Meet Yale's Legendary Chief Investment Officer

Credited with co-founding the endowment model investing approach, we look at the life of David Swensen.

Recently we did a deep-dive into the research of two Yale professors on why they recommend investing with more leverage when you’re younger. We’ve stuck with a Yale connection this week, turning to David Swensen. Although he sadly died in 2021, his legacy via his remarkable career and investment ideology will live on for a long time.

Who is he?

David Swensen, born on February 8, 1954, in River Falls, Wisconsin, embarked on a trajectory that would redefine the landscape of institutional investing.

Growing up with a keen intellect and a passion for economics, Swensen pursued his undergraduate studies at the University of Wisconsin-Madison, majoring in economics. His academic journey continued at Yale University, where he earned a Ph.D. in Economics in 1980.

Swensen's early career saw him delve into the financial realm at Lehman Brothers, where he gained valuable insights into investment strategies.

However, it was his return to Yale University in 1985 as the Chief Investment Officer (CIO) of the Yale Endowment Fund that marked the beginning of his transformative impact. He achieved consistently strong returns for the fund over several decades. This was noted by his inclusion into Institutional Investors Alpha's Hedge Fund Manager Hall of Fame in 2008. He remained in his post at Yale right through to his death in 2021.

Success at Yale

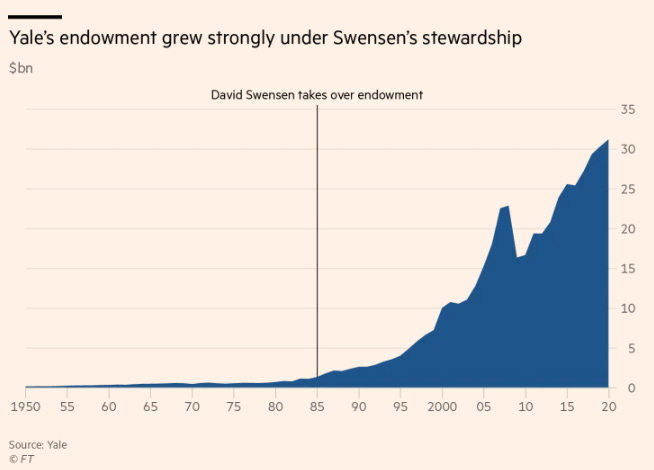

Swensen looked after the fund from 1985 to 2020. Over this period, it generated an annualized return of 12.5%. This compares to the S&P 500 index, which returned 9.7% over the same period.

Below is a neat FT chart showing the growth under Swensen’s tenure:

Charles Ellis (Yale’s endowment chair between 1997 and 2008) said of him:

“The really great painters are the ones that change how other people paint, like Picasso. David Swensen changed how everyone who is serious about investing thinks about investing. The results were wonderful, but were organised to be no surprise. If you watch a great chef prepare in the kitchen, you know the meal is going to be good.”

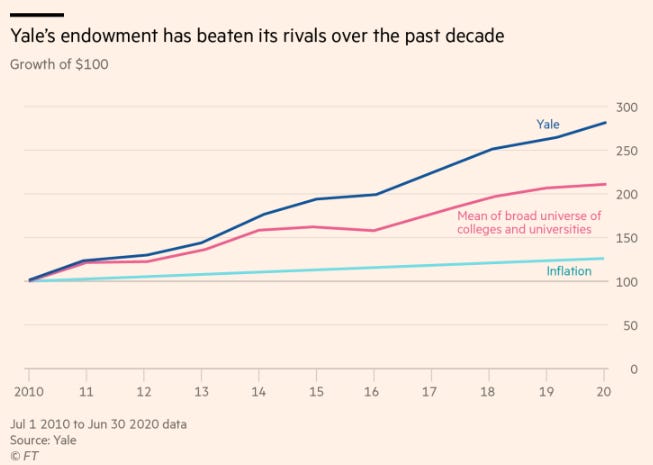

Over a decade of data performance from 2010-2020, Yale managed to comfortably outperform University endowment competition.

If you are not already, consider becoming a premium reader of AlphaPicks. This allows you to access all of our articles without paywalls.

This includes our flagship Monday weekly rundown with actionable trade ideas, our weekly published stock screener model results, as well as our Wednesday and Friday research and opinion pieces on global markets.

You can access a free 7-day trial to get you started.

