“The unknown is kindest to those that don’t fear her.”

Welcome to AlphaPicks’ monthly market update - a rundown of global markets for the coming weeks in under ten minutes.

This month our guest contributor is:

Here’s what you need to know…

Macro

Our broad view going into June is that it should follow May in being fairly normal service.

Economic data out of the US for May was a touch softer for the labour market, with inflation steady. There are no alarm bells for us either that the economy is underperforming or blowing the top off. So the 31bps worth of cuts (1.5 actual cuts) through to year end seems well priced.

A continuation of this should help to support equities to trundle higher. This is especially true now that earnings season is over, with Nvidia continuing to garner bids from the market, and putting the rest of the market on it’s back.

While we don’t refute claims from the bears that Nvidia might be forming a bit of a bubble, we don’t see what will break to spark a selloff.

UK equities continue to look cheap in our view and have some way to catch up to US peers. More and more are being bought out by private equity giants, something we wrote about in more detail here.

Stocks related to key commodities including copper and gold continue to outperform. In our section below, we flag up that while we favour silver longs over gold, we feel there’s room to run for both. Copper is flying too, and if you buy into the stories of AI-demand and a China recovery (not mutually exclusive) then copper can keep going.

Central bank meetings for the US and UK aren’t live, so we see little drama here beyond guiding towards when the first cut will be later this year. For the ECB, we do think June will be the month where the first cut will happen, but this is already priced in and therefore anticipate little movement in the EURO following such a move.

As a friendly reminder, you can become a premium subscriber with us for just £10 a month. This provides you full access to our weekly articles without a paywall, including our flagship Monday trade ideas and access to what we are buying and selling in our Global Asset Portfolio.

Thoughts on US inflation from Alyosha

One of the most problematic components of the Consumer Price Index is transportation fuel. Politicians point to high gas prices whenever they talk about inflation but the price of wholesale gasoline in the NY harbor today is on average $0.60 cents per gallon cheaper than it was 13 years ago in 2011. And exclusive of periodic volatility, it stayed there for 9 years until 2014.

Spot June rbob settled at $2.475 on May 31, 2024. On August 31, 2005, spot rbob settled $2.57. Three years later spot rbob settled $2.51. And so forth again, for 4 years from 2011 to 2014. Reverse inflation adjusted wholesale gasoline prices today would be equal to $1.50 a gallon +/- $.05 cents in 2011 and $0.97 cents in 2005 by my estimate.

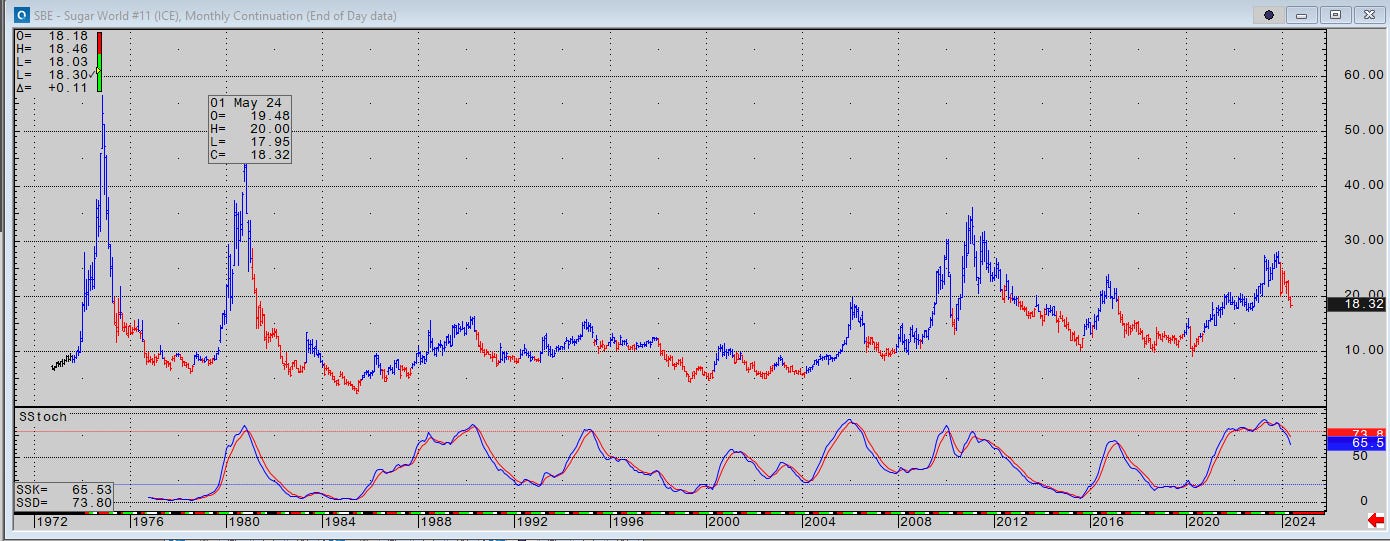

This is a good example of hedonic deflation. Corn, one the most versatile sources of calories globally, traded $394 in March 2024. Corn traded 3.97 in 1974, 3.99 in 1980, and multiple times in the last 50 years. Sugar settled at 18.32 cents per pound yesterday. Sugar has traded 18 cents bi-annually (at least) since 1973. Cotton and live hogs have been the same price every year... year in year out for 50 years. The list is very long.

Currency debasement, taxes and interest have inflated food and energy prices in CPI, but hedonic productivity has actually made some of them 50 to 90% cheaper at the wholesale level.