Meet The New ETF With 100% Loss Protection

Structured products are back thanks to higher interest rates. Here's how to build them yourself.

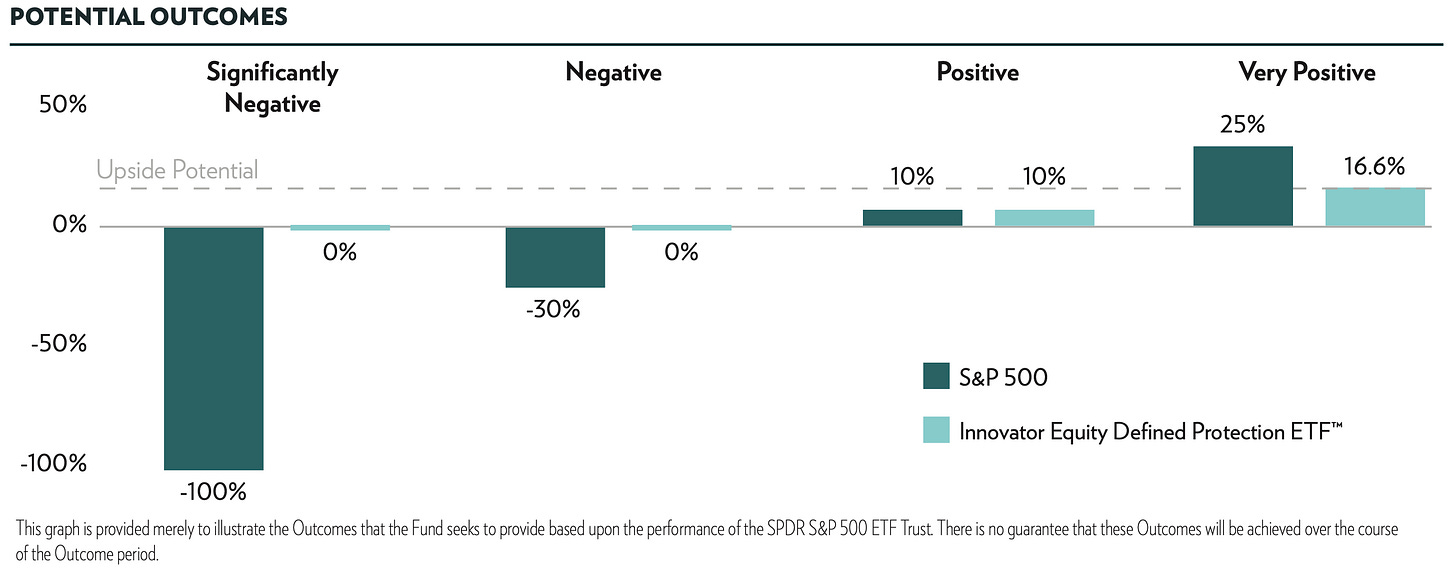

The new ETF provides 100% downside protection yet allows participation if the index moves in the client’s favour.

We flag up why structures like this are coming back into vogue due to higher interest rates.

We highlight how investors can build such products at home at a cheaper all-in cost.

In recent weeks, news has broken about a new structured product packaged as an exchange-traded fund (ETF). It’s called the Innovator Equity Defined Protection from Innovator Capital Management.

It’ll provide 100% protection for two years against any downside in the S&P 500 and allow investors to benefit from any upside up to a cap of 16.62%. Full details of it can be found here.

These types of products aren’t new, but only recently (due to interest rate movements) are they starting to pop up in attractive ways…

The general premise of a structured product

Traditionally, a structured product consisted of the purchase of an option and a zero-coupon bond.

The zero-coupon bond doesn’t pay a coupon during the life (hence the name) but rather is bought at a discount to par. Let’s say that you pay $90 for a ZCB that will mature at $100 in two years time. Your return is the difference in the price rather than the interest payments.

For a structurer, they would take the $100 from an investor and use $90 to buy the ZCB. Given that this matures at $100 in two years’ time, the tenor of the product would be two years. The structurer knows that barring credit risk, the $100 will get paid back, so worst case, he can give $100 back to the client.

With the extra $10 he has ($100-90), he can go and purchase a call option on an index or a basket of stocks. If the stocks rise in value, the product generates a profit for the client. Usually, this is in the form of a call spread, which cheapens the cost but caps some upside.

A simple example of how this would look from the front-end (client perspective) would be…

Two-Year Principal Protected Note Linked to the S&P 500

100% Protection on the downside

100% Participation in upside movements in the index, capped at X%

Where’s the catch?

Clearly, if the above was an actual product, everyone would buy it. The main consideration is that in recent years with low-interest rates, ZCBs simply didn’t pay much. You might buy at $99.8 and redeem at $100. With such a tiny amount left to buy options with, it really didn’t make sense to trade this product.

Alternatively, higher risk was built in. For example, instead of 100% protection, it could be cheapened to 90% or 80%. Or the upside potential would be capped, say to only benefiting from 50% of the upward movements.

Yet thanks to the sharp rise in interest rates over the past year, structured products are very much back in vogue. Below shows the rise in the 1-year US ZCB. With generous yields, structurers and traders can play around with much more, all still while offering 100% protection.

Going back to the Innovator Equity Defined Protection, it’s clear that the potential benefit offered (even though it’s capped at 16.62%) wouldn’t have been possible even just this time last year. I guess we can thanks Chair Powell and Co for that.

How to build it at home

The ETF does have a low fee of 0.79%, although we imagine they are building in a spread within the product as well.

Typically, if you were buying a structured product through a bank, not only would you pay an upfront fee but also embedded fees of 3-5%. In reality, you can build these by yourself and save a lot on costs.

A lot depends on the platform used by retail traders. If one can access options and bonds, these trades can be made without too much effort.

Even if ZCBs aren’t available, more traditional bonds can be used instead with slight modification.

As a special edition of our Monday Trade Ideas, we’ll be posting three structured product ideas next Monday, along with a breakdown of how to build them. In order to receive these direct to your inbox, make sure you are subscribed.

This looks very interesting