Lucid Riding Passenger With Aston Martin

Aston Martins new deal with Lucid, the financial outlook of the company, and the EV sector being a good buy.

Aston Martin signs new deal with Lucid group for EV cars

Optimistic outlook and quadruple earnings by 2027

Stocks to watch in the EV sector

Since its first public offering in 2018, Aston Martin has endured a trying time on the stock market. Last year, the group's pre-tax deficit more than doubled. Canadian businessman Stroll invested in Aston Martin in 2020 and is now working to turn around the company's troubles and drive it towards electrified automobiles.

Stroll asserted on Monday that he “should be knighted” for his work at the company, which he said involves “saving thousands of jobs” and “investing hundreds of millions into Formula1” through the Aston Martin racing team.

The car manufacturer agreed on a new deal with electric car maker Lucid. However, the deal was formed just before the bankruptcy filing of electric vehicle manufacturer Lordstown Motors, highlighting how challenging the transition from combustion to batteries will be.

A lucid deal?

The automaker will use Lucid's batteries and powertrains in its electric vehicles when released in 2025. Along with the technology transfer, Lucid will receive up to £186 million in cash and shares and a 3.7% ownership in Aston Martin.

For its upcoming battery electric car products, Stroll said the agreement would offer Aston “access to the industry's highest performance and most innovative technologies.”

Under chief executive Peter Rawlinson (Lucid CEO), who made his name helping to develop the Tesla Model S, the EV maker has created highly regarded battery and drivetrain technology. But like rival start-ups, it has struggled to produce the technology on any scale.

While the agreement puts Lucid at the heart of Aston’s electric ambitions, the UK company will still use some electric systems from Mercedes as well as engines and in-car technology that date back to the 2020 deal.

Aston’s outlook

The company also shared its optimistic outlook for the coming years, projecting a quadrupling of earnings by 2027. Aston Martin remains on track to meet and potentially exceed its targets for 2024 and 2025.

The financial goals set by Aston Martin in 2020 aim to achieve approximately £2 billion in revenue and £500 million in adjusted EBITDA. The company expects to substantially achieve these targets in 2024 and potentially surpass them in 2025.

In 2022, Aston Martin reported revenue of £1.38 billion and adjusted EBITDA of £190.2 million, indicating its current financial strength.

Looking ahead, Aston Martin has established ambitious mid-term targets for 2027 and 2028. These targets include generating around £2.5 billion in revenue and £800 million in adjusted EBITDA, with an approximate margin of 30%. This demonstrates the company’s commitment to solidifying its position in the luxury car market.

Additionally, Aston Martin aims to improve its balance sheet by reducing leverage. The company has set a new target leverage ratio of approximately 1.5 times within the next two years. It anticipates achieving “sustainably positive” free cash flow and maintaining a net leverage ratio of around 1.0 times between 2027 and 2028.

There has been particular interest in their DBX models, with a 59% year-on-year growth. The company also noted that “the excellent start to the Formula 1 season by the Aston Martin Aramco Cognizant Formula One Team has driven significant brand visibility and heightened product consideration.”

The EV market

Goldman Sachs joined a list of brokers turning less bullish on Tesla TSLA 0.00%↑ shares this week after the electric-vehicle maker's blistering rally this year.

The stock dropped 2% in premarket trading after Goldman's Mark Delaney downgraded his recommendation to neutral from buy, noting the substantial surge in the shares and price declines for new cars.

“The stock now better reflects our positive long-term view of the company's growth potential and competitive positioning,” Delaney wrote in a note. “We are also cognizant of the difficult pricing environment for new vehicles.”

Last week, Wall Street warned that Tesla's lightning-quick rally had started to show signs of unravelling, warning investors were too optimistic about its artificial intelligence credentials and that the stock had become “overbought.”

Goldman's downgrade is at least the fourth in the past week. Morgan Stanley, citing optimism about AI taking the stock to “fair valuation,” cut Tesla to equal weight. Barclays also cut the stock to equal-weight, saying it had rallied too far and too fast while questioning the near-term fundamentals of the company. DZ Bank AG, meanwhile, recommended investors sell the stock.

However, money moving away from Tesla may mean that other EV stocks can flourish, notably Lucid and Rivian.

