Burry's Betting Big...

...on China and gold

13F filings offer a useful insight into the recent past of what funds have been buying and selling. We say the recent past as naturally any trading activity is slightly out of date by the time the information gets released. Yet it still provides a great glimpse under the hood of what popular managers are doing and how they are positioned.

This week saw the release of the Q1 2024 filing for Michael Burry’s Scion Asset Management. We feel Burry needs no introduction for our reader base, but for those that want to know more about him, check this out here.

Not every filing is worth reviewing in detail, but there were several position changes that we found interesting. When you consider that Burry historically makes large concentrated bets on his portfolio, arguably all of his ideas are high conviction. Here’s what we noted.

Before we get going, a friendly reminder that you can become a premium subscriber with us for just £10 a month. This provides you full access to our weekly articles without a paywall, including our flagship Monday trade ideas and access to what we are buying and selling in our Global Asset Portfolio.

It Shines Like Gold

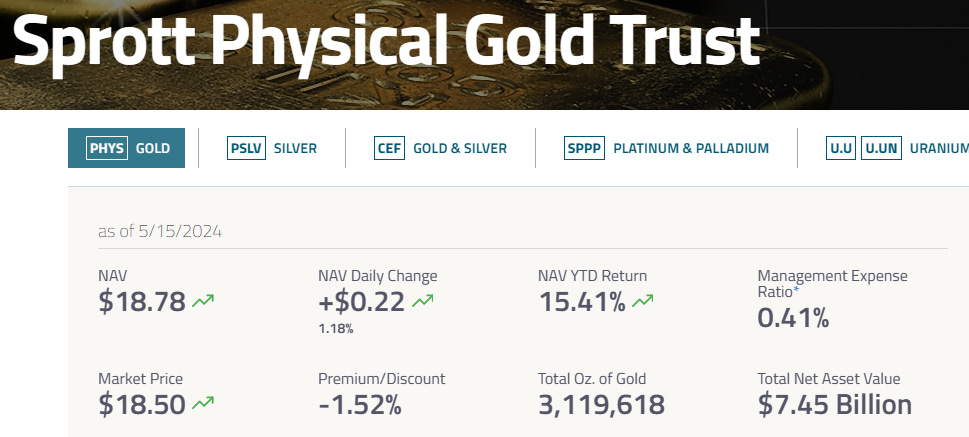

Burry added $10.3m worth of the Sprott Physical Gold Trust (PHYS) during the quarter. The closed end fund holds all of its assets in physical gold bullion.

With a low expense ratio of 0.41%, it provides a no frills way of making a play on gold moving higher.

It becomes his fifth largest holding in the portfolio at 7.37%.

After struggling to meaningfully break and hold above $2,000 an oz for several years, the break higher in Q1 has seen a swift follow through, with the precious metal showing little signs of slowing down.

We’ve pointed to several reasons that fundamentally have supported the gold price rally this year, including:

Impending rate cuts

One of the primary drivers is the anticipation of interest rate cuts by most G10 central bank. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, making it more attractive to investors.

Geopolitical Tensions

Ongoing conflicts such as the Israel-Hamas war and the broader geopolitical tensions between major powers like the US and China have increased demand for gold as a safe haven.

Central Bank Purchases

Continued buying by central banks around the world has supported gold prices. Countries such as China, Turkey, and Russia have been increasing their gold reserves, with a secondary aim of diversifying away from the US dollar.

Putting this all together, we agree with Burry’s trade here as part of a precious metal rally. However, we actually prefer to express this via buying silver (XAG/USD).

We think the gold to silver ratio is too low (see below), as well as pointing to more industrial demand for silver instead of gold. So there could be more legs to this silver rally, and with volatility historically higher, the upside push could be larger.

China China China

Burry increased his stake in several Chinese names that he has already been building up.

Even though he exited several Chinese positions back in 2023, he has been back in over the past couple of quarters. Key names include exposure to Alibaba, JD.com and Baidu. Interestingly, this makes JD and BABA his two largest holdings as of the end of the quarter:

We flag up a few reasons why China is starting to look appealing to some that were previously on the sidelines: