Markets: Hindenburg Are Back

The accusations, reactions, responses and ethics behind Hindenburg's latest short report.

Hindenburg’s accusation of scamming and fraud

Block seeks to take legal action

The ethical debate of short reports

The case: Hindenburg v Jack Dorsey and Block

If you don’t know who Hindenburg is, we’ll give you a quick rundown.

Hindenburg Research specialises in forensic financial research and has experience in the investment management industry that spans decades, with a historical focus on equity, credit, and derivatives analysis. That’s how they describe themselves.

However, others may describe the research company as activist short-sellers who sink companies’ stock prices.

Regardless of your view, we can all agree that when they release their latest report, people pay attention. What they say has a massive impact on stocks.

The latest target from the firm is Block and CEO, Jack Dorsey. For those unaware of him, he was the co-founder and former CEO of Twitter, with the now famous first tweet:

Block downgraded to Square

In its investigation, Hindenburg alleged that Block’s wildly popular Cash App was likely facilitating scammers taking advantage of government-stimulus programs during the pandemic. In response to a public records request, the state of Massachusetts told the short seller that it sought to claw back over 69,000 unemployment payments from the bank behind Cash App accounts, an amount that exceeded those it sought to reverse from major banks like JPMorgan Chase and Wells Fargo, which have far more customers.

“Block ignored both internal and external warnings that multiple individuals using the same bank account number to receive government funds was a brazen red flag of fraud,” Hindenburg said in the report. “Multiple key lapses in Cash App’s compliance processes facilitated billions in government payment fraud.”

Block’s response

It simply read:

“We intend to work with the SEC and explore legal action against Hindenburg Research for the factually inaccurate and misleading report they shared about our Cash App business today.

Hindenburg is known for these types of attacks, which are designed solely to allow short sellers to profit from a declined stock price. We have reviewed the full report in the context of our own data and believe it's designed to deceive and confuse investors.

We are a highly regulated public company with regular disclosures, and are confident in our products, reporting, compliance programs, and controls. We will not be distracted by typical short-seller tactics.”

How did markets react?

Initially, not very well. A picture tells 1,000 words.

The stock plummeted 22.8% over the first hour before US markets opened. Not good news for investors.

However, day traders had a different story. With the decline in pre-market, SQ was on many watchlists. Traders were treated with a 16% move higher after the opening bell.

Despite substantial intraday moves for some to capitalise on, the overall result was the loss of all 2023 gains for Block. As a result, the day closed down 14.82%.

