:

ALPHAPICKS PREDICTION: 2023 RECESSION AVOIDED

US

For the US, there are a lot of red flags that we are seeing. For example, take the inverted yield curve, across multiple maturities (shown below).

historically, having a negative spread on short-dated (3mth, 1yr) versus longer dated bonds is a warning sign of an imminent recession. In part, the theory looks at why the market is predicting rate cuts versus the current base rate. If this lines up with needed monetary policy easing measures due to a weak economy, it spells trouble.

Another factor we flag up is employment. The unemployment rate might still be at record lows, but other gauges paint a much less pretty picture. Initial jobless claims are on the rise over the space of the past couple of months:

Further, insured unemployment claims are up 20% year-on-year.

What could allow the US to avoid a recession this year? For one, a complete pause from the US Fed in raising rates, and even some cuts into the autumn should help to ease sentiment.

ALPHAPICKS PREDICTION: 2023 RECESSION DUE

EU

Finally, we turn to the EU. If we had written this piece six months ago, few would have argued against the Eurozone being in a recession this year.

Goldman analysts were among the first to change tact, and many others also changed their tune…

What about now? Don’t get us wrong, the Eurozone is still in the picture to enter recession this year. The GDP figures are below, showing a very patchy past two quarters of 0% and +0.1%.

However, the fundamental picture for growth has improved significantly. The concerns around energy prices, the war in Ukraine, fragmentation risks and much more were swirling in the air.

Even though these risks are still present, they are nowhere near as great. Rather, with inflation falling and the ECB being noted as one of the more prudent G10 central banks, things don’t look overly ominous for the bloc.

ALPHAPICKS PREDICTION: 2023 RECESSION AVOIDED