“To improve is to change, to be perfect is to change often”—Winston Churchill

Welcome to AlphaPicks’ monthly market update, a rundown of global markets for the coming weeks in around ten minutes.

Here’s what you need to know…

If you are not yet a premium subscriber to AlphaPicks, you can manage your account here.

Macro

The trading and investing landscape for May can be best described as ‘macro whiplash’. The almost constant change in trade policy out of the US made it difficult to try and have a clear conviction, with being nimble yet again serving as the best tactic for many.

We entered the month with more optimism of trade resolutions between the US and key trading partners such as China and the EU. Progress was made to some extent, although the erratic nature has made any correspondence out from the administration incredibly unreliable.

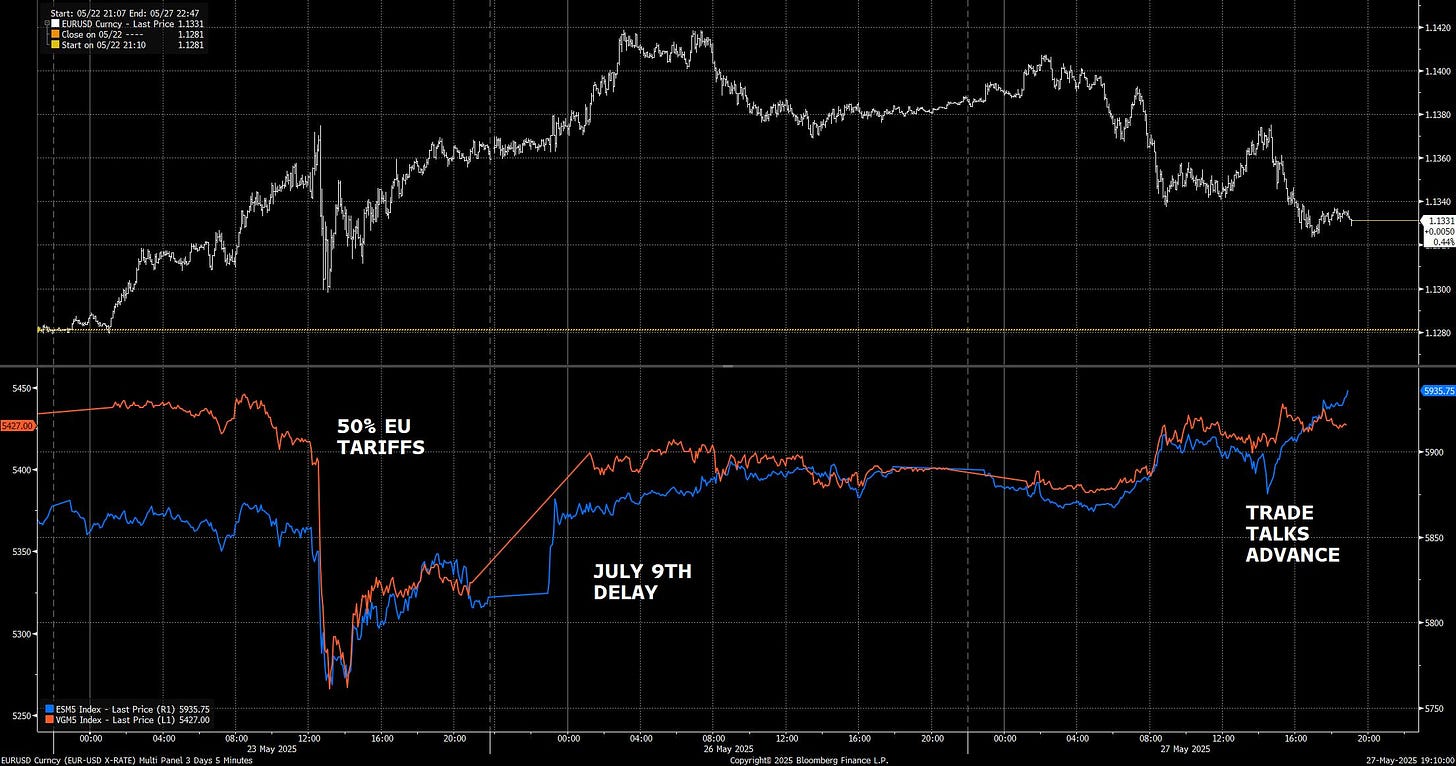

A good example of this was with the EU, with the imposition of 50% tariffs, then becoming an extra month extension of talks, to outright positive discussions. Related asset price moves in EUR/USD and in equity indices can be seen below:

It’s clear that Trump is now no longer just fighting the trade war with external parties, but even within his own justice system. This provided another case of the whiplash we refer to.

