Meet The Code Breakers

In memory of Jim Simons, we look at the top 5 quant traders that changed the game.

The passing of Jim Simons last week at age 86 caused the finance community to stand up and pay respects for one of the true greats in the trading and investing space.

Noted for his pushing of boundaries in the quant space, his investment returns at Renaissance Technologies will be part of his outstanding legacy to the industry.

We thought it appropriate to muse over Simons and some of the other top quant managers that have acted as the code breakers in recent decades.

Before we get going, a friendly reminder that you can become a premium subscriber with us for just £10 a month. This provides you full access to our weekly articles without a paywall, including our flagship Monday trade ideas and access to what we are buying and selling in our Global Asset Portfolio.

Jim Simons

We covered Simons’ life and career back last October, which can be read here:

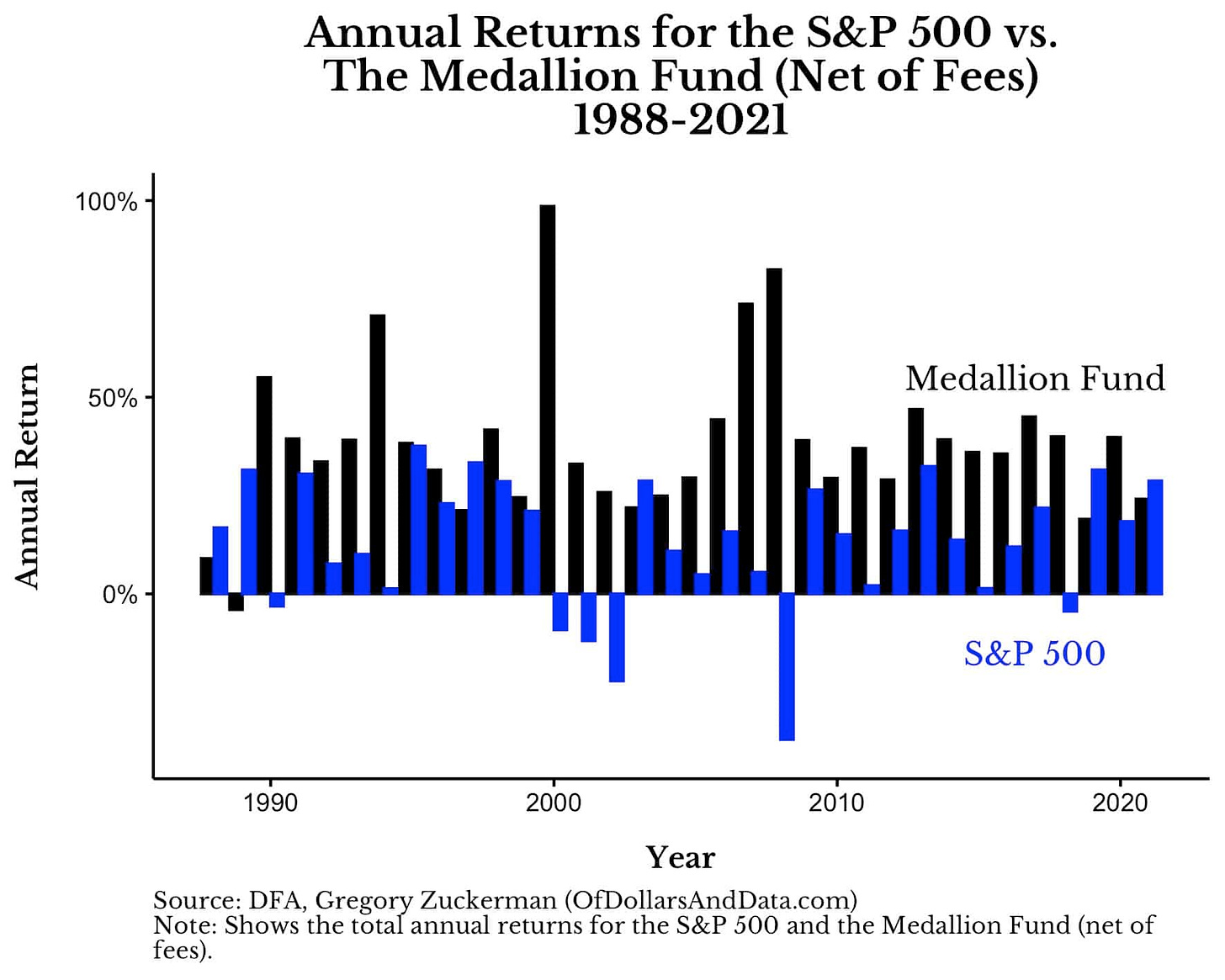

His Medallion Fund returns vs the S&P 500 can be noted below:

We’ve read many tributes to the great man over the past week, and flag up two below as being ones that we enjoyed reading, for those that want to spend more time on him.

Erik Hoel actually met Simons once, and shares his view of him and his vision. Hoel notes that “I’m talking instead about what he represented culturally, at least among a certain set (he was never much for the public spotlight like some billionaires). Jim was always talked of as living proof that you could just brute-force your way through impossibilities with the right approach.”

Frederik Gieschen runs through several principles that contributed to his success, including the final one to “hope for good luck,” which Simons called “the most important principle.”

David Shaw

Shaw is widely recognized as one of the pioneering figures in quantitative trading via his fund, D. E. Shaw & Co. Founded in 1988, D. E. Shaw quickly gained a reputation for its sophisticated use of mathematical models and computer algorithms to identify trading opportunities.

Shaw, who holds a Ph.D. in computer science from Stanford University, leveraged his expertise to build a firm that excelled in analyzing large datasets. He has detailed some of his thoughts in Jack Schwager’s Stock Market Wizards book.

His approach, which blended computational finance with high-frequency trading, often revolves around classical and statistical arbitrage from two or more different assets that he believes are mispriced at a point in time.

His book, Trading In The Zone, is hugely popular and details some of his trading rules.

Cliff Asness

