“We all have dreams. But in order to make dreams come into reality, it takes an awful lot of determination, dedication, self-discipline, and effort.”

—Jesse Owens.

Welcome to AlphaPicks’ monthly market update - a rundown of global markets for the coming weeks in under ten minutes… or 12, if we’re being precise.

This month, our guest contributor is:

Here’s what you need to know…

Macro

It felt as though equity markets were turning a corner on the July pullback. The Fed signalled rate cuts to come in September. All was well. Markets legged higher.

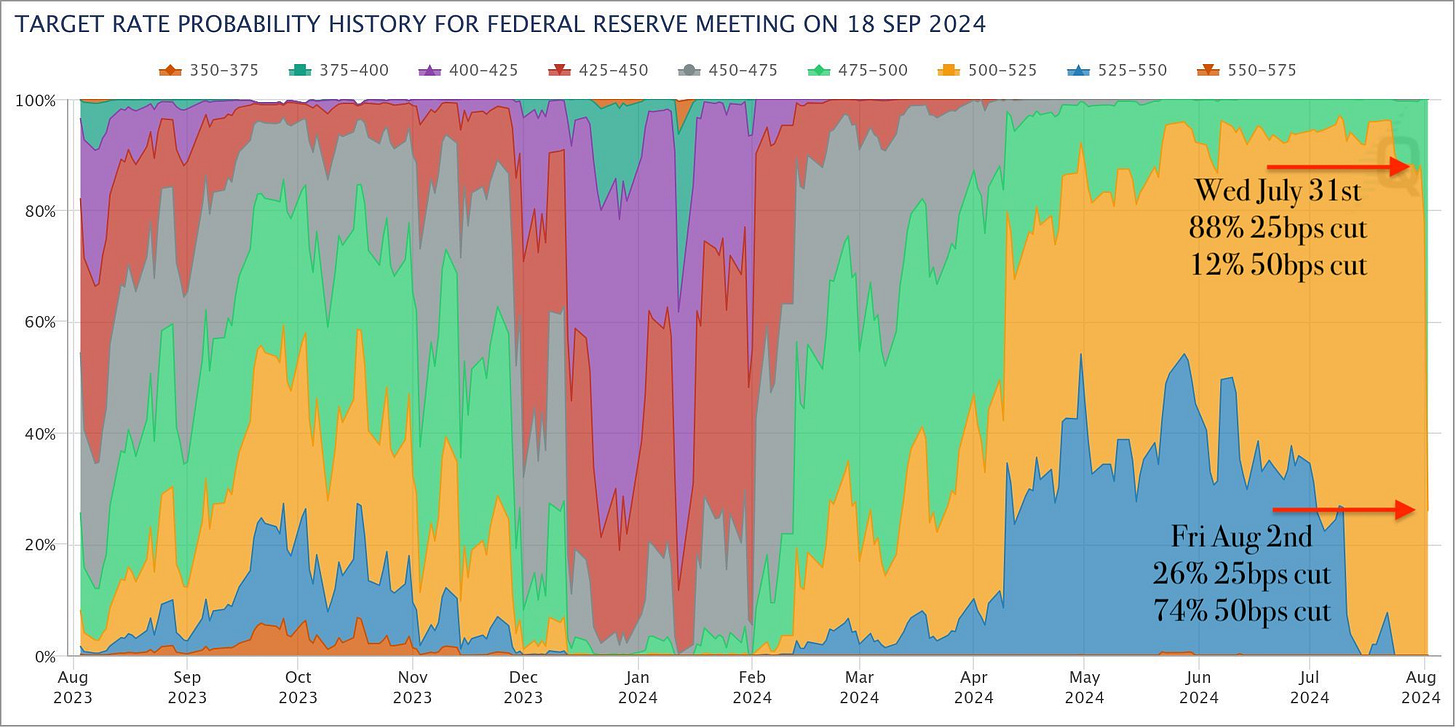

Friday’s jobs report suggested more concern in the labour market than had previously been believed. Now, markets see September cuts from the Fed for completely different reasons and at a steeper rate.

There is growing concern that the Federal Reserve is lagging behind and should have already initiated interest rate cuts. This worry is amplified by the fact that the Fed does not have rate-setting meetings scheduled for August or October, limiting its opportunities to decrease rates. Although off-calendar rate changes are feasible, they are uncommon and typically only used in emergency situations. More thoughts on this are in the rate section further on.

Another macro factor at play in the US is the election. While at the start of last month, Trump was heading towards a landslide victory, Biden’s resignation from his re-election campaign and Kamala Harris’s takeover has seen the ‘Trump Trade’ take a step back. There have been talks relating to a Sep 4th debate, so we may see more of a move in the election odds in the following months.

The BoE started its rate cut journey on Thursday. Five of the bank’s policymakers voted for the quarter-point cut, while four voted to keep rates steady, unconvinced that inflation in the UK was sufficiently tamped down.