Earlier this week, the US Court of International Trade ruled that the administration had improperly imposed wide-ranging tariffs on dozens of US trading partners, declaring the legal justification for the levies under the 1977 International Emergency Economic Powers Act (IEEPA) invalid.

Yet in a reversal on Thursday, a federal appeals court issued a temporary stay, pausing the trade court’s ruling while considering a longer-lasting hold on the decision.

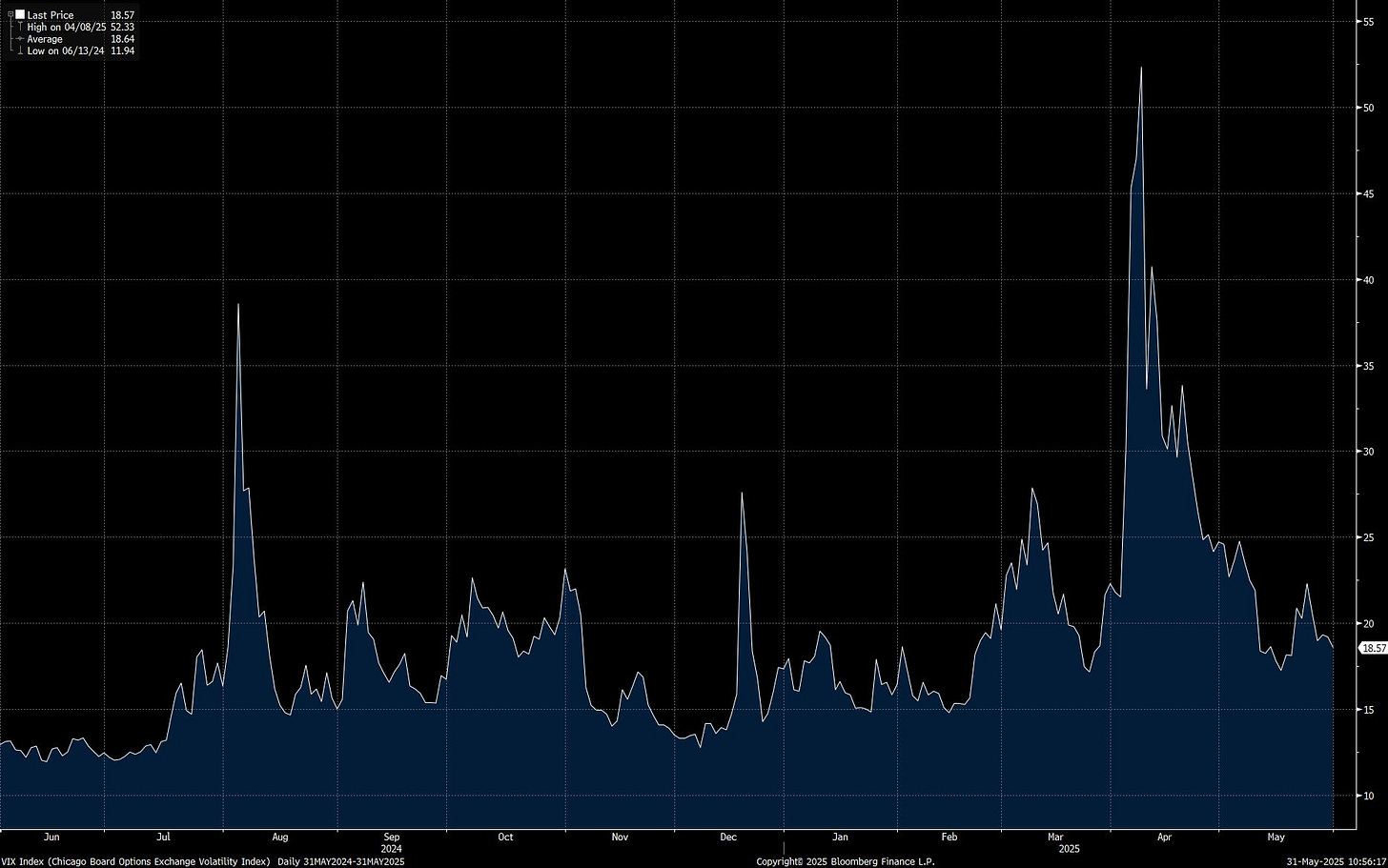

Looking forward, it’s unlikely the situation will improve anytime soon, and the assumption that the market will become more accustomed and less volatile to these headlines is only partially valid. Structuring VIX higher plays for the coming 0-3 months can provide attractive payoffs.

When trying to get a feel for the health of the US consumer, the UofM Consumer Sentiment Index held steady at 52.2 in May, matching April's reading. While the temporary reduction in tariffs eased some inflation concerns, 64% of consumers still anticipate deteriorating economic conditions over the next year

