Markets: More POW From Powell

The reaction of stocks and bonds to Jerome Powell's remarks is more than just noise. Now, a pivotal few days ahead await.

A hopeful rally fades

The shift in rate hike expectations

Key technical and fundamental factors ahead

Investors were cheerful at the January rally, which provided a hopeful outlook for the year and seemed to be setting up a different story from that of 2022. Cryptocurrencies were up 50%, with Chinese tech and big US tech firms up more than 50% and 30%, respectively.

However, February ended with a sell-off, and after an optimistic start to March, Jerome Powell may have flipped the switch back yesterday.

The Bear Returns

The post-October rally in global markets was predicated on hopes that slowing inflation would usher in a pause in interest rate hikes and, ultimately, a pivot towards cuts. Unfortunately, that faith has been tested by robust US economic data, signs that inflation is stickier than expected, and central bank policymakers continue to talk a tough game.

US corporate profits, which underpin share valuations, are also under strain. Consensus forecasts now think earnings fell in 2022, and forecasts for 12% earnings growth this year could prove an uphill struggle.

Yesterday was the start of Fed Chair Powell’s semiannual Monetary Policy Report to the House Financial Services Committee. His comments to start the day sent markets into a retreat, with the S&P 500 falling nearly 1% in the initial 15 minutes. A relief bounce was short-lived, and markets closed down 1.53%. Powell’s remarks pushed yields on two-year notes to a 15-year high.

“The latest economic data has come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.”

Translation: The central bank is open to raising the fed funds target range by 50 basis points later this month to a range of 5% to 5.25% if necessary.

The Dollar saw a strong rise following the meeting. The index, DXY, rose past resistance of 105.30 to a high of 105.88. One of our trade ideas for the week was to short GBPUSD below 1.19. This trade is now nicely in profit. The rest of our trade ideas can be found here, released at the start of each week.

