In For Le Pen-ny, In For A Pound

Economic implications and our thoughts if the centre doesn't hold.

Last week, an ECB meeting that led to the first rate cut from a major central bank in this cycle failed to bring much volatility to the markets. It was fairly priced in by the time the meeting came around.

In comparison, this week saw French President Emmanuel Macron call a shock election after a sudden rise from the far-right.

A quick rundown

This has been the biggest story this week, so many of you may have already read the story. For those that haven’t, let’s do a quick rundown before we move onto the financial side of things.

Macron surprised the nation by announcing the dissolution of France’s National Assembly following the strong performance of Marine Le Pen’s far-right party in the European elections. Macron declared that new elections for the lower house of the French parliament will be held on June 30 and July 7, marking a high-stakes and unexpected move. With early ballot counts projecting National Rally to have secured around 31% of the vote, which is a historic high for the far-right party in European elections.

The market impact

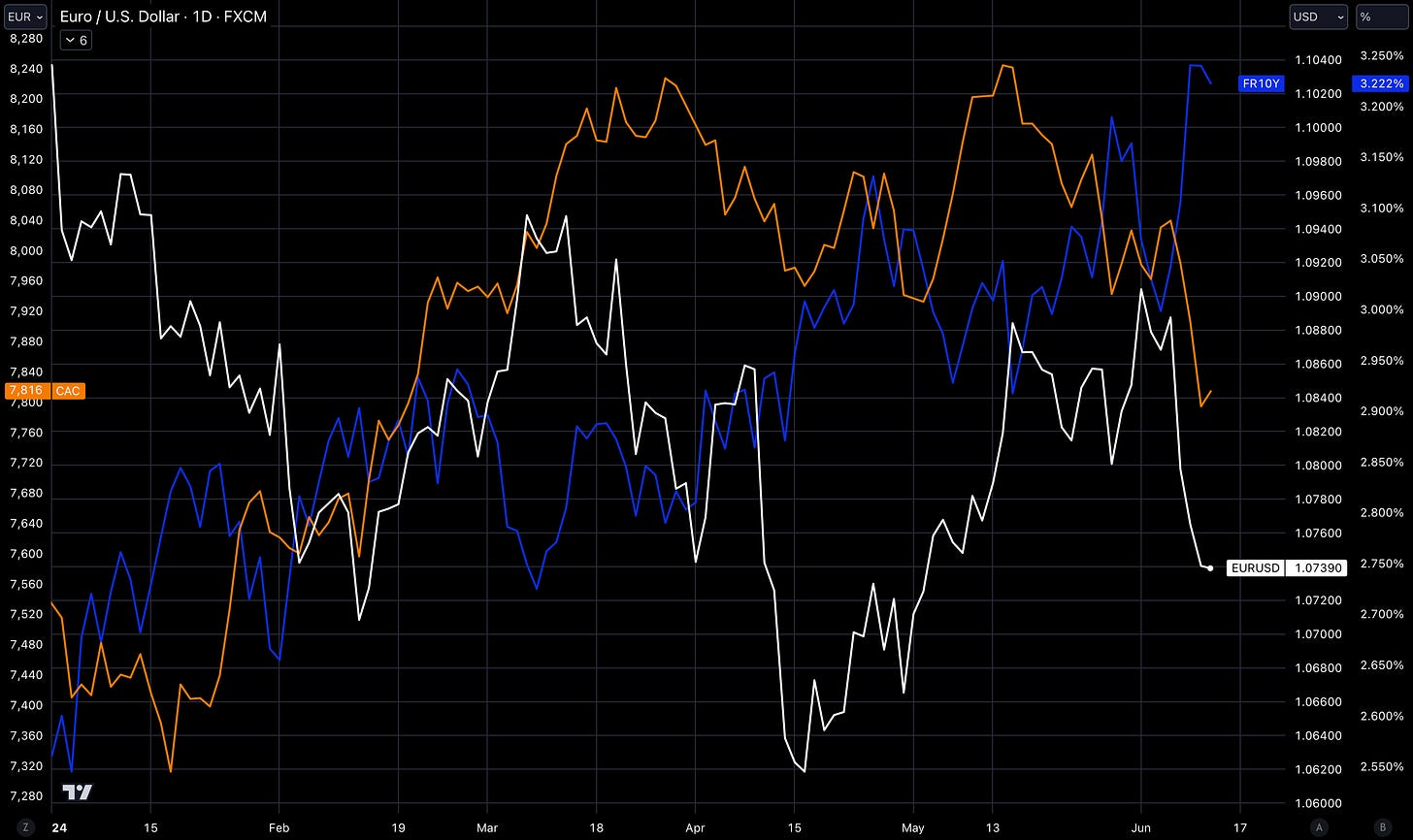

France’s major equity index, the CAC 40, has fallen 2.3% since last week’s close, the euro has fallen to 1.0739 to the dollar, and French 10Y bond yields rose to 3.222%.

Another clean way to view the move is via EUR/GBP. The pair had been holding key support around the 0.8500 barrier but this broke with EUR weakness when markets opened Sunday evening. This is a really significant break that wouldn’t have given way easily, but the desire of traders to reduce EUR exposure from the news is very telling.

In terms of the worst performers within the CAC 40, take a look at the top 10 losers over the past month (with the bulk of the drop coming over the past week):

The one sector that immediately stands out is banking, with BNP, Soc Gen and Credit Agricole high up on the list.

The French banks, which hold substantial government debt and could be targeted for windfall taxes, have chatter amid market concerns about a borrowing spree by the far-right.

There’s a “shoot first, think later” mentality in markets, but investors have to price a higher risk premium.

Economic implications of the far-right

If Le Pen’s Rassemblement National were to form a government, its protectionist big-spending agenda could put Paris into conflict with Brussels, which would alarm investors further.

Part of her push is what has been referred to as “economic nationalism”. Le Pen has historically favoured protectionist policies, which could lead to higher tariffs on imports. This might protect certain French industries but could also lead to trade conflicts, increased consumer prices, and potential retaliation from trading partners.

Any attempts to renegotiate trade agreements with Brussels would only further fragment the Eurozone. Although the Party stance on Frexit (France exiting the EU) has softened, there could still be efforts to reclaim national sovereignty from the EU. This could strain France’s relationship with EU institutions and potentially affect foreign investments.

When we look at the stance on social welfare and public spending within France, there’s also concern about the inflationary implications.