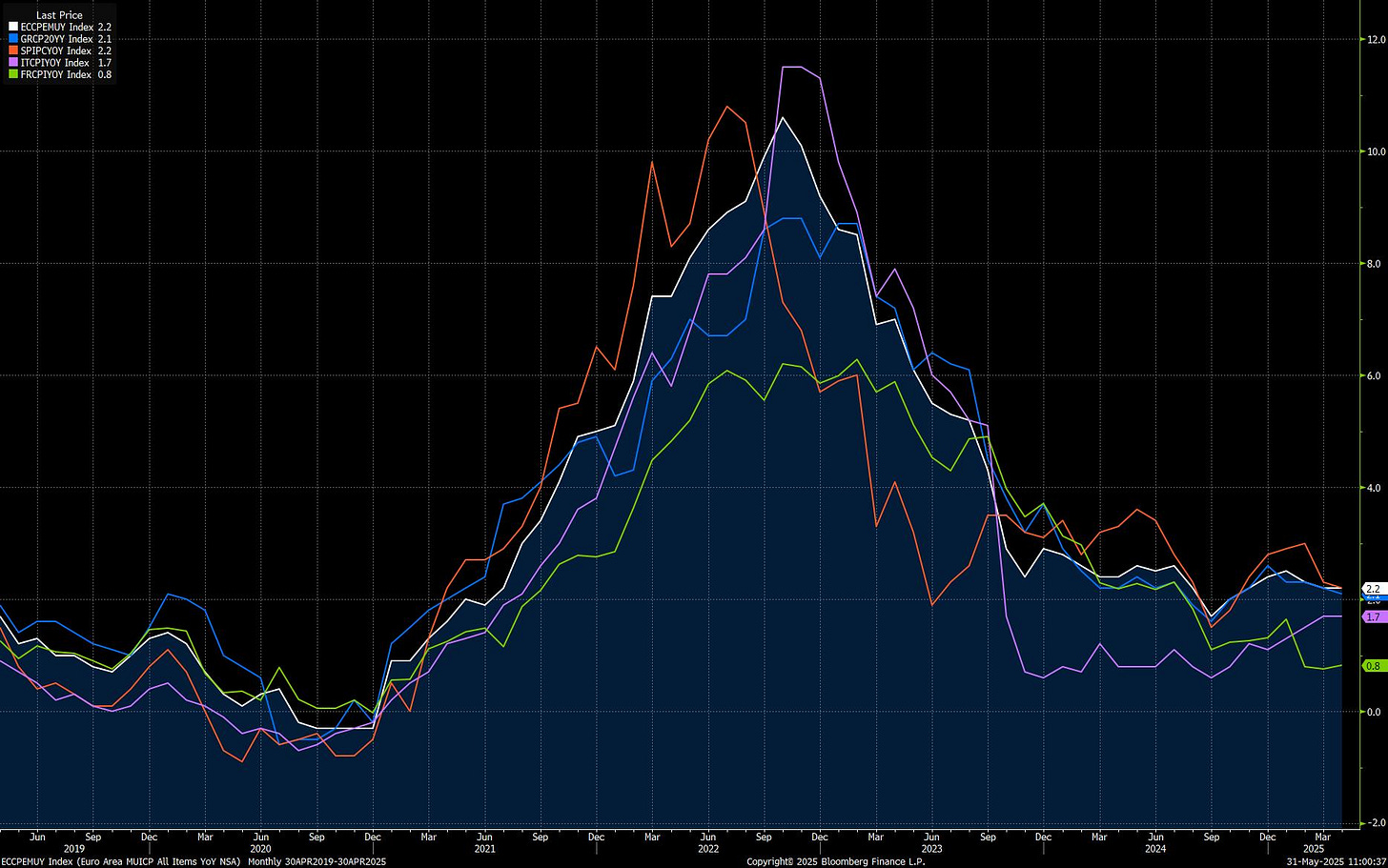

In the Eurozone, inflation prints steadied, with Spain at 2.2%, Germany at 2.1%, Italy at 1.7%, and France dropping to just 0.8%.

This has bolstered expectations for another interest rate cut from the ECB, potentially the eighth since June 2024. Easing wage pressures, a stronger euro, and falling energy costs contributed to the slowdown, giving the ECB more room to support growth without risking overheating.

The UK presented a more complex picture. The Bank of England cut interest rates to 4.25%, even as April inflation rose unexpectedly to 3.5%, well above its 2% target. The monetary policy decision was anything but a clear call. The 5-4 call wasn’t even the main eyebrow raiser, but rather the fact that of the four dissenters, Swati Dhingra and Alan Taylor advocated for a larger 0.5% cut to 4.0%. In contrast, Catherine Mann and Huw Pill preferred maintaining the rate at 4.5%.

Policymakers expressed interesting views, with MPC member Alan Taylor arguing that the spike was due to temporary effects like higher utility bills and council tax changes, and not a reason to pause the easing cycle.

Catherine Mann expressed concerns over “greedflation,” where companies raise prices beyond cost increases to rebuild profit margins, which will likely see her continue to vote to keep rates on hold.

