Meet The Man Credited With One Of The Greatest Trades Of All Time

From shorting internet stocks just before the dot.com bubble burst, Sir John Templeton carried with him an exceptional reputation.

Templeton was a member of the old guard of value investing from the 1940’s onwards.

His greatest trade came just years before he died, when he picked the top of the dot.com bubble almost to perfection.

One of his most famous quotes resonates that “the four most dangerous words in investing are: 'This time it's different.'"

When it comes to pinning down some of the greatest stock market trades of all time, we set the bar high with several criteria. For example, it has to have spotted a clear gap or arbitrage opportunity in the market. It also has to be fairly unique, or be a first-mover in placing the trade. Finally, although the size of the profit isn’t everything, it needs to have generated a sizeable return to be worthy of recognition.

We feel the dot.com trade from John Templeton in 2000 matches up. But first, who was the great man?

A summary of Templeton

John Templeton was a renowned American-born British investor, philanthropist, and pioneer in the field of finance. Born in 1912, Templeton's life was defined by his unwavering curiosity and innovative approach to investing.

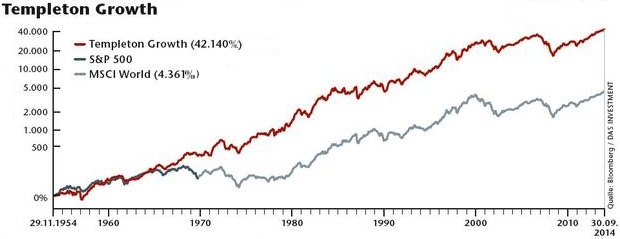

He founded the Templeton Growth Fund in 1954, which became one of the most successful investment funds in history. It averaged 15% returns per year for 38 years. The performance vs benchmarks is shown below:

Known for his long-term perspective and contrarian investment strategies, Templeton was a proponent of value investing and had a remarkable ability to identify undervalued stocks around the world.

Beyond his accomplishments in finance, he was deeply committed to promoting the principles of generosity and spiritual exploration. As a committed philanthropist, Templeton established the John Templeton Foundation, which aimed to bridge the gap between science and spirituality.

He died in 2008.

Details of ‘the trade’

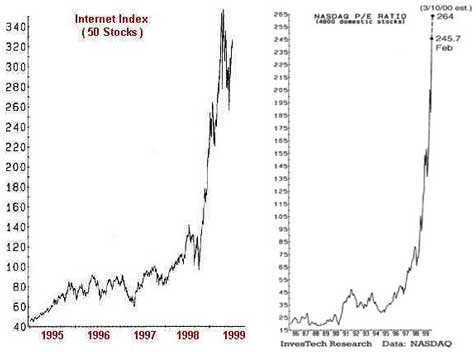

Templeton was almost at the end of his career when his best trade happened. He noted the sharp rise in the price of internet stocks, fuelling what was referred to as the dot.com rally. It’s easy to look back and say that it was a bubble, but shorting such bubbles is very difficult.

The reason for this is that a melt-up scenario can exceed fair value in the short term, and can cause you to have the right view, but be unable to hold on to a losing position for long enough to be proven right!

Timing is everything, and John Templeton picked it to perfection.

He shorted a whole variety basket of internet stocks, amounting to 84 NASDAQ composite shares.

He commented on it, saying:

“This is the only time in my 88 years when I saw technology stocks go to 100 times earnings; or, when there were no earnings, 20 times sales. It was insane, and I took advantage of the temporary insanity.”

The rally (and P/E ratios) up to the period he shorted the stocks are shown:

The story from here on out is fairly simple. Weeks after the short, the bubble burst. Between March 2000 and October 2002, the NASDAQ fell from 5,048 to 1,139, erasing nearly all of its gains during the dot-com bubble.

Templeton didn’t hold onto his trades until 2002, but rather sold out just a few weeks after placing the trades, netting $80m in profits. We couldn’t validate the notional size of his trades, but in the month following when he placed the trades, the NASDAQ Comp fell by 26%.

If we assume no leverage was taken on for this, then it would have been a notional trade of around $307m.

If leverage was taken on, then the actual outlay of capital could have been even smaller.

Our three favourite quotes

Over the decades, Templeton gave out various great piece of advice and quotes. Here are our favourite ones…

"The four most dangerous words in investing are: 'This time it's different.'"

This quote highlights the importance of avoiding complacency and skepticism in investing. Templeton believed that investors should be wary of assuming that current market conditions or trends will persist indefinitely.

"The only way to avoid mistakes is not to invest—which is the biggest mistake of all."

Templeton emphasizes that refraining from investing altogether is a mistake in itself. He recognized that investment inherently involves risks and the possibility of making mistakes. However, he believed that avoiding investment entirely would mean missing out on potential opportunities for growth and wealth accumulation.

"Invest at the point of maximum pessimism."

This quote reflects Templeton's contrarian investment philosophy. He believed that the best investment opportunities often arise when the market sentiment is overwhelmingly negative. By investing during times of maximum pessimism, when prices are low and expectations are low, an investor can position themselves for substantial gains when the market eventually recovers.

More weekend reading…

Below are three Substack articles we really enjoyed reading recently that you might enjoy as well.

Growth Is Crushing Value by Caleb Franzen