“Sic Transit Gloria Mundi” ~ “Thus Passes Worldly Glory”

Welcome to AlphaPicks' monthly market update - a rundown of global markets for the coming weeks in under ten minutes.

Guest collaborator: Deer Point Macro

Here’s what you need to know…

Macro ~ FX & Rates

Deer Point Macro: FX and rates that are top of mind going into the following month

A significant focus for the coming months centers on FX, where I think there’s still plenty of alpha to be generated despite subdued overall volatility, as well as within the rates complex.

Euro

At the forefront of my observations, is the EUR/USD. The ECB will be meeting on April 11th, and this should play out interestingly. Looking at the EURO on the 1 month time frame is where we will begin. We have observed massive demand for put buying relative to calls, and I do believe that this will continue to be the case into the ECB meeting as the market starts to anticipate a much more dovish ECB relative to the FED. This should start to put some downside on the EUR/USD. Hence, there is anticipation for this sideways chop in EUR/USD spot to start to fade, and for the EUR to move lower relative to USD. Implied vol on the one month has started to rise with a 40bps rise in implied vol now sitting at 5.40 vols.

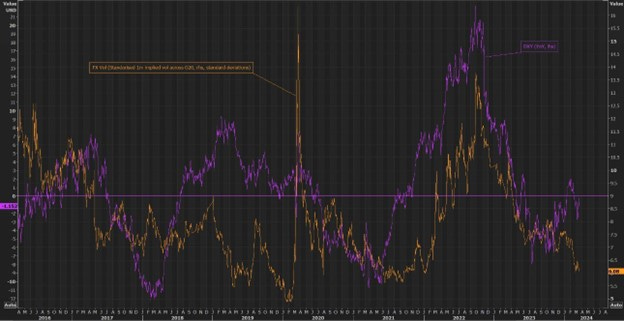

Looking at the EUR/USD 1m Risk Reversal 25 delta, we are now witnessing rollover. Currently, we are seeing more buying of puts than calls. However, since COVID the overall level is relatively in line with where the options activity has been. Looking at the implied vol. this is also relatively low, and it does not appear that anything interesting is happening on the vol front with vol continuing to remain relatively suppressed.

Regarding the meeting for the ECB. I would expect the potential of witnessing the demand for puts to outstrip the demand for call buying, and potentially adding to some downside in the EUR/USD which over the last 3 months has been stuck in a range between 1.07-1.10.

Now observing the EURO, we witness something rather interesting happening with the term structure. We are only just starting to see widening until further out the maturity of the term structure. This implies that there is a macro risk that is being priced into the EURO, and thus traders are cautious about the outlook. This is driven by low expectations for growth, low productivity, and geopolitical issues within the Red Sea that seem more likely to hurt the EU compared to the US. Once again supporting the thesis that we should observe weakness in the EURO overall.

Asia FX

Focusing further on FX APAC continues to be intriguing. As FX vol has declined, we witness more and more people within the market seeking carry. This has increased the sharp for the carry trades. Regionally the attractive bet continues to be long rupees vs. other currencies within Asia. Given my outlook, India will start to be more attractive from a growth perspective relative to China as it appears their growth has peaked. This seems like a trade that will not fade out in the intermediate term. China will continue to struggle from a growth perspective and thus carry trade for rupees continues to be favored.

China

Now a simple observation on China. From the equity side, I do think that getting long China here could lead to an overall value trap. Many are pointing to the fact that China should start to stimulate, but looking at the overall correlation between liquidity (broad measure looking at the fiscal impulse+monetary operations) has shown very little correlation recently between liquidity and overall returns for the stock market.

Another big aspect that many have been worried about is the overall level of selling of treasuries by the Chinese. Frankly something I’ve been wanting to touch on as well, China and many other nations rapidly increased their overall holdings of treasuries during the pandemic. However, there has now been a lot of buzz around the net selling of treasury securities.

There are other explanatory variables for this, but it seems one of the largest ones is the overall buying of long-dated treasuries and the impact it has on fx-hedging.

When the Fed started raising rates and the curve flattened, this had a net negative impact, given the overall mechanics of FX-hedging. We have seen China start to sell treasuries over the last year. However, if we get a cross-country synchronization of cuts we should see foreign investors start to pick back up their allocation of treasuries. This has started to happen for some nations over the last few months till now where we are seeing net buying, and some of this has to do with the steepening of the curve.

However, for further allocation and net buying of treasuries, further steepening of the curve would be required. We are not seeing some slight steepening happening, which would see to the revival of China’s net buying of treasuries. Something to monitor is 1m-6m, as steepening would most likely need to be positive before we see a wave of bids back in from Foreign nations for UST.