FX

Thoughts from guest contributor Alexie (@Viraelum) on FX ideas for the month ahead:

Trade 1: EURUSD 12-Month 1.29/1.05/0.95 Seagull Structure: Long 12M 1.05 put, short 12M 1.29 call, short 12M 0.95 put; zero-cost ±15 bp vol. Target 0.97, hard stop 1.13.

Rationale: ECB–Fed rate gap poised to widen; EUR downside skew trades 0.8 vols cheap to 5-yr median. Seagull monetises muted right-tail, maintains convexity to structural EUR depreciation as it evolves into primary funding currency. Risk: Euro-area wage-price spiral forces ECB to guide deposit rate back to 3.25 %, steepening 1y1y €STR by 90 bp and driving EURUSD through 1.13.

Trade 2: USDJPY 6-month Broken-Wing Put Fly 149/144.5/139. Long 1× 149 put, short 2× 144.5 puts, long 1× 139 put.

It pays out if spot settles in the 140.5-148.5 range, with maximum profit at 144.5; any additional yen strength only incurs the limited loss built into the structure.

Rationale: 6M implieds trade 1.4 vols rich to 12M after recent front-end hedging demand; calendar flattener captures relative skew normalisation while retaining long-dated vega for 2025-2026 yen strength. Carry drag contained; theta on short leg funds 65 % of long-leg decay. Risk: Compression of longer-dated vols; exit if 12M-6M vol spread narrows below 0.5 vol.

