“Impossible is just a big word thrown around by small people”

Welcome to AlphaPicks’ monthly market update—a rundown of global markets for the coming weeks in under ten minutes (sort of).

Our guest contributor this month is Michael J. Kramer, financial market strategist and portfolio manager of the Mott Capital Thematic Growth Portfolio.

Here’s what you need to know…

Macro

Michael Kramer:

It has become clear that the stock market is only as strong as Nvidia, and if we have passed peak hype for Nvidia and the promise of AI, the equity market in the U.S. — and possibly globally — could face a tough road ahead.

While Nvidia’s results were strong and exceeded sell-side expectations, they were not enough to surpass the overall market’s expectations. Looking at options positions, it was evident that the market was overly bullish on the stock breaking out above $140, but it simply wasn’t meant to be.

If data from regional Fed surveys and inflation expectations are correct, and inflation is indeed accelerating again, then the Fed is done cutting rates. The combination of a Fed with no further promise of rate cuts and a market without Nvidia’s leadership could make March a challenging month for equity investors—not just in the U.S., but globally.

AlphaPicks:

The U.S. economy could be gearing up for a significant downturn in the first quarter, following two reports highlighting weaker consumer spending and a dramatic increase in the trade deficit at the year’s start, according to the latest GDPNow forecast from the Federal Reserve Bank of Atlanta. The gross domestic product is now projected to drop at an annualised rate of 1.5% in the current quarter, a notable revision from the previously expected growth rate of 2.3% just days ago. However, it is still early in the quarter, and the GDPNow estimate will be updated as more monthly data becomes available.

The regional Fed bank anticipates that net exports will deduct 3.7 percentage points from GDP. Recent government figures revealed that the merchandise trade deficit in January widened by more than 25%, reaching a record $153.3bn. Before this data, the GDPNow forecast estimated that trade would only reduce GDP by 0.41 percentage points.

Projections for consumer spending indicate it will contribute less than 0.9 points to first-quarter GDP, down from an earlier expectation of 1.53 points before the latest consumption data was released.

Notably, inflation-adjusted personal spending fell by 0.5% in January, marking the most significant decrease in nearly four years. After months of strong spending leading up to the holiday season, consumers tightened their wallets, pulling back on purchases of motor vehicles and other goods. Additionally, severe winter weather impacted a significant portion of the country in January.

The U.S. economic landscape is taking a significant downturn, presenting a stark contrast to the excitement that characterized the beginning of ’25. As a result, investors are rapidly trying to recalibrate their strategies in response to this shift.

For full access to all articles, consider upgrading to paid.

Equities

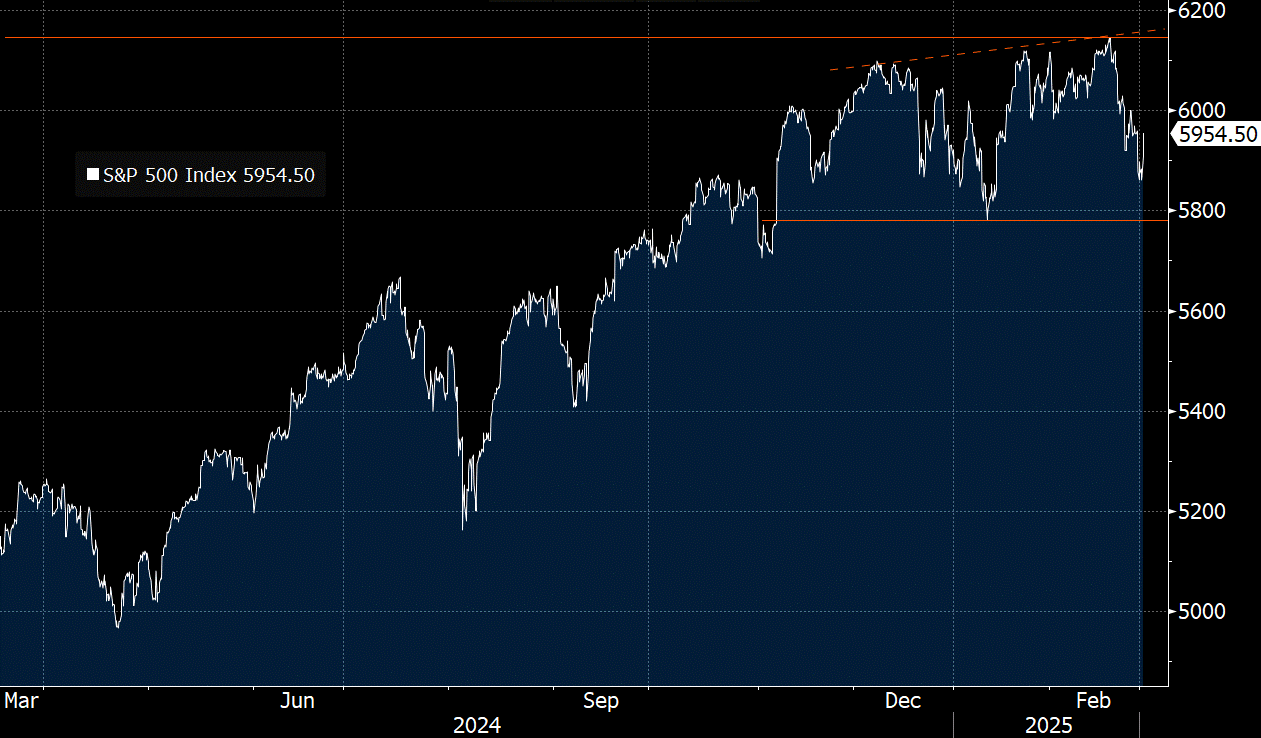

Equities spent most of February digesting macro drivers, such as geopolitical tensions, trade wars and growth scares. First, let’s talk about how the U.S. indices have gone nowhere since the election.

Equities, by default, go up and to the right over time. It’s different to an asset like gold, which we argue needs a fundamental driver behind any price appreciation. However, headwinds such as stagflation, risk-off sentiment in heavy-weight tech names, and uncertainty around tariff/trade plans have left equities struggling to break to new highs. December, January, and February have all seen attempts to rally higher materially, but have ultimately seen sellers come in just a few points above.

Conversely, there haven’t been any developments to devalue equities lower. The Fed’s change of stance in December is behind us, AI narrative concerns only left tech in breather mode, rather than in retreat, and growth scares have added some more uncertainty, but are not yet large enough to send everyone running to defensives or cash. Growth is the biggest narrative that we see over the next few weeks, but we expect indices to stay within the recent range for the rest of the quarter.

Europe is still the standout market YTD, but the election in Germany and tariff negotiations between the EU and the U.S. have seen markets also put the brakes on. There looks to be continued investments from EU members into sectors like defence, while institutional money is also flowing in as funds rebalance their previously under-weight Europe allocations.

We feel some profit taking/de-risking was the driver toward the end of the month, and don’t see major headwinds ahead.

Hang Seng has been tremendously strong this year, with the tech index up 24% and the overall index up 14%. Towards the end ot the month, Trump turned his attention back towards President Xi and added another 10% levies to imports. The reaction was some selling in the indices, which cooled the month’s rally.

The developments of DeepSeek remain the reason as to why China can be a big player in the AI tech race, and government spending across sectors will continue so as not to fall too far behind. We see China as a continued hedge against the U.S.

FX

The U.S. Dollar index (DXY) finished the month modestly lower than where it started. Despite it only falling by less than 1%, the fact that it didn’t materially rally despite several influencing factors reinforces our view that the top is in for 2025 for the dollar.