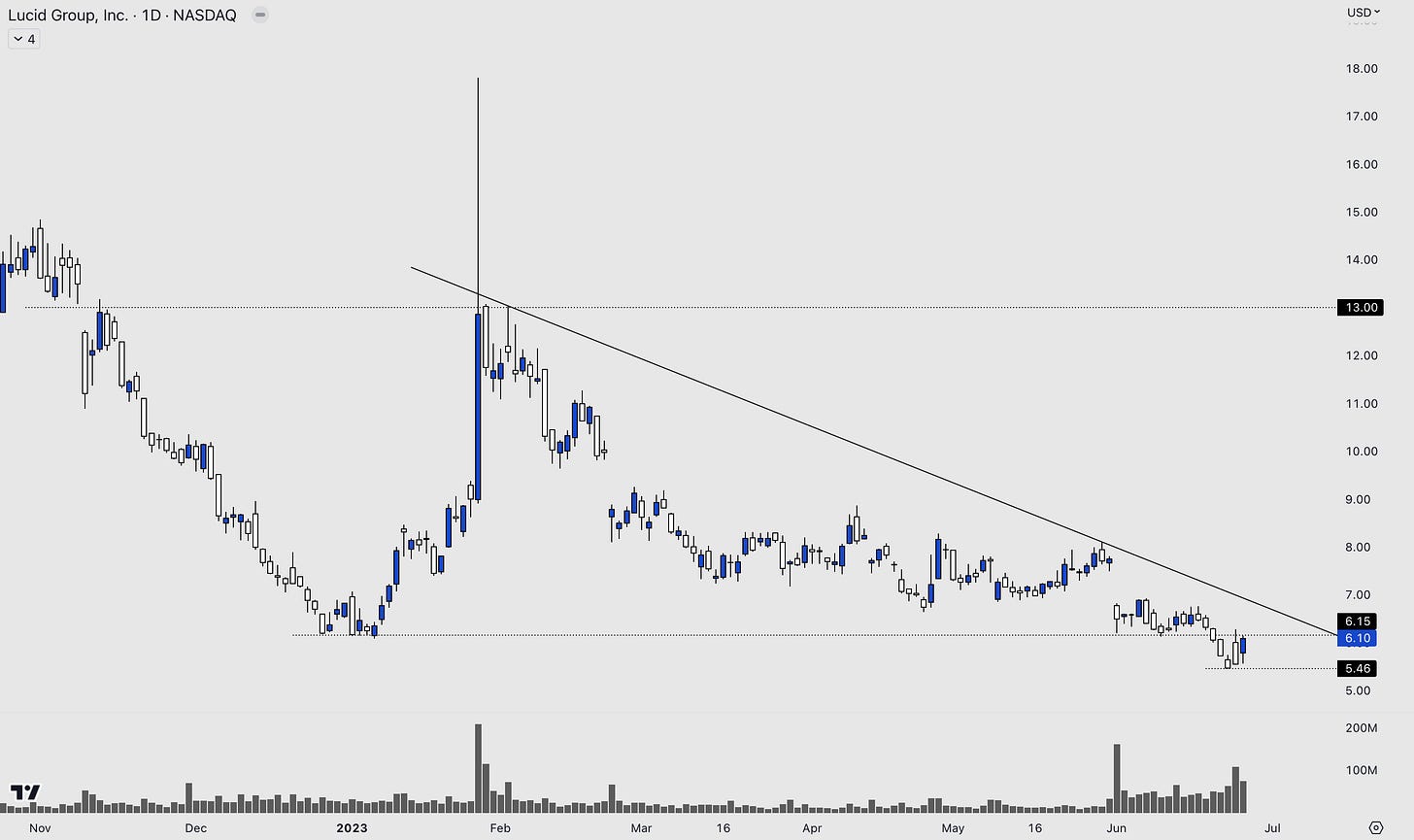

Lucid LCID 0.00%↑ is near all-time lows. However, with positive deals such as the Aston Martin one and a lot of positivity with other EV names, it could be the time to start looking long-term at this name. Also, this is a very popular name among retail traders and often sees strong moves up when the stock gets going. The stock has a short float of nearly 10%.

