The luxury industry’s focus on attracting an ultra-wealthy clientele has caused a problem: neglect of a major revenue generator, the middle class.

To regain the patronage of this crucial consumer group, brands like Burberry and Yves Saint Laurent are resorting to price reductions, which would have previously been viewed as a taboo strategy. While individual middle-class consumers may not make substantial purchases of designer goods, they collectively contribute significantly to the luxury market.

Over half of global luxury sales come from approximately 330 million people who spend less than €2,000 annually on luxury items. In contrast, wealthy consumers, comprising about 2.5 million individuals who spend over €20,000 per year on luxury goods, constitute a smaller yet impactful segment, accounting for 10% of luxury sales.

Before we get into the article, you can become a premium subscriber with us for just $20 a month. This provides you full access to our weekly articles without a paywall, including our flagship Monday trade ideas and full access to what we are buying and selling in our Global Asset Portfolio.

Despite the influence of these heavy-hitting spenders, the majority of the industry’s growth in recent years has been driven by aspirational shoppers aiming to emulate a luxurious lifestyle, particularly in Asia. However, the landscape is changing with pressures emerging in the key luxury markets of China, and consumers are cutting back on spending due to declining property values, prompting them to prioritise saving over discretionary purchases.

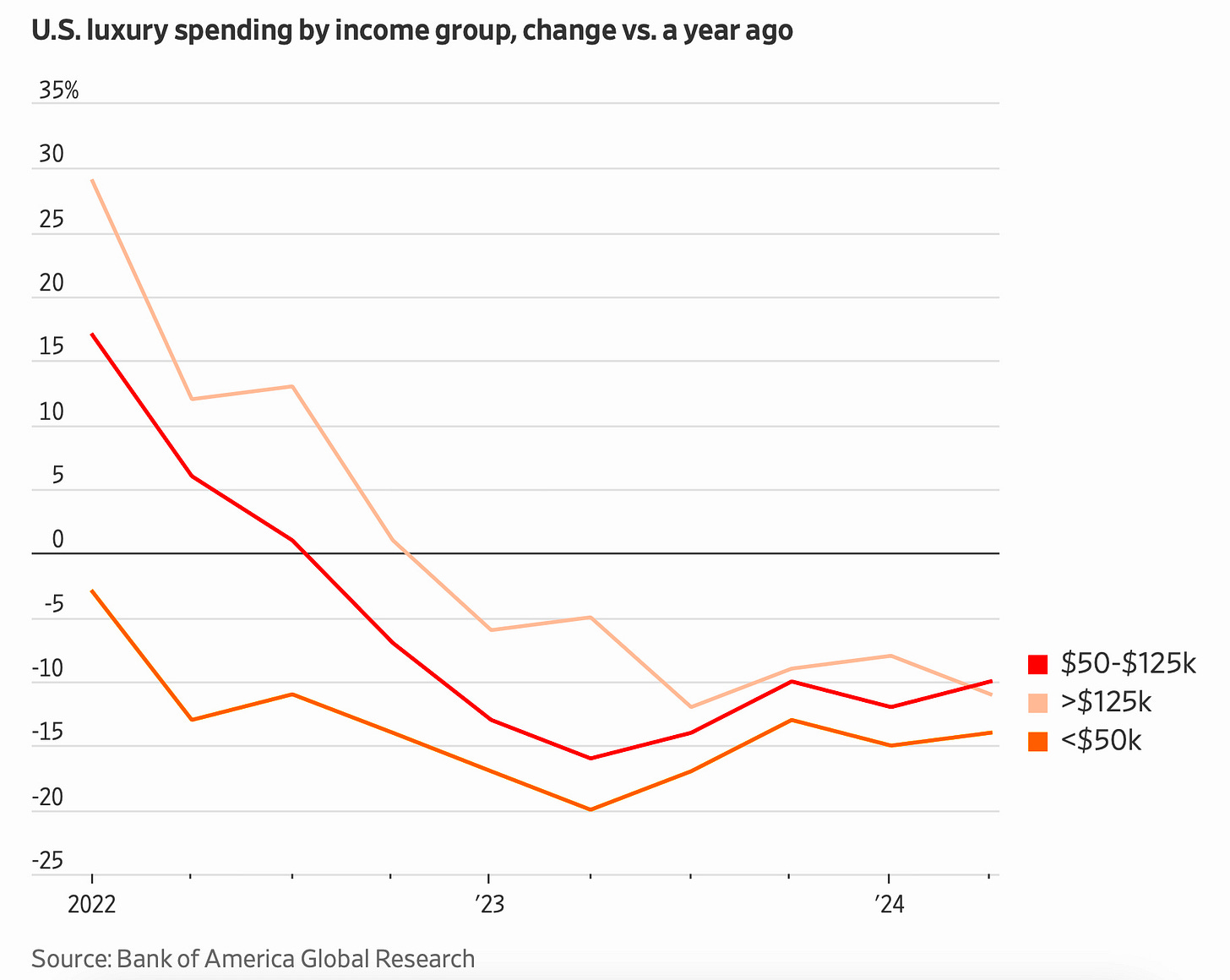

Similarly, lower-earning Americans, who developed a penchant for luxury during the pandemic, have curbed their spending, particularly those earning less than $50,000 annually. Even middle-income consumers earning up to $125,000 are tightening their budgets as escalating prices across various sectors have constrained their purchasing power for luxury goods.

Dynamic Shift

The industry is now experiencing a significant pullback, which is having the biggest effects on weaker luxury brands.

British fashion house Burberry recently took drastic measures, including scrapping its dividend, replacing its CEO, and issuing a profit warning due to a sharp decline in sales.

The Americas and Asia Pacific regions saw a 23% drop in sales, while Europe, the Middle East, India and Africa (EMEIA) reported a 16% fall. This has only added to the downward momentum of the stock price this year, which is now 50% lower.

Watchmaker Swatch saw a 70% decrease in operating profit in the first half of the year, primarily due to a substantial reduction in demand in China. German brand Hugo Boss issued a profit warning, citing a decline in store footfall in China.

Companies such as Burberry, Swatch, and Hugo Boss have forgotten who their customers are. Too much time has been spent trying to emulate the ultra-luxury of the biggest names in the industry, names that have never had to cater to the middle class to prop up their bottom line.

One of the self-inflicted issues is the sharp increase in product prices, rendering them unaffordable for many middle-class consumers.

Burberry’s decision to release new, significantly more expensive handbags alienated its traditional customer base without attracting enough wealthy buyers to compensate for the loss. In response, some luxury brands are discreetly reducing prices on their full-price items in an effort to entice customers back. This strategy represents a shift in the industry’s typically rigid approach to pricing.