The Next Rate Hikes

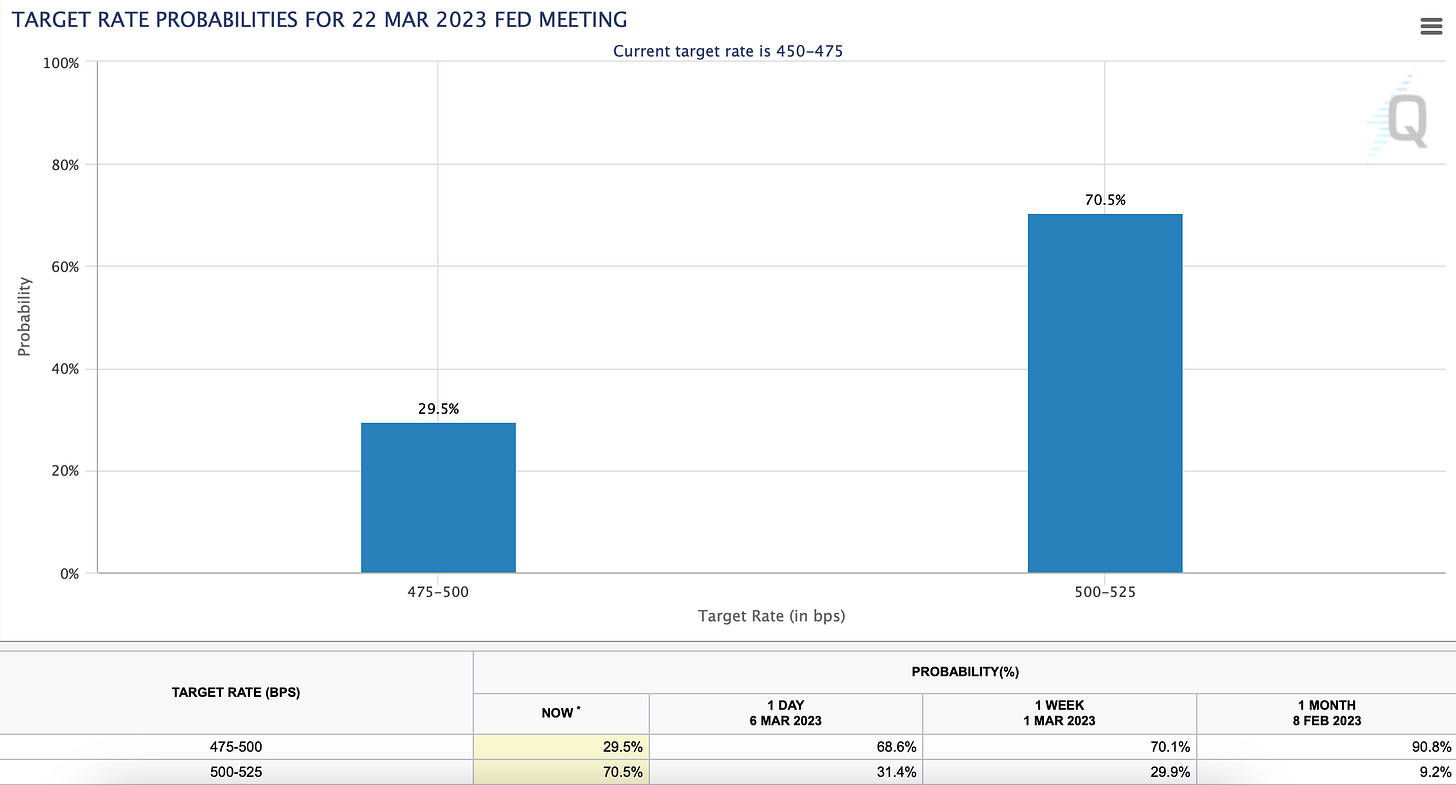

By the end of the day yesterday, probabilities for a target rate of 500-525 had swung to 70.5%. This is a complete turnaround on the forecast from one month prior, which was just 9.2% for the same target rate. See the image below.

Below is a forecast of Fed Meeting outcome probabilities. The data shows that hikes through to Q1 2024 are likely.

It’s easy to see why investors would interpret the Chair’s comments as hawkish. But the operative word there is “if,” and it seems silly to speculate. Investors will get more clarity this week with the release of new non-farm payroll data, followed on Tuesday by an updated consumer price index.

The coming data could certainly swing either way. Economists expect February’s job growth to slow considerably to 224,000 jobs — a number that is still too strong for the Fed’s objectives but leads to vastly different interpretations from January’s figure.

There is quite a vital schedule ahead. Below is the list of events and implied volatility for those days. This will be handy to note for traders, as option premiums will be higher on the specific days below.

What Next?