Thoughts from AlphaPicks on CHF

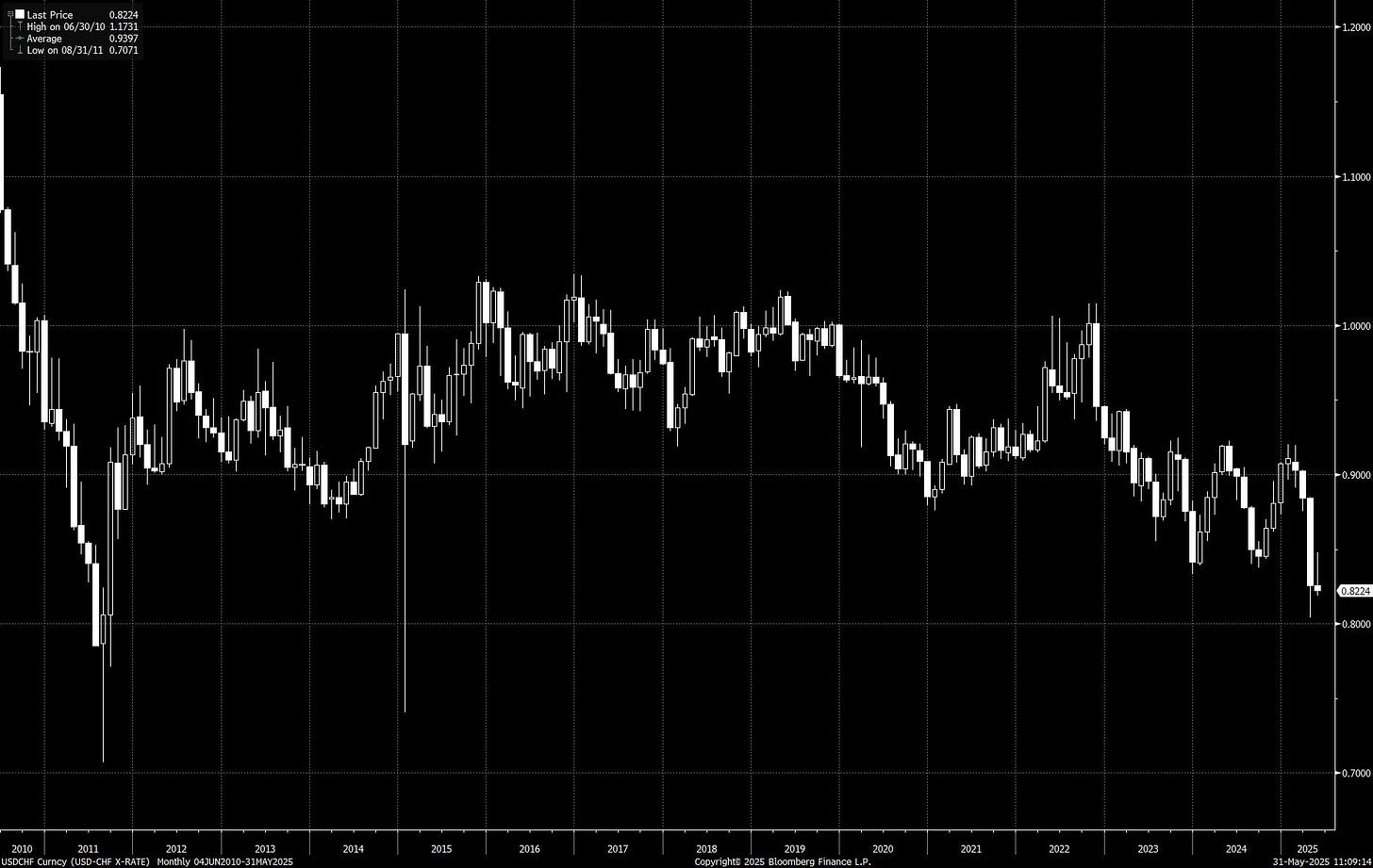

After rebounding from April lows just above 0.8000, USD/CHF continued to trade with downside pressure, with both the USD leg struggling to catch a bid and CHF continuing to be well supported by haven buyers.

