“There is no passion to be found playing small, in settling for a life that is less than the one you are capable of living” — Nelson Mandela

Welcome to AlphaPicks’ monthly market update, a rundown of global markets for the coming weeks in under ten minutes (we didn’t overrun the target this month).

Before we get into it, our latest venture, APFX, has just launched. You can read more about it here. For institutional readers, feel free to contact us at research@alphapicks.co.uk to discuss access.

Here’s what you need to know…

If you are not yet a premium subscriber to AlphaPicks, you can manage your account here.

Macro

Last week, the Federal Reserve entered a new stage in the interest rate cycle, that of a wait-and-see attitude. During the news conference following the meeting, Fed Chair Jerome Powell remarked that, with interest rates now “significantly less restrictive” than they were prior to last year’s cuts, there is no rush to adjust our policy stance.

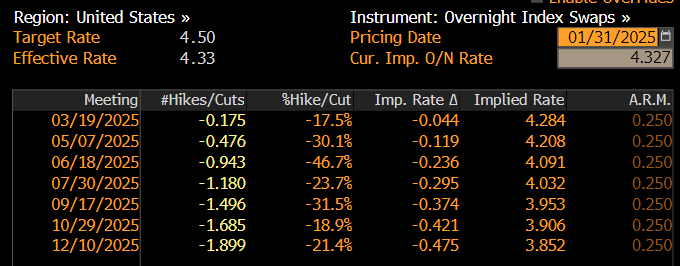

Market pricing (see below) is now basically in line with the latest dot plots, looking for two further 25bps cuts in 2025.

Following Powell’s remarks, President Trump criticised the Federal Reserve and its chairman for allowing inflation to surge four years earlier, asserting his commitment to curbing price hikes. “I will tackle this by unleashing American energy, cutting back on regulations, rebalancing international trade, and reigniting American manufacturing,” he stated in a post on his social media platform.

All in all, there were not many takeaways from the meeting.

Feb. 7th sees the release of NFP and the unemployment rate. Estimates for Jan’s NFP are 154k, compared to 256k previously. Unemployment is expected to come in consistent with last month’s figure at 4.1%. Labour markets have remained resilient and will not weigh into the Fed’s decisions unless weakness is seen again.

Over in Europe, investors are facing a central question: how many more times will the ECB cut interest rates? Economic growth in the eurozone came to a standstill in the last quarter of 2024, while headline inflation has increased for three consecutive months, now sitting at 2.4%. This situation has created a challenging backdrop of stagflation.

ECB President Christine Lagarde indicated that the bank plans to implement several more rate cuts in the upcoming months. She noted that Thursday’s decision received unanimous support from the ECB’s rate-setting committee and emphasised that the current policy rate is still restrictive, hindering economic growth.

Lagarde added, “It would be premature at this point to discuss when we should halt rate cuts.”

Investors anticipate that the ECB will continue cutting interest rates by a quarter-point in the upcoming meetings, possibly extending into the summer or beyond. The ECB is expected to operate on autopilot in the near future, aiming to bring policy rates back to a neutral level, around 2%, as an initial step.

However, a potential trade war could disrupt this plan. If the U.S. were to impose a 10% tariff on all eurozone imports, it could dampen the region’s economic growth by as much as 0.5 percentage points within a year, which may prompt more significant rate cuts.