Markets See Through the Blackout

A weekly look at what matters and how to trade it. (October 6th)

US equities managed to grind higher despite the first government shutdown in seven years. The S&P 500 broke cleanly through the 6,700 resistance level that capped the prior week, notching yet another record close. Markets appear increasingly numb to political headlines, even a shutdown that will furlough three-quarters of a million workers and cost $400 million per day hasn’t dented sentiment. For now, investors are betting the Fed’s next cut will do more to shape Q4 than Washington’s latest dysfunction.

Healthcare was the week’s winner. Pfizer’s deal to avoid Trump’s threatened drug tariffs marked a rare instance of policy clarity, offering the sector relief after months of headline risk. The company agreed to cut select drug prices by as much as 85% and launch a new direct-to-consumer platform, TrumpRx, a populist flourish with market implications. The S&P Pharmaceuticals Index hit its highest since March, with analysts calling the agreement a “clearing event” that resets the earnings outlook for 2025.

Elsewhere, the M&A machine rumbled back to life. Electronic Arts confirmed a $55 billion buyout led by Jared Kushner’s investment firm and Saudi Arabia’s PIF, the largest LBO on record and a reminder of the Kingdom’s expanding influence across sports and gaming. The transaction pushed global deal value above $1 trillion for the quarter, one of only two times in history that threshold has been reached.

Economic visibility dimmed as the shutdown halted data releases, forcing markets to rely on second-tier indicators and Fed commentary. The ADP print showed a 32,000 decline in employment. Weak, but unsurprising given recent payroll trends. Fed officials filled the vacuum with speeches that added colour but no clarity. Governor Williams noted inflation risks “have come down somewhat,” while Goolsbee admitted service inflation remains “hard to explain.” Translation: the Fed still doesn’t fully understand what’s keeping inflation sticky, but it’s running out of patience to fight it.

Rates and FX traded in a similarly subdued fashion. The dollar was range-bound, lifted modestly by the rise in US real yields but contained by the policy path already priced in. Treasuries rallied in parallel, with yields posting their largest weekly drop in a month as investors leaned into the growth drag implied by the shutdown. The curve bull-flattened, OIS markets held steady, and volatility collapsed.

The shutdown might make for good political theatre, but markets have learned not to flinch. With rate cuts on the table, AI hype intact, and positioning at extremes, the equity tape looks like it’s daring the Fed to surprise.

Week Ahead Calendar

The coming week will be defined by the ongoing US government shutdown, which continues to block the release of key economic data, including September payrolls. That leaves the Federal Reserve’s September meeting minutes on Wednesday as the main event, offering the market’s only real guidance on the policy path after last month’s rate cut. The University of Michigan consumer survey on Friday will act as a proxy for inflation expectations in the absence of official data, while a heavy Treasury auction schedule (three-, ten-, and thirty-year sales midweek) will test investor appetite for duration amid rising yields and fiscal uncertainty.

In Europe, attention turns to the ECB’s meeting accounts on Thursday, which could clarify policymakers’ tolerance for further easing as growth stagnates. Industrial data from Germany and Italy will add context but are unlikely to shift the narrative. The UK remains quiet, with gilts trading off global yield dynamics.

In Japan, the focus is on BoJ Governor Ueda’s speech on Wednesday and the 30-year JGB auction on Tuesday, both watched for signs of policy normalisation and investor appetite at higher yields.

China’s markets reopen Thursday, with investors parsing Golden Week spending and liquidity data for signs of real demand.

With US data dark and global policy signals mixed, markets will be left trading tone over trend. The curve, more than the calendar, will tell the story.

Japan

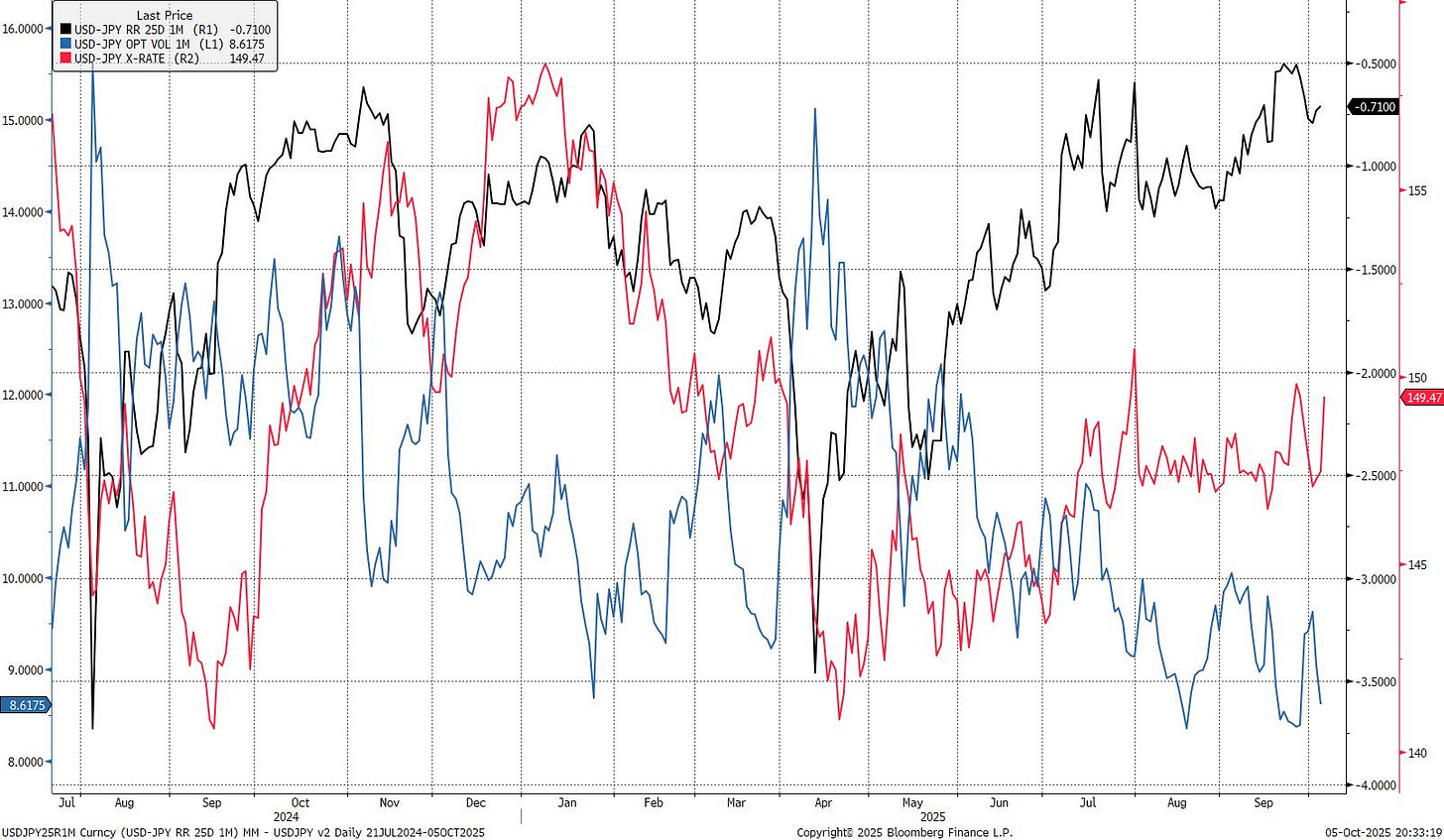

Japan is the biggest news out of the weekend. Pro-stimulus lawmaker Sanae Takaichi’s near-certain elevation to prime minister sent markets into motion—the yen sliding past 150, long-end JGB yields surging 17bp, and the Nikkei jumping nearly 5% to record highs. The move reflected an instant repricing of Japan’s policy mix of less BOJ autonomy and more fiscal firepower.

Overnight index swaps slashed the odds of an October rate hike from 60% to 25%. A leader who once called rate hikes “stupid” is now steering a government that prizes growth support over normalisation discipline. Fiscal dominance is back, and with it, a steeper curve and weaker currency.

The policy pivot lands as Japan’s bond market was already uneasy. Supply concerns ahead of this week’s 30-year auction are intensifying, with foreign investors reluctant to absorb new issuance amid a falling yen. The long end has become the pressure valve for political optimism; stimulus hopes lift stocks and crush bonds in equal measure.

Equities are choosing their winners early. Exporters, defence contractors, and construction firms are in play, all positioned to benefit from a weaker yen and renewed fiscal push. Banks, which had rallied on rate hike hopes, are the immediate losers. Domestic cyclicals and small caps could see inflows as expectations for local growth improve, but the rotation toward “fiscal beneficiaries” is the dominant theme.

A sharp yen slide will eventually test policymakers’ patience. Verbal intervention seems inevitable, though unlikely to change the trend. The deeper story is political: Japan is reverting to coordination between fiscal expansion and monetary accommodation, the same playbook that underpinned Abenomics, but in a world of tighter global liquidity and rising term premia.

Market takeaway: Japan has re-entered the global macro stage of “Run It Hot”. The new trade is steepeners and exporters over banks (long Nikkei, short long-end JGBs, curve steepener, short yen) until the bond market or the Ministry of Finance forces a rethink.