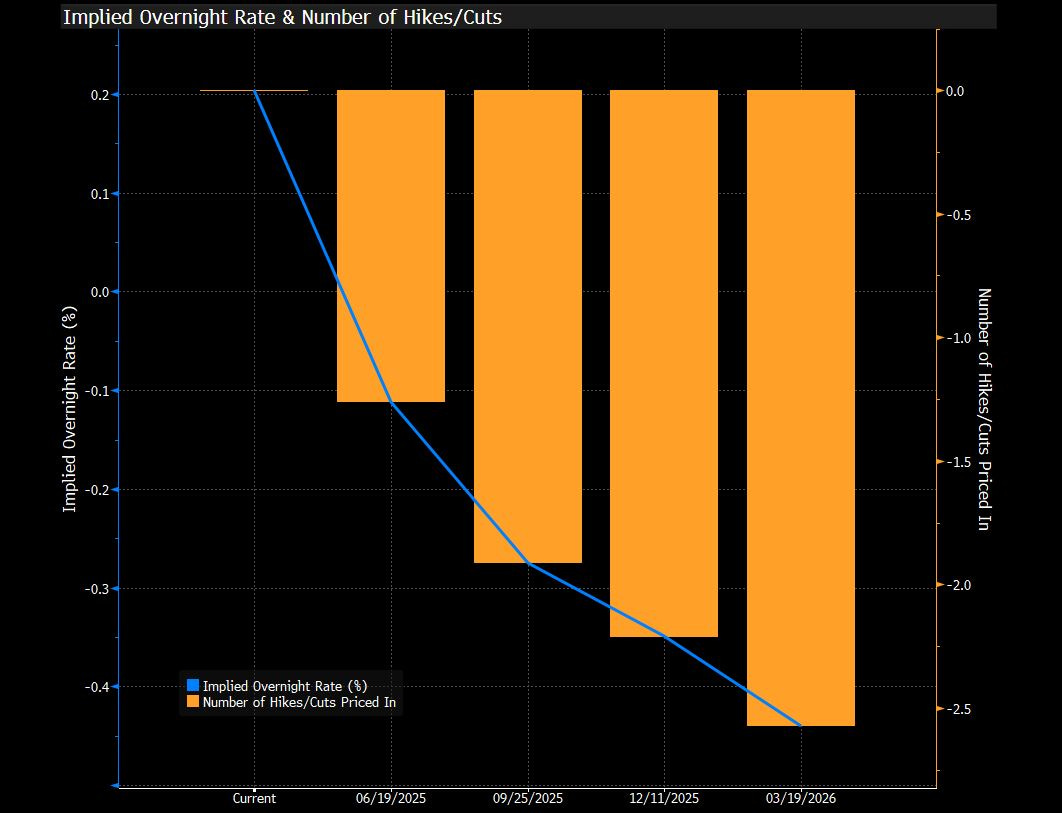

The next SNB meeting is scheduled for the 19th June, with rates pricing finely balanced between a 25bps and a jumbo 50bps at 31.5bps.

