Michael Burry Was Wrong, But It Doesn't Mean The Market Is Right

The famed investor might have apologised yesterday for his previous conviction to sell, but we aren't out of the woods yet for equity markets.

Legendary investor Michael Burry admitted this week “I was wrong to say sell” in February.

The stock markets have climbed since then, with the NASDAQ 100 officially entering a bull market on Wednesday.

However, with plenty of risks still present, we feel the market is getting ahead of itself.

For those not familiar with Michael Burry, we suggest sitting back this weekend and watching The Big Short, one of our teams favourite finance related movies.

It tracks the true events leading up to the financial crisis of 2008/9, and how some investors (including Burry) forecasted and accurately called the problems in the housing market. Due to this, he has since gained a cult like following and has issued some contrarian opinions. However, given his success back in 2008, he does carry weight with his thoughts.

Back in February, Burry tweeted an ominous one word ‘sell.’

Without specifying which particular financial market he was referring to, many pointed to the US equity markets. We were in a situation where expectations of a terminal Fed rate were climbing higher and higher, with concerns around inflation being more persistent.

Burry says he was wrong

By the letter of the law, Burry would technically be flat if he had shorted SPX when he initially tweeted. The index was around 4,050 points on 31/01, and it closed yesterday at 4,065 points. However, if he had shorted the NASDAQ 100, he would be down 8%.

Regardless of his actual performance over this period, he clearly feels the fundamental picture has changed. That’s why a fair amount of news coverage picked up his latest tweet:

We flag up a few contributing factors that have pushed equity markets higher this the end of January.

The response to the issues with SVB and First Republic showed investors they effectively have a backstop either from Tier 1 banks or the US Gov.

UST yields have moved lower across the curve, easing expectations about further significant Fed hikes.

Broader risk sentiment globally has improved, shown by increases in the price of assets such as Bitcoin.

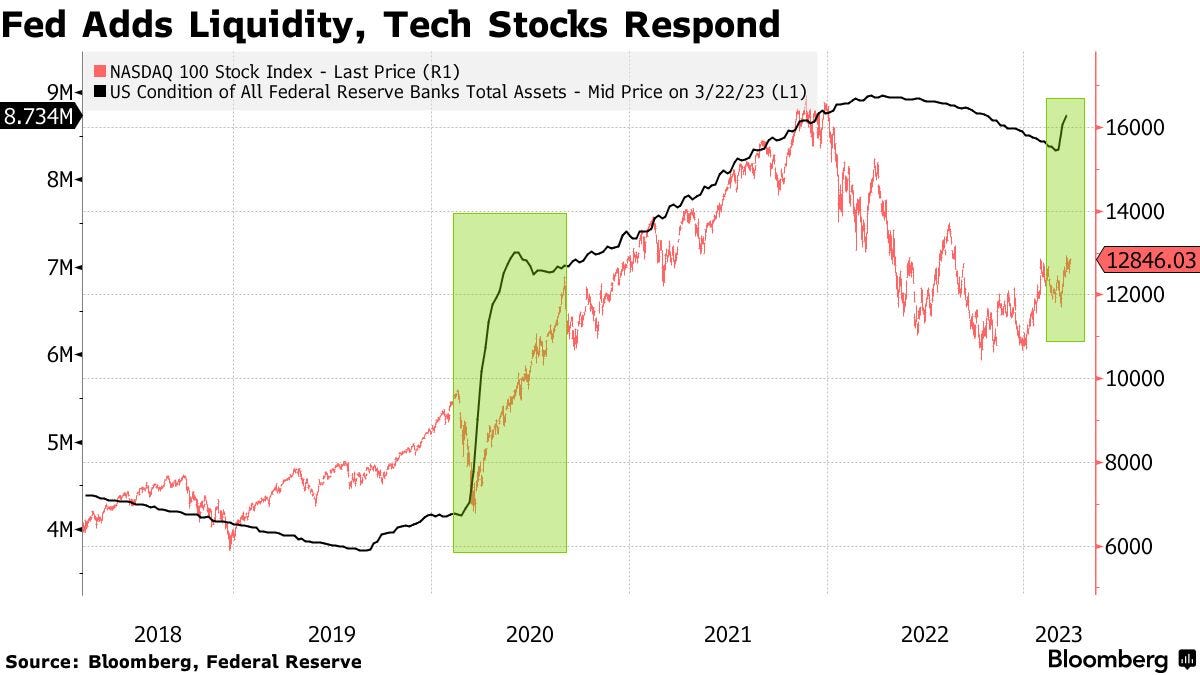

The expansion of the Fed’s balance sheet (by some $400bn) also can be seen to have a correlation to the move higher in the NASDAQ, shown by the below chart.

Why the market isn’t always right

The bump higher in the past month might be justified to some from the above reasons. Yet we don’t feel that we’re anywhere near out of the woods yet.

To begin with, we feel the market is looking at the financial instability from failed banks in the wrong way. It shouldn’t be a case of celebrating the backstops being provided by the state. Rather, it should be concerned about the lack of risk management and balance sheet prudence of the banks.

We haven’t seen bank runs and failures of this extent since Burry became famous back in 2008. Why isn’t the market understanding that this isn’t a normal occurrence in the US banking sector?

Another point of worry is that at the last US Fed meeting, Powell reiterated his priority remains inflation control and backed this up by the committee hiking by 25bps. Since then, Fed president Bullard has backed further hikes later this year.

