MicroStrategy's Billion-Dollar Gambit

Funding a Bitcoin treasury through Wall Street-style financial engineering.

On the surface, MicroStrategy (MSTR) may look like the comeback story of the century. The stock fell 99.9% after the dot-com crash but has recently reclaimed new ATHs after a 25-year recovery. More often than not, stocks that fall hard struggle to get up again. MSTR might be one of the few exceptions to that, but they’ve played a risky game to get here.

Below the surface, there is an intricate dynamic at play that may be viewed as ‘make or break’ for Saylor and Co. as he takes a stable but slowing software company and transitions into financial arbitrage in the capital structure of a corporate treasury.

An overview of how MicroStrategy ended up in today’s situation, enticing convertible bond arbitrage players along the way, is warranted.

MicroStrategy Brief

MSTR’s business model has changed since its early days. The company’s software business made an $18.5m loss in Q3 2024. However, the 44-page earnings report does not mention this side of the company much—just two pages. Instead, all the attention revolves around a new focus: Bitcoin.

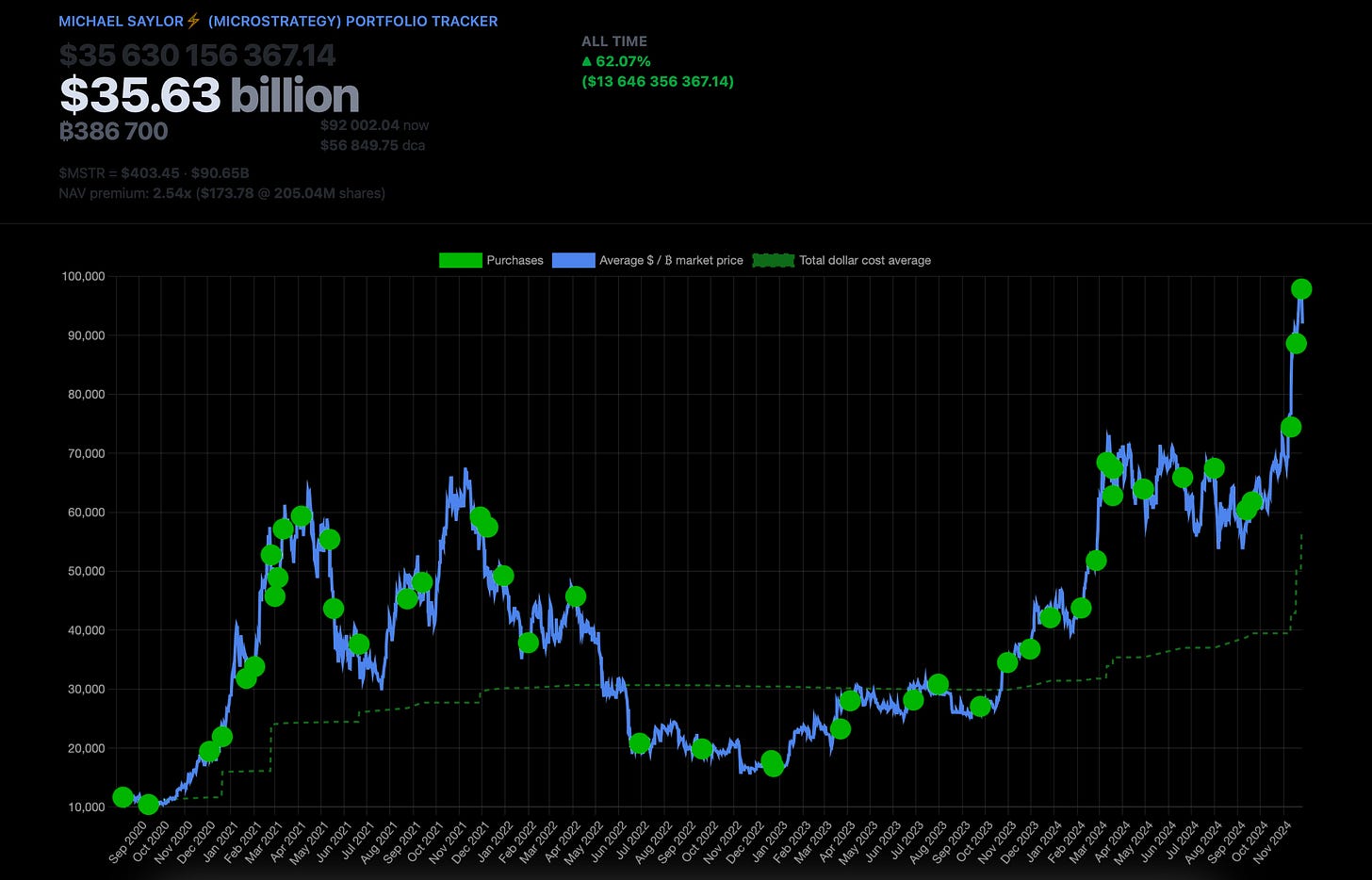

They have become a Bitcoin buying machine. MSTR is the largest corporate Bitcoin holder globally, with 386,700, valued at approximately $35.6bn (assuming a Bitcoin price of $92,000).