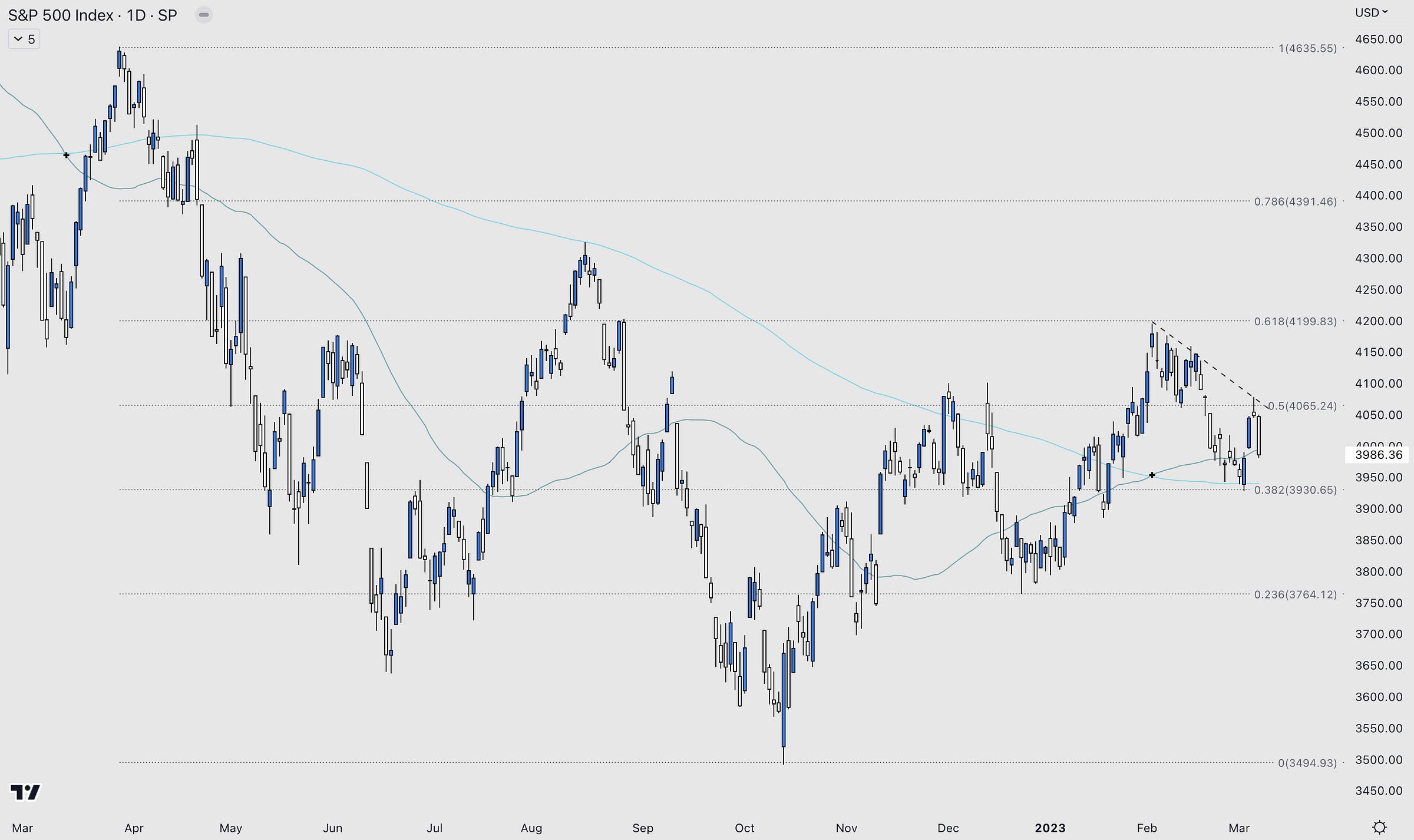

Last week saw a terrific rise off the 200-day moving average. While stock-picking investors were waiting around trying to decide their next market move, their computer-driven counterparts were busy buying.

This week sets up for another test. Yes, the markets will be driven heavily by Jerome Powell's comments. However, he has set the tone and is unlikely to have a significant change. Therefore, a second test of the 200-day seems likely - this level also coincides with the 0.382 retracement from March 22 swing high to October 22 swing low.

The more times a support/resistance level gets tested, the less it will hold.

With price closing below the 50-day yesterday, the next few days hold importance on both a technical and fundamental level.

Other Factors

Investors are struggling to price other substantial risks too. While some attribute semi-magic powers to markets’ abilities to see the future, in reality, investors are hopeless at evaluating factors such as the likely outcome of the war in Ukraine or the situation over Taiwan, to name but two known unknowns.

If faced with risks they cannot quantify, markets tend to turn a blind eye and hope for the best. When unanticipated shocks arrive, they then take a very nasty tumble.

AlphaPicks is a reader-supported publication. We have had tremendous support over the last few weeks, and for that, we say thank you to those of you following us.

Also, we release shorter-form content and data throughout the week on our Twitter page. So please be sure to drop us a follow and turn on notifications to stay up to date.

Twitter - @AlphaPicks

If you want to contact us or have any article ideas you would like us to cover, please email us.

Email - theeditor@alphapicks.co.uk

If you enjoyed this post, you can help us by clicking the heart ❤️