Investment approach

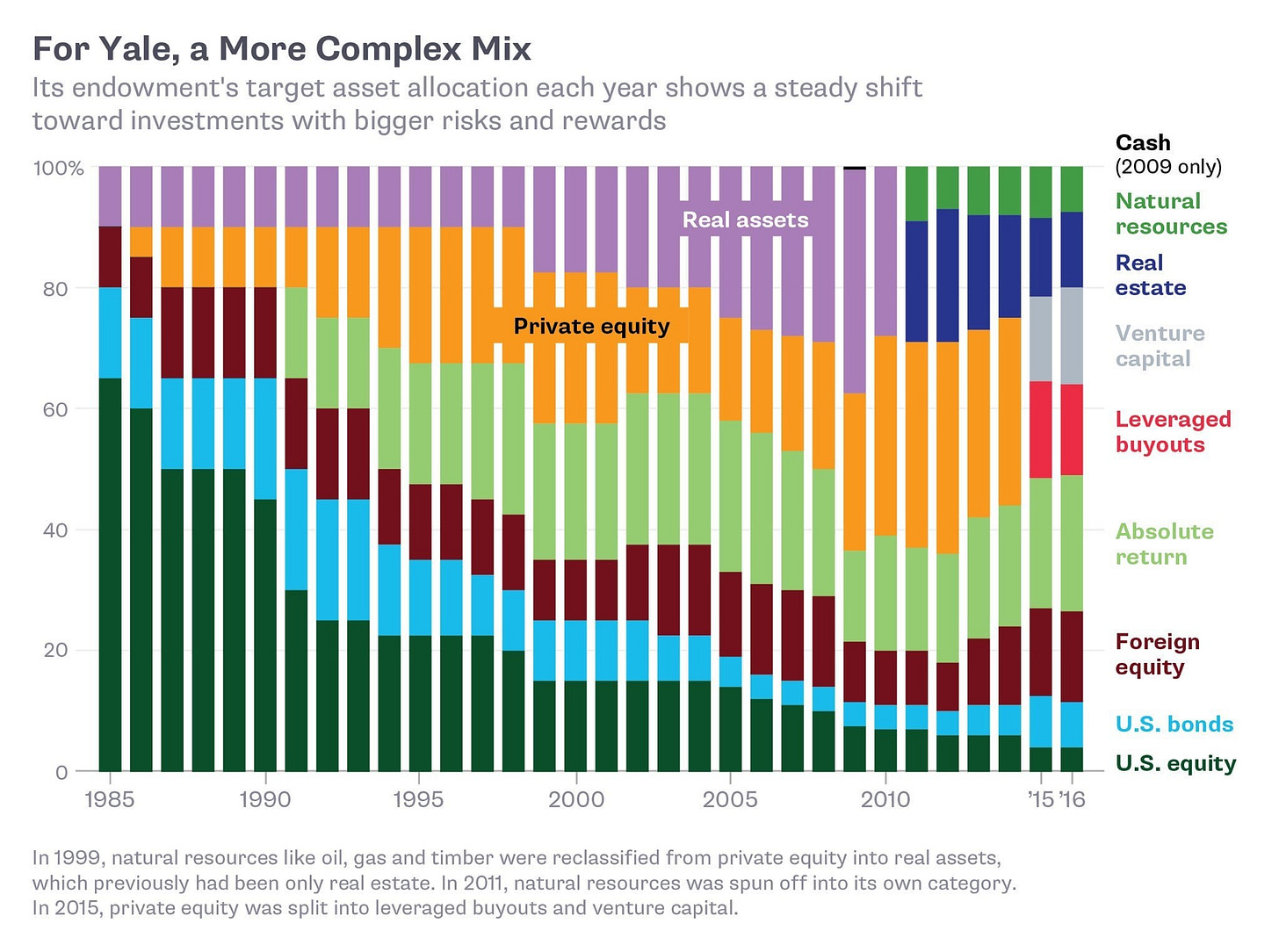

Swensen tore up Yale’s traditional 60/40 allocation approach and implemented some key changes in the investment strategy that allowed the fund to outperform. As a side note, the ideas are put together in what is now referred to as the Yale Model or the Endowment Model, given the success and use in being replicated by other endowment funds.

Here are the key factors:

Diversification: Swensen advocated for broad diversification across asset classes to reduce risk and enhance returns. Rather than relying solely on traditional stocks and bonds (in the 60/40 split), he allocated significant portions of Yale's endowment to alternative assets such as private equity, venture capital, real estate, and natural resources. This diversified approach helped Yale navigate volatile market conditions and capitalize on opportunities across various investment sectors.

Long-Term Orientation: He emphasized the importance of adopting a long-term investment horizon. Instead of chasing short-term market trends or attempting to time the market, he focused on identifying high-quality investment opportunities with the potential for sustainable growth over time. By maintaining a patient and disciplined approach, Swensen sought to capitalize on the power of compounding and maximize returns over the long term.

Active Management and Manager Selection: Swensen believed in the value of active management, particularly when it came to selecting skilled investment managers. He sought out talented fund managers with proven track records and a deep understanding of their respective asset classes. Swensen emphasized the importance of conducting thorough due diligence and building strong partnerships with investment managers who shared Yale's investment philosophy and objectives.

Alternative Investments: A cornerstone of Swensen's strategy was the allocation to alternative investments. He recognized the potential for higher returns and reduced correlation to traditional asset classes offered by alternative investments such as private equity and hedge funds. Swensen's strategic allocation to alternative assets played a key role in enhancing portfolio diversification and driving long-term performance.

Fiduciary Responsibility: Swensen approached investing with a strong sense of fiduciary responsibility, prioritizing the long-term interests of Yale's endowment and its stakeholders. He maintained a transparent and disciplined investment process, adhering to rigorous risk management practices and ethical standards. Swensen's unwavering commitment to fiduciary duty earned him the trust and respect of the Yale community and the broader investment industry.

Best quotes

"The essence of investment management is the management of risks, not the management of returns." This quote encapsulates Swensen's core philosophy on investing. He believed that success in investment management isn't about chasing high returns but rather about understanding and mitigating risks. Swensen emphasized the importance of diversification and prudent risk management in building a robust investment portfolio.

"Trying to time the market is like trying to catch a greased pig at a county fair - you may end up dirty and empty-handed, but at least you'll have a good story to tell!" Here he passes on a humorous take on why trying to time the market is incredibly hard and often unprofitable. Sure, it can make for a good story down at the local bar, but ultimately we’re in the business of making money.

"Individual investors who trade frequently incur serious penalties. The costs of institutional investors’ high turnover are passed on to individuals." The great man cautioned against frequent trading, highlighting the detrimental impact it can have on investment returns. He believed that excessive trading not only incurs high transaction costs but also erodes long-term investment gains. Swensen advocated for a disciplined, long-term approach to investing, rather than succumbing to short-term market fluctuations.

"The investment business is the most cynical, rapacious, and unloved sector in America." His blunt assessment of the investment industry reflects his belief in the need for transparency, integrity, and fiduciary responsibility. He criticized aspects of the financial sector that prioritize short-term profits over the best interests of investors. Swensen advocated for a more ethical and client-centered approach to investment management.