LVMH - Losing Value, More Headaches

After posting the largest intraday decline since Nov 2021, we feel LVMH could be in for more trouble.

Tuesday saw LVMH (Louis Vuitton Moet Hennessy) shares fall by as much as 8.5% following the release of underwhelming Q3 results.

This sparked a lot of media attention, given the economic bellwether that the stock has become since the pandemic. It also has some investors concerned about the results for rivals that are due to report later this month, particularly Kering SA.

But is this all just a storm in a teacup?

Key details from the trading update

Below we share the breakdown of revenue change by business segment:

On the face of it, the reported change in revenue year to date conflicts with the fall in the share price. Yet a key point to remember here is not the results at an absolute level, but how they came out relative to expectations.

Unfortunately, the 11% growth in Fashion and Leather Goods was well below expectations. This houses Louis Vuitton and is a finger on the pulse of the Asian consumer (more on than later).

Wine and Spirits also underperformed, with reported revenue down 10% versus last year. The update flagged up lower demand in the US as a driver for this.

Why we wouldn’t buy the dip

LVMH is now down circa 1% (as of writing) on the year, with over €100bn being taken off the market value since the peak in early Q2.

However, even with this move we’re not sure that the stock is great value when we compare it to peers. Consider two examples.

1, Return On Equity = LVMH comes in at 29.51%, with Hermes International at 34.06% and Capri Holdings at 33.26%. The higher figure the better, with LVMH ranking the worst.

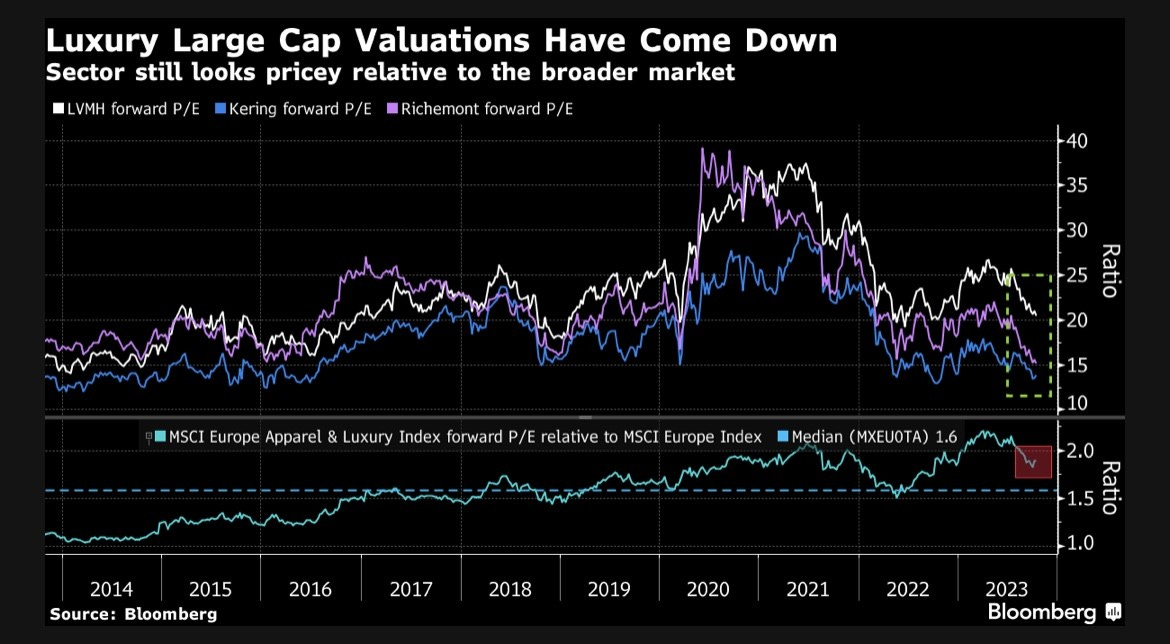

2, Forward Price-to-Earnings (P/E) = LVMH comes in at 21.44, with Kering at 14.45 and Richemont at 15.1. The lower figure the better, showing more potential value.

It’s important to note that despite us thinking that this isn’t a dip worth buying, we aren’t presenting a doomsday scenario for LVMH. Rather, we feel it reached a bubble like status over the past year, and now investors are waking up to the fact that it can’t continue to live up to the hype.

For the rest of the article, we’ll go through:

A key issue for LVMH

Why luxury is in trouble

Actionable trade ideas