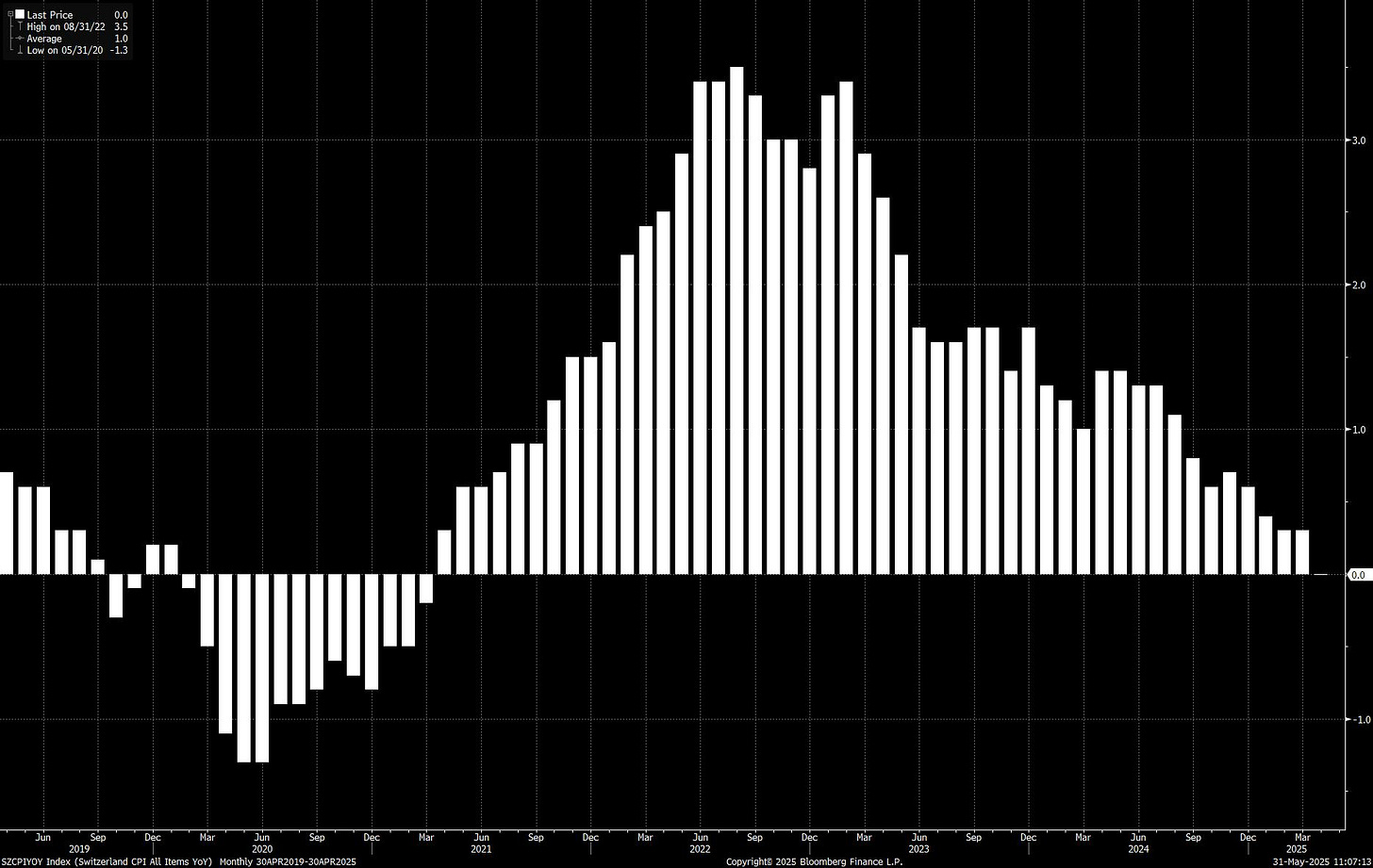

We feel the SNB will be keen to try and weaken the Franc, especially given the lack of corrective moves over the past couple of weeks following the April surge. Of course, some of the rationale behind a larger cut can be justified via data, with April headline CPI falling to 0%:

This provides more of a get-out-of-jail-free card for the SNB to play in loosening monetary policy at a faster pace than is currently priced. This is likely one of the few ways to induce some CHF weakness.

It’ll be interesting to see how June pans out for related CHF crosses and whether SNB actions, or even a risk-on bid and use of CHF as a funding currency (more attractive with lower…even potentially negative rates) can help to release the pressure valve. If not, then the next real downside test is a break of 0.8000—something we haven’t seen since 2011:

Equity Indices

The tone in global equity markets has firmed, driven by a more constructive backdrop on trade and earnings. Europe (SXXP) has already outperformed YTD, shedding the heavy coat of US tariff anxiety. With the trade headwind fading and macro data stabilising, European equities are holding their ground. Valuations still look more reasonable relative to US peers, and the political relief is adding a tailwind for risk sentiment in the region.

In the US (SPX), the market has shown that it can navigate the chaos. Earnings season passed without major shocks, and retail investors remain active buyers of any dip. The renewed AI trade narrative is adding a fresh layer of enthusiasm, reinforcing the view that corporate innovation can keep the bull case alive. Notably, funds remain well underexposed to tech after the derisking wave in April, with many firms lagging the index in performance as a result. This underexposure is now a fourth leg of support for flows (a slow but steady catch-up) that can fuel further upside as managers chase performance.

Emerging markets remain the overlooked beneficiary of this recalibration. Local currency assets, in particular, offer an appealing mix of stronger fundamentals, cheap valuations, and low foreign investor positioning. Improvements in external balances and fiscal discipline across countries like Brazil, India, Indonesia, and South Africa have created the most compelling entry point in over a decade. These former “Fragile Five” economies now boast positive current account balances and have embraced more orthodox economic policies. As global capital begins to rotate out of crowded US positions, EM local markets (including Latin America, Eastern Europe, the Middle East, and Africa) stand ready to soak up those flows, with the prospect of robust returns and currency appreciation in tow.

Overall, global equities have found a new equilibrium in the aftermath of tariff anxiety and earnings resilience. The path ahead is volatile, but Europe and EMs look poised to extend their outperformance, while US equities still have room to grind higher, so long as the AI narrative holds and the retail bid doesn’t fade.