How does a company that posted a net loss for the past three quarters fund these acquisitions? Through equity sales and debt financing. And it seems like what they have done already is just a toe in the water. Saylor unveiled an audacious plan just days before the election to hire investment banks to raise $42bn in capital over three years through stock and bond offerings to buy more tokens. His company had $4.3bn in convertible debt outstanding as of Oct. 29.

Equity financing is a fairly straightforward concept. It involves raising capital by selling shares. As MSTR is a public company, it does this by selling shares of its company to public markets.

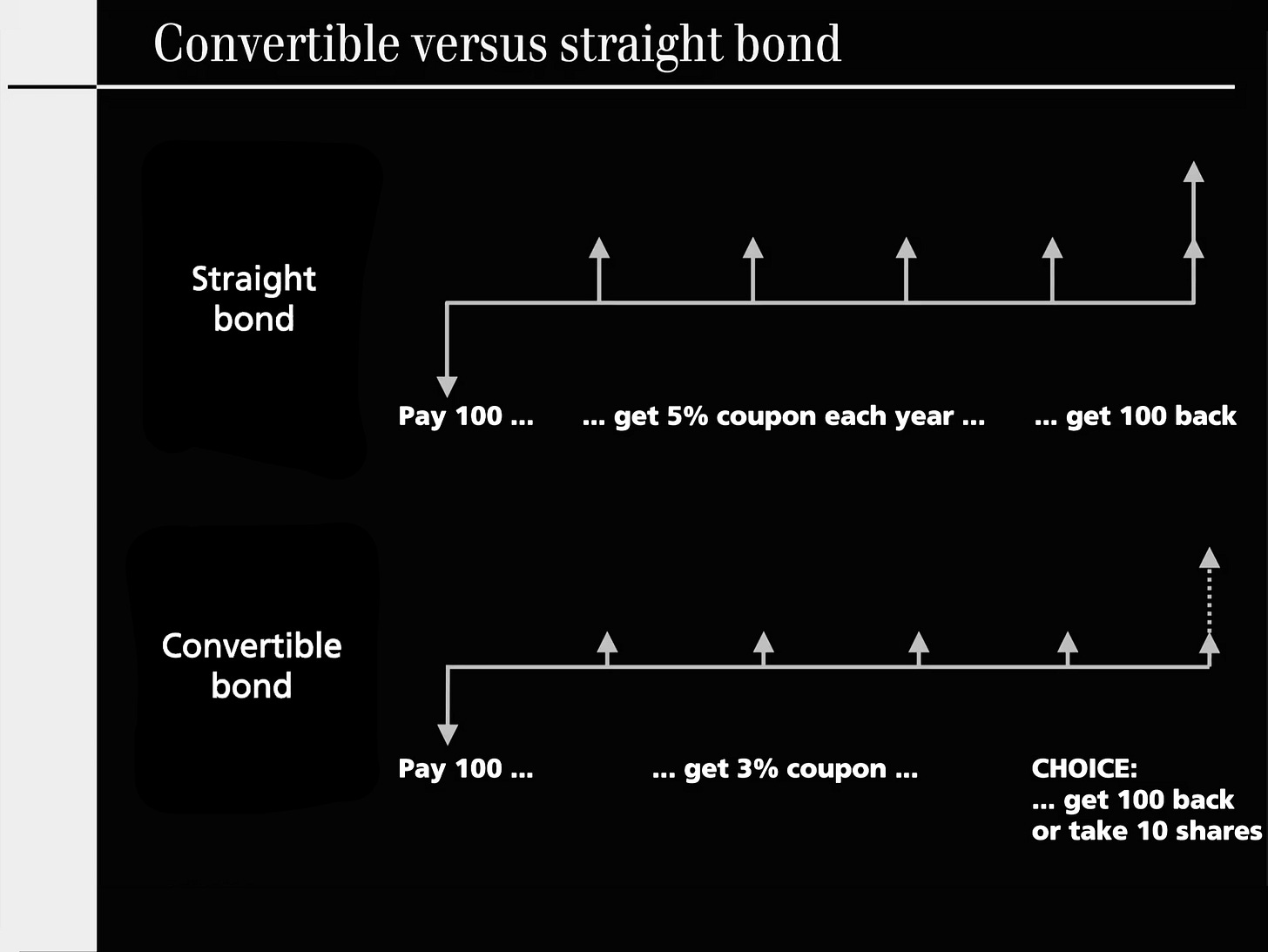

Selling debt to finance a company is a little less straightforward. Corporate bonds are debt securities issued by a corporation to raise money. Bonds are sold to investors, and the company gets the capital. In return, the investor is paid a pre-established number of interest payments at either a fixed or variable interest rate. When the bond expires or “reaches maturity,” the payments cease, and the original investment is returned.