Given the current US rate is 4.75-5.00%, you might think the market is pricing in a year end rate of 5.25% or even 5.50%. Nope. It’s currently at 4.37%.

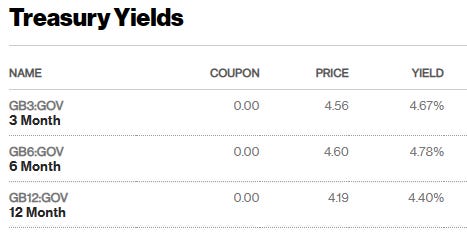

You can get a feel for the short end of the yield curve from the below pricing:

The correlation between rates and equity markets is strong. We feel there is a clear disconnect from what the Fed is telling us and what is currently being priced in. If we’re correct, the stock market should fall when it reprices.

Where is the smart money going?

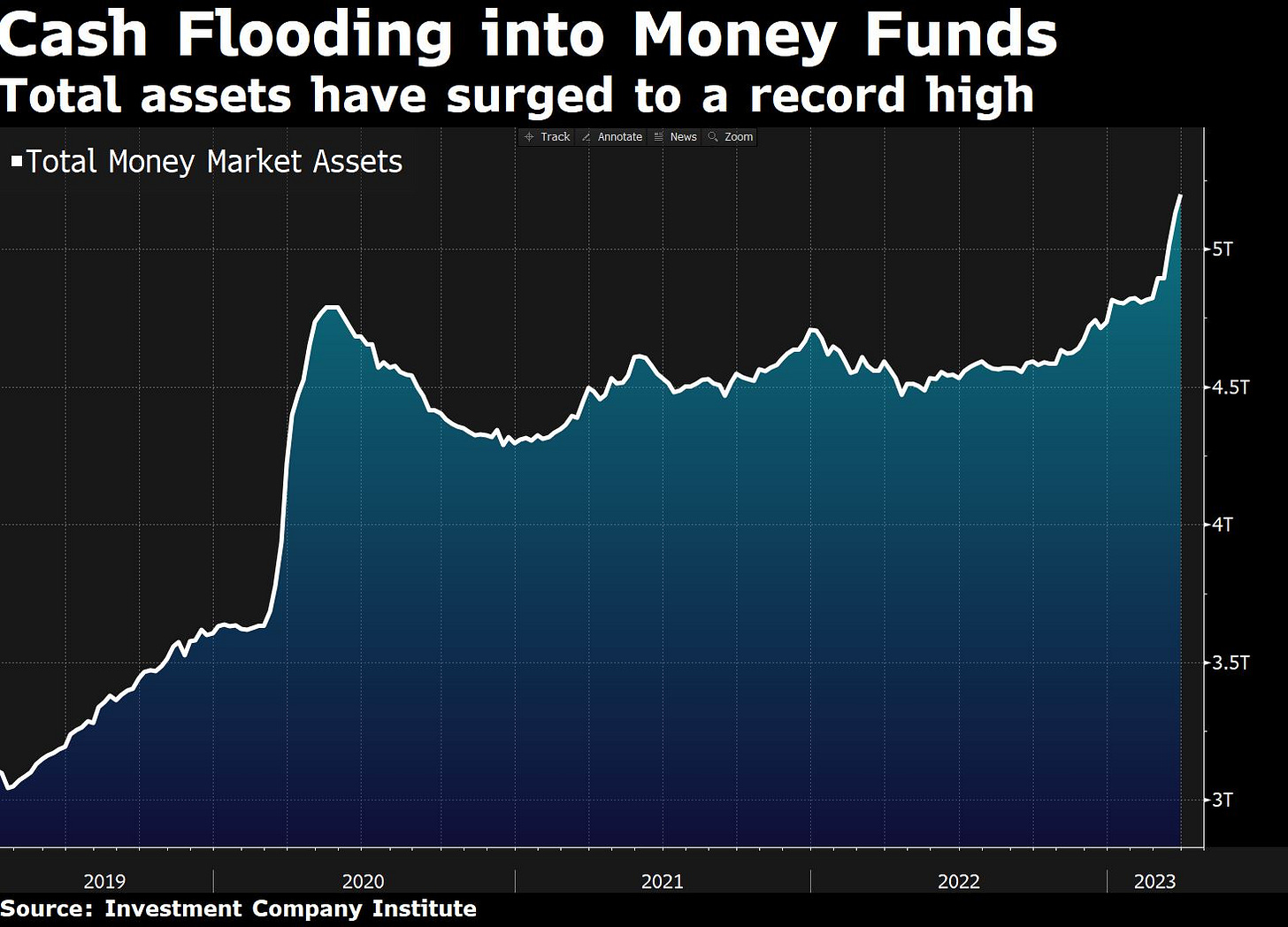

A very telling chart to us is the flows into money market funds (see below). We had a sharp spike at the start of the pandemic, as investors pulled money from stocks and other assets and put it into MMF. We’re seeing another spike at the moment.

Given the rise in yields, we feel the smart money is moving OUT of stocks and into MMF as an example.

We are also seeing strong demand for gold. XAU/USD recently tested $2,000 and appears to be consolidating just below this level for another opportunity to break higher in coming weeks. Year-to-date, the precious metal is up 8.8%.

Our Twitter account posts quick, informative tweets and data throughout the week. We also join live trading spaces, which you can listen to. So please drop us a follow and turn notifications on to stay up to date.