Bonds

The trade détente has put a fresh coat of gloss on risk sentiment, but the global bond market remains in the throes of a deeper structural repricing. As optimism on US-EU trade talks lifts equities, bonds are bracing for another leg higher in long-end yields.

The US Treasury market is ground zero for this rethink. The president wants lower rates, but the market is pushing back. Bessent’s nod to the 10-year benchmark only underscores the White House’s dissonance with a market that smells inflationary risk and fiscal profligacy. The flattening impulse has given way to a bear steepener, with term premia rebuilding amid shifting growth and fiscal narratives.

Across the Atlantic, Europe’s bond complex is proving more resilient. Gilts, OATs, and bunds have been outperforming Treasuries, buoyed by more anchored inflation expectations and a political backdrop that, while noisy, lacks the same direct fiscal fuel. The macro risk of Trump’s tariff threats remains, but the market’s working assumption is that Europe’s negotiating leverage and internal cohesion will keep a lid on US-inspired volatility, at least for now.

In Japan, the BoJ’s exit strategy is playing out in real time. The long end of the JGB curve has been leading the global steepening trade, testing how far yields can rise before policy recalibration kicks in. With historical steepness levels already flashing red, Japanese yields may be closer to their upper bound, while the US and European curves have more room to adjust.

Next-Month Views:

US Treasuries: We see further upside for long-end yields as term premia grind higher. US economic resilience and persistent fiscal headwinds argue for more steepening ahead. Stay cautious on duration—the bear steepener is not done.

Europe (Bunds, OATs, Gilts): Eurozone and UK sovereigns look set to continue outperforming Treasuries. The market is still wary of political tail risks (tariffs, elections), but the relative calm in inflation expectations and a less aggressive fiscal backdrop should keep European curves better bid versus the US.

Japan: The JGB long end is already testing limits, and we expect the steepening to moderate here. But volatility remains the watchword. Japan’s exit narrative is a wildcard that can feed further moves in global term premia.

The bottom line: optimism on trade is feeding animal spirits in risk assets, but the bond market is still untangling the costs of fiscal expansion and structural inflation shifts. Long-end yields are headed higher, with the US leading the charge. Europe will continue to outperform, but don’t expect an easy ride. Term premia is a global story now, and volatility is the new normal.

Commodities

An interesting commodity that flashed across major headlines in May was Uranium. Both contracts on the heavy metal and uranium-linked companies such as miners saw a significant move up on the back of news on Trump’s nuclear revival plans, the latter demonstrated by the ‘Global X Uranium’ ETF (URA ticker) price chart below.

Whilst the focus leading up to the presidency and during the first part of his term has been on reinvigorating US oil and gas production, Trump recently added another dimension to his national energy security policies by signing executive orders to stimulate the domestic nuclear industry. Proposed policies such as fast-tracking federal approvals for mining permits and expansion plans for industry workforce all point towards growing the domestic supply and reducing dependence on foreign sources.

The above political developments in the US, combined with the renewed interest and growing demand for nuclear energy driven by the artificial intelligence sector, such as for powering data centres, have provided strong tailwinds to push Uranium higher. Whilst there will always be concerns regarding Trump headlines and what his administration is able to deliver in practise, it is hard to deny the growing importance of AI and its related requirements needed to meet the insatiable demand from investors and tech firms. If price action action can break the resistance levels and peaks seen in October and November of last year, we could see a notable leg up.

Gold has turned cautious since April after hitting a peak of ~$3500 and trading back down around the $3300 level. However, recent sell-offs have been well supported by the 50-day Moving Average illustrated in the below chart.

Whilst the upward trend in gold is likely to remain intact in the long-term, due to protracted risks around trade policy, a Russia-Ukraine stalemate, and declining US inflation that continues to raise market expectations for a Fed rate cut, the short-term picture for gold could be more muddy and susceptible to volatile fluctuations. As highlighted earlier in the post, the recent rebound in US yields and the Dollar could continue placing downward pressure on gold and sustain profit-taking.

That wraps up our Money Markets for June. Weekly updates on views and trades will come as usual to start each week.

See you tomorrow,

AP