Convertible bonds are more complex.

Convertible Bonds

Convertible bonds are a flexible financing option for companies. A convertible bond offers investors a type of hybrid security, which has features of a bond, such as interest payments, while also providing the opportunity of owning the stock. The bond’s conversion ratio determines how many shares of stock you can get from converting one bond. For example, a 5:1 ratio means that one bond would convert to five shares of common stock.

The conversion price is the price per share at which a convertible bond can be converted into common stock. MSTR’s latest offering is 0% (no interest paid) convertible senior notes offering a 55% premium, equating to an implied strike price of ~$672.

If you’re looking to raise money, and maybe debt markets are too expensive at 10 or 15% because you’re not in particularly good credit, then you can go down the route of selling a convertible bond. This way, you can get a much lower coupon because you’re embedding an option to sell your stock at a massive premium to the market. The low coupon rate is the reason Saylor has gone down this route.

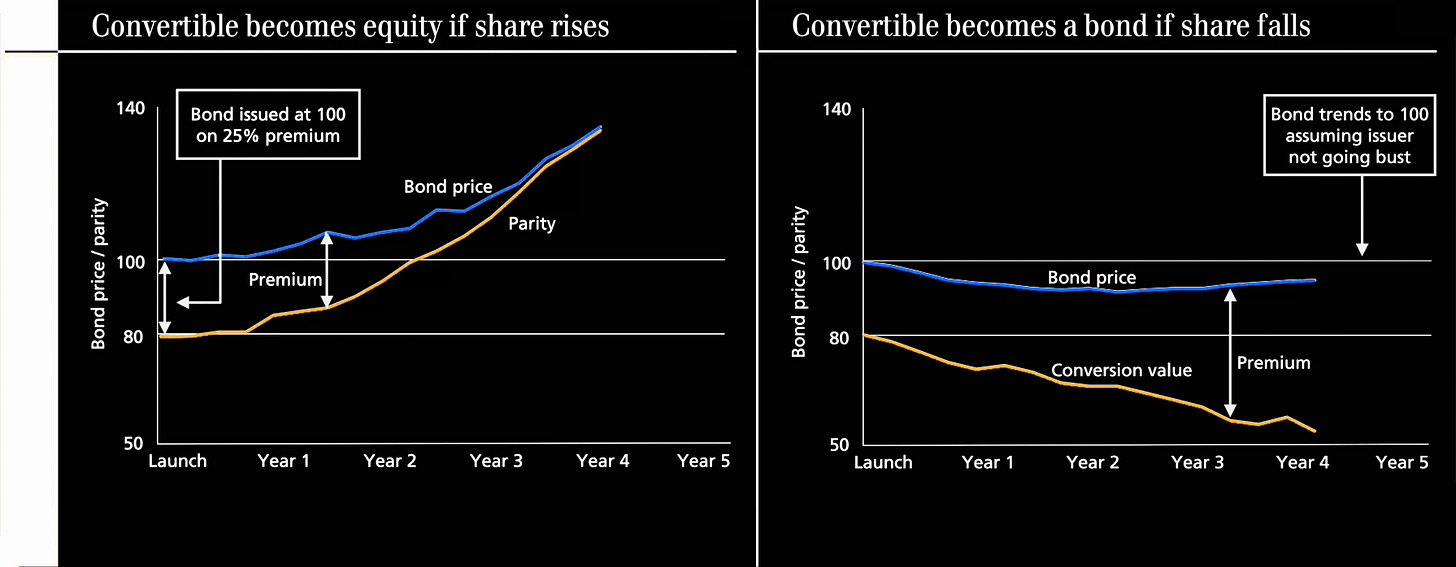

Now, swap to the investor’s POV. In MSTR’s case, you’re giving Saylor your cash at a 0% interest rate and hoping the stock price surpasses $672 (using the latest offering as our example) to make a profit. Granted, there’s not a massive downside to this deal. Your money will be paid back at the end of the term, and in the case of liquidation, debt holders take priority over equity holders. But who is buying MSTR’s CBs with a 0% coupon?

Most of the buyers of a convertible bond are not buying it because “if the stock goes up, great, and if it doesn’t, I’m protected to the downside.” What these buyers are doing is trading it as if it were an out-of-the-money option. They trade CBs alongside a stock short. They take the bond, and they hedge it on whatever the implied amount of shares that they should have short against it, calculated by the delta. You don’t have to hedge the delta perfectly; this depends on the risk exposure the CB buyer wants to run.