Hindenburg track record

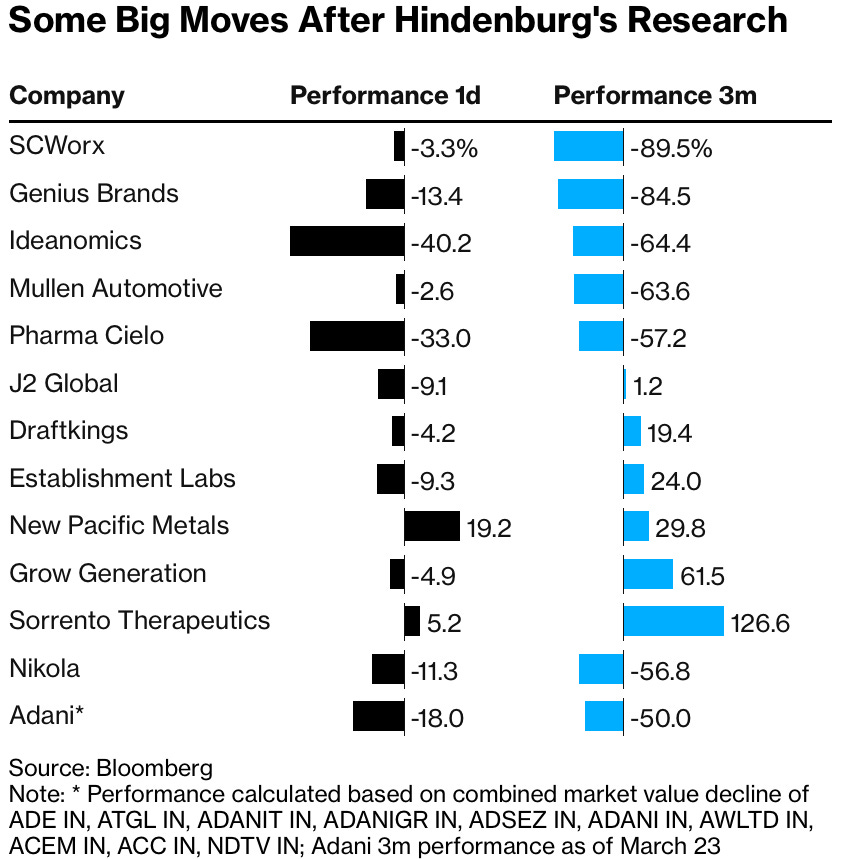

Hindenburg has targeted about 30 companies since 2020 and their shares lost about 15% on average the next day. Six months later, the shares were down 26% on average.

There is an ethical debate to be had on Hindenburg and similar short reports.

Many have criticised Hindenburg's strategies, alleging that the company manipulates the stock market through its reports. Hindenburg disputes these claims and maintains that it is just exercising due diligence in its capacity as an investor.

Supporters of Hindenburg contend that the company is an advocate for market transparency, exposing dishonest behaviour and guarding against investor misinformation. They see the company as a valuable watchdog that encourages market efficiency and holds businesses accountable.

Transparency is good, and misinformation should be exposed. But what constitutes “manipulation”? Maybe the rest of that discussion is for another time.

Who loses?

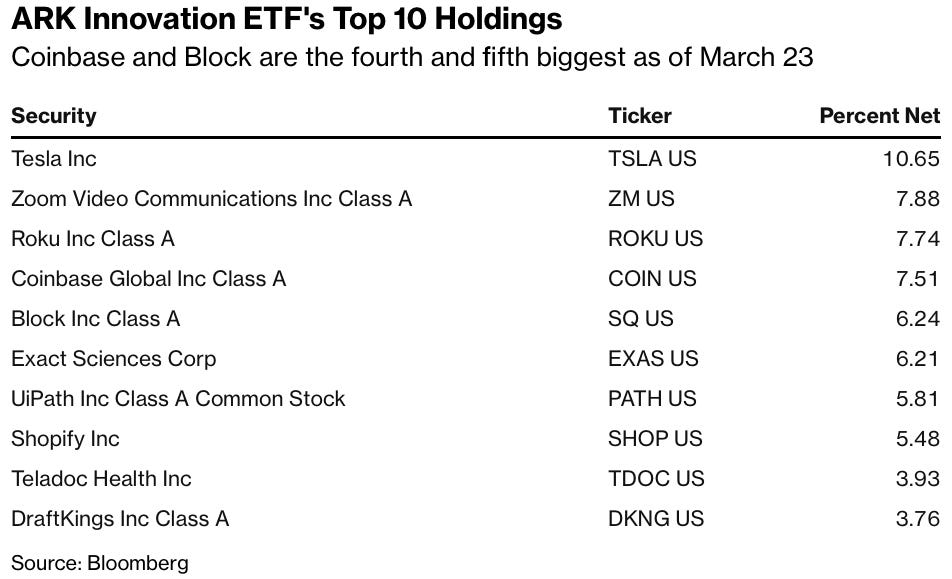

One loser of the day was Cathie Woods. The CEO of ARK Invest ARKK 0.00%↑ took a double hit on investments.

Not only do they hold a stake in Block worth 6.24% of their portfolio, but the growth investment group also have a significant share in Coinbase, 7.51%.

The biggest US crypto exchange Coinbase tumbled 14% after disclosing it received a warning notice from the Securities and Exchange Commission about a potential securities law violation.

We hope you enjoyed reading this article and will keep you updated on the unfolding events between Hindenburg and Block. These can be found on our Twitter.

Please like and share this post. It helps more than you could imagine. We are a reader-supported publication and always appreciate your support.