The New York Fed released an article this week discussing the possibility of a China hard landing, and this should be noted as well, for it could occur in the next month or so (depending on data) and affect the overall US outlook along with the dollar. I am optimistic about US growth, but this is vital to note. Everything below is summarized from the New York Feds blog.

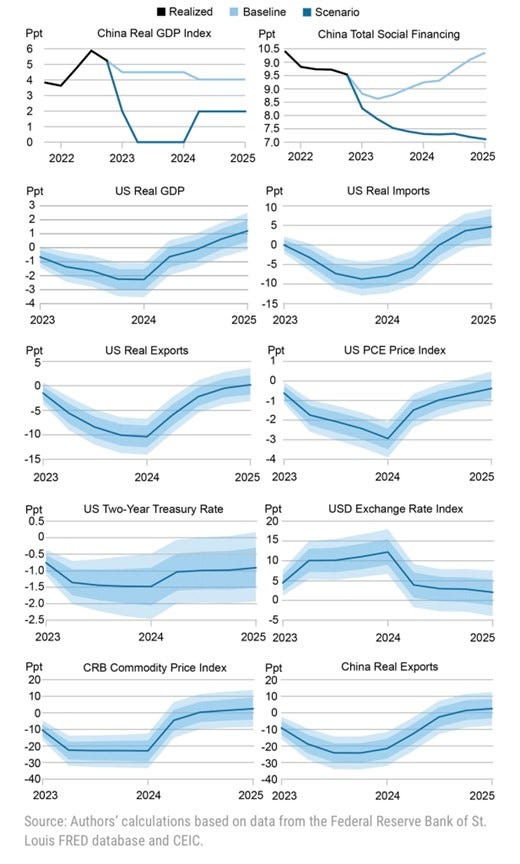

Using a Bayesian VaR to quantify the impact on US growth and inflation should there be a continued decline in the Chinese property sector.

They find that under a scenario Real GDP would decline by about 200bps and exports would fall by about 10ppt.

PCE would decline by 3ppt below baseline in such a scenario. Further impacts would cause a decline in global commodity prices everywhere.

If this scenario plays out, my expectation of a decline in USD would be null, as it would appreciate massively while global commodity prices fall. This could be the only risk to a higher dollar as mentioned above, and is something to monitor closely for shifts in the overall entry/exit of bullish dollar positioning.

US Dollar

I will conclude this with the US. I do expect the DXY to weaken overall. I have been in the bullish dollar camp for most of last year with expectations that the DXY would not fade into the 90s. However, I expect this trend to start to turn around this year. Lower currency volatility tailwind for the Dollar.

The strong risk that we have seen across asset classes reduces the bid for safe-haven assets like the dollar.

Furthermore, the ability thus far for CNY to maintain peg is contributing to stability in other currencies.

What we are now witnessing given the above is the overall reduction in FX vol. However, over the next month, I would try to not get in the way of the overall dollar strength, especially given the anticipation from the NY Fed given their most recent DSGE (dynamic stochastic general equilibrium model) forecast for Q1 2024 growth to come in around 1.9% revised up from 1.2%. Any other economic surprises (to the upside) could continue to add to the dollar strength, however, longer term throughout the remainder of the year and I would expect this to begin to ease.

US Rates

Looking at US rates, bear steepening should not be taken off the plate given the rise in 10y term premium. Considering the current rise in term premium, it looks like we could observe more bear steepening. Term premium is currently starting to creep up and we have been witnessing Z5/Z6 move higher last time term premium rose. When looking at the graph in April, where you witnessed the steepening of Z5/Z6 this was bull steepening that occurred during the banking worries in the US. The other time we observed steepening was all bear steepening which was driven by an overall higher 10y term premium. As the term premium is starting to tick up again. The z5/z6 bear steepening should be something on the lookout into the next month, especially if inflation data continues to come in sticky. I will touch on PCE next and some good developments there.

Prices are falling for an increasing % of both items, as well as for expenditures. All this worry about inflation data coming in hotter than expected seems to be very overblown. We are continuing to see price declines within the inflation index, and thus this seems to be a point where the Fed can start to take its foot off the gas. However, that does not mean that we will observe an easing of term premium as of yet. So far, the overall elevation noted in term premium is still something that could spook the market. Although we are seeing easing in components of the PCE. (shown below) It is still something that should be noted, however, given the worry about upticks and inflation hovering around 3% for the remainder of the year. That expectation in and of itself could cause term premium to inch higher.

Now onto some thoughts on other asset classes from AlphaPicks:

Indices

We’ll be honest, US stock markets seemed to ignore everything during March and decided that this was a risk-on mood that meant buy anything and everything.