The bank expects inflation in the UK to pick up slightly in the coming months to around 2.75%. Officials said rates need to “remain restrictive for sufficiently long” until they are confident inflation will return to target.

The bank has revised its growth forecast, anticipating a rise to 1.25% for the year, up from the previous projection of 0.5%. However, officials anticipate a subsequent slowdown due to the effects of high interest rates, with growth expected to decrease to 1% in 2025.

Over in the eurozone, the ECB has also commenced its journey of descent. A slight increase in inflation, to 2.6% in the year to July, is making it seem less certain that the European Central Bank will cut interest rates in September. However, two cuts are still on the cards as the CB may have to ease monetary policy further to aid the region’s struggling economy.

Equities

We are in a moment in time for financial markets where understanding WHAT and WHY things are happening is critical. As we have ended the month of July and started August, equities are having a drawdown as they break the 5,400 level in SPX:

The greater sign of capitulation is how implied vol is at a historical extreme compared to realized vol. This represents a significant implied vol premium in the vol complex for equities:

Implied volatility (IV) premiums and discounts refer to the differences between the implied volatility of an option and the historical or realized volatility of the underlying asset. When the IV is higher than the historical volatility, it indicates an IV premium, suggesting that options are relatively expensive as traders anticipate higher future volatility. Conversely, an IV discount occurs when the IV is lower than the historical volatility, implying that options are cheaper and traders expect less future volatility.

The question we are faced with is if this pullback in equities is going to turn into a full-fledged bear market or if we will consolidate in the month of August before continuing back to all-time highs. While we can’t know the future, we can know the exact signals to watch for in order to discern which outcomes is dynamically unfolding.

First, we have seen a growth surprise to the downside in economic data but not an outright contraction (chart is the economic surprise index and rolling SPX returns).

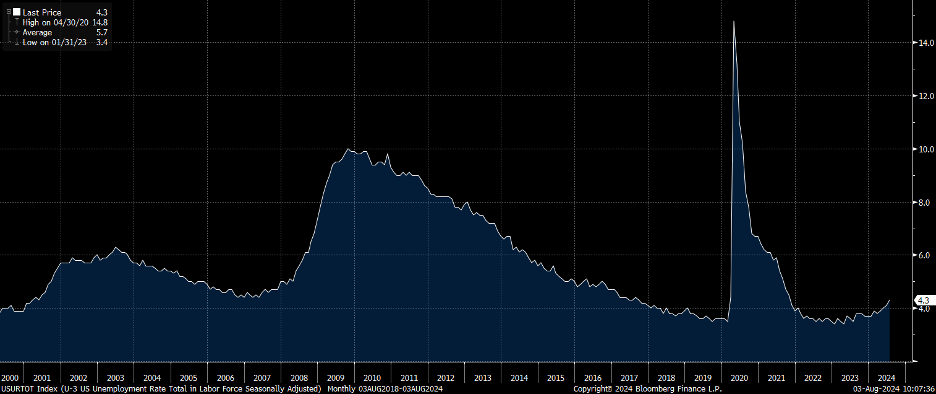

The unemployment rate ticked up in the most recent NFP print, but we are still softening from an incredibly low level:

If we see a lack of persistence in growth data decelerating, this will begin showing the market that the “growth scare” is being over-extrapolated.

Second, implied vol has accelerated to an extent that is unlikely justified given the underlying drivers that will be reflected in realized vol. Watching this premium will be critical moving through August:

Finally, watching how the forward curve is pricing cuts for the end of 2025 as it correlates with equities will be important. The rate cuts that have been priced on the forward curve are also unlikely justified, given we have only seen a marginal declaration in growth data.

AlphaPicks:

The UK’s FTSE 100 was positive in July, a standout among many other index decliners. Strategists at Bank of America called the FTSE 100 the “anti-Nasdaq,” where the dearth of tech stocks often bemoaned in London could prove to be an advantage for the benchmark should there be a further selloff across the pond.

Overseas earnings for the UK’s largest companies complicate the outlook, though. The UK stock market is driven 80% by earnings offshore, so there is a weak link between UK interest rates and the earnings of the UK stock market.

The housing sector is an evident beneficiary of rate reductions. Construction companies have experienced value growth this year in anticipation of cuts, which increase consumer access to mortgages and decrease business debt expenses. Declining inflation and a strengthening economy have further enhanced the outlook for the significant housing sector, as recent surveys indicate a rebound in housing prices.

Financials is one area set to struggle. Lower interest rates reduce banks’ net interest income, a key metric for the sector.

The global equity selloff has been intensified in the eurozone as Stoxx 600’s poor earnings results continue. The few resilient names in the index were pulled lower during the sentiment shift. The seasonality weakness of August and September in Europe doesn’t help the outlook, either.

FX

After breaking lower at the beginning of July, the DXY had trodden water for a few weeks before everyone jumped into action on Friday. The payrolls report saw sharp selling, driven by the move lower in the rates space. Given the US-centric problem faced, the USD struggled to catch any safe haven bids, with investors looking elsewhere (e.g., JPY).