Meet The Two Yale Professors Who Say To Invest With More Leverage

We review the stories of Ian Ayres and Barry Nalebuff and their investing philosophy.

Although our Sunday investor pieces usually focus on a prominent investor or trader, we turn more towards academia this weekend. “But AP, theory and reality in financial markets can be completely different”, we hear you cry. That’s true in some cases, but from researching these two gentlemen, we think you’ll want to hear what they say.

Earlier this week, Market Sentiment published a great article, “Should Your Portfolio Be 100% Stocks?” It is a terrific write-up and one you should add to your reading list this weekend. There was one section in the article that really caught our eye: The concepts put forward by Ian Ayres and Barry Nalebuff in their 2008 paper.

Who are they?

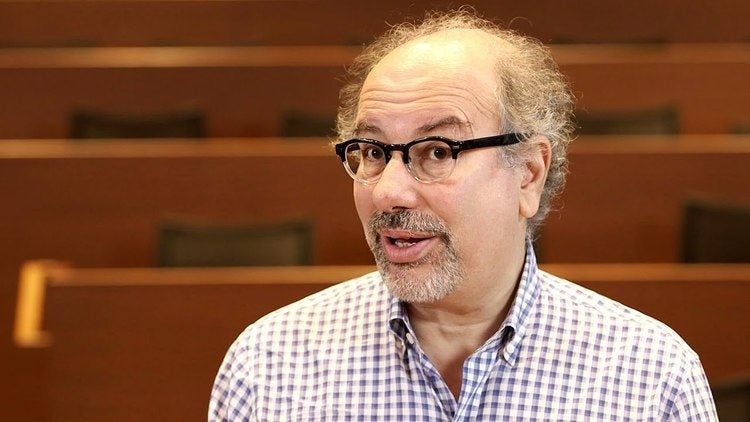

Ian Ayres, born on August 22, 1959, is an accomplished American economist, lawyer, and professor who has made significant contributions to the fields of law and economics.

Ayres earned his Bachelor of Arts degree from Yale University in 1981 and went on to receive his J.D. from Yale Law School in 1986. Early in his career, Ayres displayed a keen interest in the intersection of law and economics, which shaped his academic pursuits. He became a professor at the Northwestern University School of Law before joining the Yale Law School faculty in 1994, where he currently serves as the William K. Townsend Professor of Law.

Barry Nalebuff, born on January 22, 1958, is also an accomplished American economist, professor, and business strategist. He’s best known for his influential work in game theory and business innovation.

Nalebuff completed his undergraduate studies at MIT, where he earned a Bachelor's degree in Economics in 1980. He later pursued a Ph.D. in Economics at Oxford University as a Rhodes Scholar. His early academic interests in game theory and competition laid the foundation for his impactful career.

He has held teaching positions at prestigious institutions, including the Yale School of Management, where he is currently the Milton Steinbach Professor of Management.

Jumping Straight To The Point

Back in 2010, Ayres and Nalebuff came together to write and publish Lifecycle Investing. They argue that the traditional asset allocation model for investors is leaving some returns on the table. They say that it’s possible to increase returns without adding significant risk.

One factor that is put out there (particularly for young investors) is pushing the use of leverage.

The book advocates using leverage as part of its strategy to enhance the potential returns and risk management of an investment portfolio over an individual's lifetime. The idea of incorporating leverage (borrowing to invest), is grounded in the authors' belief that judicious use of leverage can be a powerful tool when employed strategically.

Throughout an investor’s 20s, 200% leverage is recommended (shown in the below chart) into stocks. This scales down to 100% by age 36 and reduces down to a 40% allocation to stocks at 65. This is contrasted to the Birthday Rule strategy, which uses your age to calculate your allocation to stocks (decreasing in a linear fashion as you get older).

This was quite (and still is) a controversial idea. But there are sound reasons argued in the book as to why it can help:

Amplifying Returns in Early Years: The authors say that during the early stages of one's career, when human capital (future earning potential) is high and stable, taking on leverage can amplify the returns on the investment portfolio. By borrowing to invest in equities, investors can potentially benefit from the long-term growth of the stock market, capitalizins on the higher risk tolerance associated with a longer investment horizon.

Enhancing Wealth Accumulation: Leverage can accelerate the growth of financial capital, especially in the early years when individuals have a longer time horizon for their investments. This approach aims to maximise the compounding effect on returns, potentially leading to a larger investment portfolio over the long term.

Dynamic Adjustment of Leverage: The book suggests a dynamic approach to leverage, advocating for adjusting the level of borrowing based on factors such as age, market conditions, and the stability of human capital. This dynamic adjustment allows investors to respond to changing circumstances and market conditions throughout their life.

Leverage as a Risk Management Tool: Ayres and Nalebuff propose using leverage not only for return enhancement but also as a risk management tool. By adjusting the leverage ratio over time, investors can potentially protect against downside risk during periods of market volatility, especially as they approach retirement. This includes using Options and other derivatives.

A quick reminder: we publish our own stock screeners to flag up shares that look attractive. These are sent to our premium subscribers.

You can become a premium subscriber for just £10 a month. This gives you full access to all of our content, including our flagship Monday trade ideas, right through to our screeners.

To make the offer even sweeter, we’re offering a 14-day free trial as well. It wouldn’t be fair to ask you to pay without first letting you see what value we offer.

Does it work?

We highlight the table below (from the book) when assessing whether a more aggressive use of leverage for young investors makes sense:

The columns compare the lifecycle strategy against the Birthday Rule idea (explained earlier) and the constant % allocation to stocks (no explanation needed!).

The max 200% leverage is noted, which is where the significant outperformance can be seen. The mean result of the ending portfolio value for the lifecycle strategy is 89.2% higher than the BR and 63.3% higher than the Constant %.

The simulation was done within a timeframe of well over 100 years. Granted, this ended just as the global financial crisis was kicking off.

As a side note, the data was shared with Apoorv Trivedi in 2022 for the real-life performance of the strategy since 2009, and it handily out-performed the alternatives.

Words of caution

There’s no doubt that leverage can help to enhance returns, and even on a risk-adjusted basis over the long term, the points made by the authors really do give food for thought. Yet we wouldn’t be a responsible outlet if we didn’t flag up some of the dangers of leverage:

Amplified Losses: One of the primary risks of using leverage is the potential for large losses. While leverage can enhance returns in favourable market conditions, it also magnifies the impact of market downturns. A significant market decline can lead to substantial losses, potentially eroding a leveraged portfolio more quickly than an unleveraged one.

Interest Rate Risk: Leverage involves borrowing capital, typically at an interest cost. During the pandemic, this wasn’t much of a factor, but the sharp increase in rates since then affected the cost of borrowing, impacting the overall performance of a leveraged portfolio.

Margin Calls: If the value of the leveraged assets declines significantly, investors may face margin calls (we’ve all been there). A margin call requires additional capital to be deposited to maintain the leverage ratio, and failure to meet a margin call could lead to forced liquidation of assets.

Higher Stress: The emotional toll of leveraged investing can be high. The heightened volatility and potential for significant losses may lead to more stress, potentially impacting the ability to make rational decisions during market fluctuations.

This was written 18 months ago. Curious to see how many of your subscribers actually started following this?