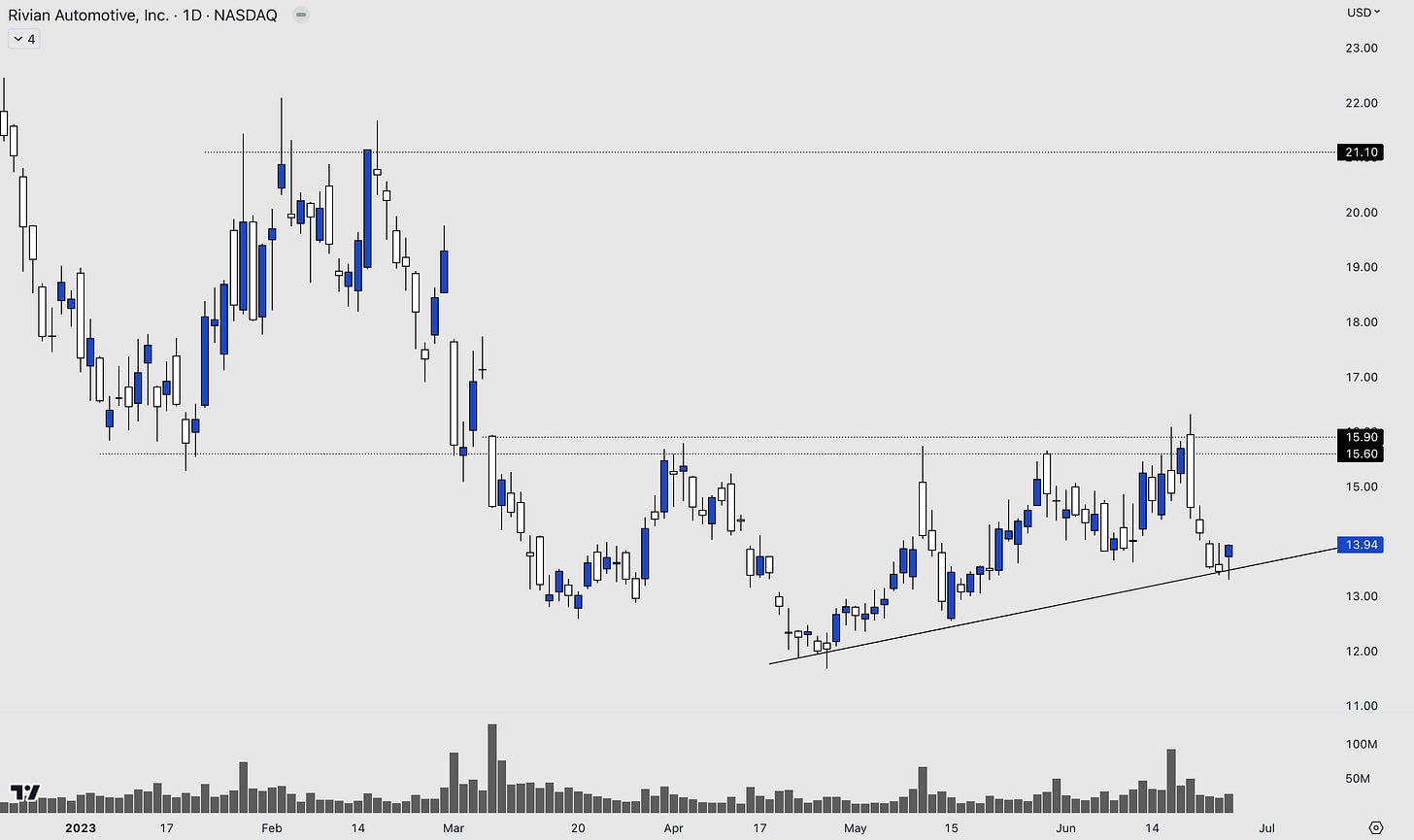

Rivian RIVN 0.00%↑ is another great name to watch in the EV sector. Price is currently holding support in the trend line. Strong resistance at $16 has held the stock back so far this year.

Both names offer good risk:reward, as they sit well below record highs. The EV sector will continue to grow over the years, and names other than Tesla have higher growth potential to tap into.

With any car manufacturer, EV or petrol, the risk is always getting off the ground. However, Lucid has been through the rocky years and is establishing a foundation. This helps lower that risk when looking long-term.

Turnaround time for Aston