"Make Sure That Being Rejected Doesn't Bother You At All"

We run through our favourite investments and quotes from Bill Ackman.

Huge hits with Chipotle and CDS have earned Ackman billions.

His high conviction can be costly, such as his $1bn Herbalife short loss.

His quotes and mantra revolve around learning from mistakes and rejection.

Who is Bill Ackman?

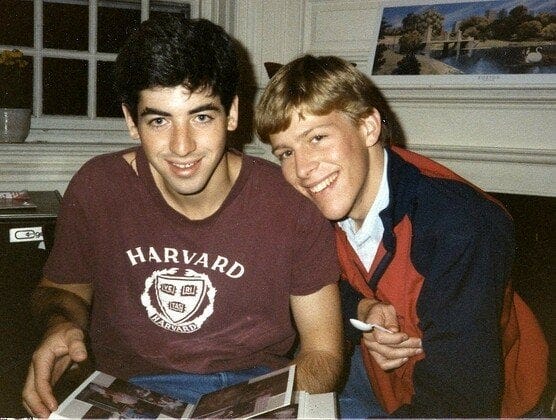

Bill, born on May 11, 1966, in NYC, is an American investor and hedge fund manager. Raised in a Jewish family, Ackman's upbringing instilled in him a strong work ethic and a drive for success. He attended Harvard University, where he studied history and earned his bachelor's degree in 1988. Afterwards, he pursued his MBA from Harvard Business School, which further equipped him with valuable skills in finance and investing.

Ackman embarked on his career at various investment firms, honing his expertise and gaining valuable experience. In 2004, he founded Pershing Square Capital Management, a prominent hedge fund known for its activism and concentrated investment strategy. Ackman's career has been marked by notable successes and high-profile battles with companies, making him a prominent figure in the world of finance.

Some of his best (and worst!) trades

Chipotle

In 2016, Ackman's Pershing Square Capital Management acquired a 10.3% stake in Chipotle, recognising the company's potential for growth and value creation.

Ackman's investment injected fresh optimism into the fast-casual restaurant chain, which was recovering from a series of food safety issues. His involvement led to key changes in Chipotle's governance and operations, pushing for enhanced board oversight and the appointment of new directors.

For example, the company replaced founder Steve Ells as CEO and brought in a respected veteran of fast food, Brian Niccol.

During the Q1 2018 earnings call, positive figures and a strong outlook saw the stock surge 24% in a single day. This means that the value of Ackman’s stake jumped $239m to $1.2bn as Chipotle shares rose $82.98 to $422.50.

Credit Default Swaps

In early 2020 Ackman took a bold view just before the COVID-19 pandemic really took off that a looming economic crisis was coming. Ackman's investment involved purchasing credit default swaps, a type of financial derivative that acts as insurance against the default of debt. He took a highly publicised and contrarian approach, making a substantial bet that the corporate bond market would experience a severe decline.

He had a position size worth $64.8bn and was paying $27m each month in the premium to hold such insurance contracts.

Less than a month later, the default swaps jumped in value (shown below) as COVID-19 took over. The value of the contracts when closed out netted a profit of a staggering $2.64bn.

Herbalife

In 2012, Ackman publicly declared his belief that Herbalife, a multi-level marketing company, was a pyramid scheme and took a massive short position on the company's stock. He argued that the company's business model preyed on vulnerable individuals, leading to financial ruin for many.

Ackman shorted Herbalife with a notional size in the billions. This investment in Herbalife was highly controversial, sparking a fierce debate between him and other prominent investors, most notably Carl Icahn, that were long the stock.

The battle between Ackman and Icahn became a spectacle in the financial world, with both investors publicly clashing over their differing views on Herbalife.

There’s a fantastic CNBC live clash between the two of them, which is well worth 4 minutes to watch…

Ackman's position ultimately faced significant losses, as Herbalife's stock price surged despite his predictions.

After five years, he closed the position out, losing circa $1bn overall.

Quotes

"The biggest mistakes are made by not learning from your mistakes."

In the world of investing, setbacks and failures are inevitable, but it is crucial to analyse and understand what went wrong in order to avoid repeating the same errors. Ackman believes that the key to success lies in continuous learning and self-improvement.

"If you find a business you understand, you're halfway there."

Ackman stresses the significance of investing in businesses that one comprehends. He advocates for thorough research and analysis before making any investment decisions. By understanding the fundamentals of a company and its industry, investors can make more informed choices and increase their chances of success.

"In order to be successful, you have to make sure that being rejected doesn’t bother you at all."

Going against the grain has worked well for Ackman, such as with his CDS and Chipotle investments mentioned above. Sure, it doesn’t always go to plan. But overall, you have to have a tough backbone when investing in order to keep going and achieve success. After all, the more doors you knock on, the more likely it is that behind the next one is what you’re looking for.

Great article, I always like seeing famous investors big winners. On his CDS bet in 2020, so to be clear he had positions worth $64billion and after he closed his positions he netted around $4.6billion of profit? I might be missing something here but isn’t that a rather lousy R:R, with a lot of risk?