Cliff Asness is also a name that few would disagree with putting on this list. As the co-founder of AQR Capital Management, Asness has played a pivotal role in blending academic research with practical investment strategies.

His background includes a Ph.D. in finance from the University of Chicago, where he studied under Nobel laureates like Eugene Fama. This academic foundation allowed Asness to develop a deep understanding of market anomalies and asset pricing theories, which he later applied to his quantitative models.

AQR's strategies often leverage factors such as value, momentum, and quality, systematically exploiting inefficiencies in financial markets. This data-driven approach has consistently delivered robust returns, establishing AQR as one of the top names in the industry.

Beyond running the fund Asness has been a vocal advocate for transparency and intellectual rigor in finance. He has authored numerous papers and regularly posts articles on his website aimed at providing others with an education. Below are two examples that we enjoyed;

Izzy Englander

Millennium is one of the most easily recognisable funds on the Street. Izzy Englander founded the firm in 1989 and has established himself as one of the most successful and influential quant traders in the industry.

Englander's approach to trading combines rigorous quantitative analysis with a diverse array of strategies, allowing his firm to thrive in various market conditions. Although the exact nature of the strategies is a tight secret, the firm lists some of the broad strategies used:

Under Englander's leadership, Millennium Management has grown into one of the world's largest and most respected hedge funds, managing over $60bn in AUM (from the launch size of just $35m).

Ken Griffin

In terms of coming close to Simons at the top, it’s impossible to not put Ken Griffin in the conversation. The founder and CEO of Citadel LLC, is widely regarded as one of the best quantitative traders due to his pioneering use of technology and data-driven strategies in financial markets.

Griffin began trading during his college years at Harvard, where he used a satellite dish to receive real-time stock quotes and execute trades from his dorm room. Under Griffin’s leadership, Citadel became known for its use of sophisticated algorithms and high-frequency trading strategies. The firm’s ability to process and analyze data at unprecedented speeds allowed it to identify and capitalize on market inefficiencies.

Like Englander at Millennium, the focus on quantitative research and development has enabled Citadel to diversify its strategies across multiple asset classes, including equities, fixed income, commodities, and credit, ensuring robust risk management and sustained profitability.