“Be tolerant with others and strict with yourself”

- Marcus Aurelius

Welcome to AlphaPicks’ monthly market update - a rundown of global markets for the coming weeks in under ten minutes…

This month, our guest contributor is:

Geo Chen, independent global macro trader and author of the Fidenza Macro newsletter.

Macro

by Geo Chen

Over the past month, asset managers have been piling into bonds, while CTAs and global macro funds have been building longs in Treasury futures. The main catalyst for this aggressive shift in positioning was the surprisingly weak unemployment rate print of 4.3% on Aug 3.

The release triggered the Sahm rule, which observes that in every previous instance when the 3 month moving average of the unemployment rate rose 0.5% from the cycle low, the economy was in the early stages of a recession. I believe that the economy is not as weak as what the bond market suggests, and that the coming Fed rate cut cycle will be slower and shallower than expected.

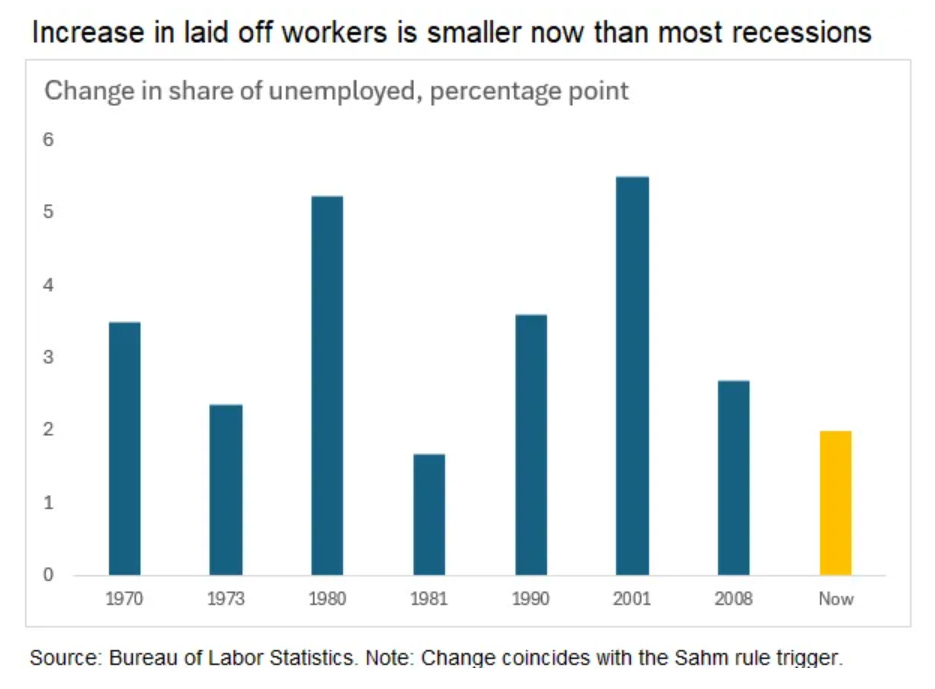

This economic cycle has been different from many cycles that came before it, which makes it difficult to rely on tried and tested recession indicators that have worked previously, such as the Sahm Rule and the yield curve. Claudia Sahm, the inventor of the Sahm rule herself, pointed out that the labor market is in much better shape at the moment than in previous recessions. Labor market recessions are usually caused by a sharp increase in layoffs, yet right now the increase in laid off workers is smaller than most recessions.

Previous recessions also saw fewer people enter the labor force and an increase in workers leaving it, resulting in lower participation. This time around, there has been no drop in net entrants into the labor force.

Thomas Barkin, in a recent interview on the Bloomberg Odd Lots podcast, said that in his conversations with companies, they are telling him that they are in a “low hiring, low firing mode.” This suggests the economy is in a state of equilibrium and not on the verge of recession. Since unemployment data is often subject to large revisions, I like using jobless claims as a source of truth, and that data is not pointing to a significant increase in firings that is typical of a recession.

Against this economic backdrop, the Fed is set to deliver on some of the rate cuts that the market has eagerly priced into the forward curve. Expectations of cuts have resulted in a similar magnitude of easing in nominal and real yields as the Oct-Dec period of last year. The chart below shows how the decline in 5 yr nominal and real yields last year was followed by a jump in the US economic surprise index over the coming months. The improvement in data was accompanied by a reversal in yields higher, as well as a rally in risky asset classes such as equities, commodities, and crypto. I believe that the upcoming round of Fed easing will have the same reflationary consequences for the market.

It’s likely that we are in a mid-cycle rate cut scenario, which tends to be very bullish for both growth, inflation, and for risky assets. The last mid-cycle easing happened in Q4 of 1998 following the Russian debt default and the Long Term Capital Management crisis. The Fed responded to the crisis by doing an emergency inter-meeting rate cut, followed by two 25 bp rate cuts months later. The market had been piling into Treasuries in a flight to safety, similar to today, but 10 yr yields bottomed out the same month the Fed delivered its first cut. In the height of the crisis, the eurodollar futures market priced in a terminal rate as low as 4.18%, but the Fed only cut rates to 4.75%.

Drawing this parallel forward to today’s environment, it’s likely that Treasuries have overshot to the upside, and are already in a topping process. The current elevated long positioning and bullish sentiment in Treasuries creates a compelling contrarian setup for shorts. The Fidenza Macro portfolio will be establishing a short in ZN futures (10 yr Treasury futures) next week.

Risk assets shouldn’t fear higher yields. We are back in a risk-parity friendly environment, where good economic news equates to good news for the market, and where higher yields are a symptom of stronger growth and improving earnings. The few cuts that the Fed delivers should be enough to jumpstart the interest rate sectors of the economy back to life.

FX

August proved to be a terrible month for the US Dollar index (DXY). It was caught up in a variety of cross-hairs which meant that it traded fresh YTD lows earlier this week.

For a start, it took a sharp knock at the start of the month following the disastrous payrolls report and kick higher in the unemployment rate. As Treasury yields dropped, so did the dollar.

This was compounded by the unwinding of carry trades, with heavy selling on USDJPY and USDCHF.

The swift retracement in the US equity market throughout the rest of the month led to a general risk-on move across assets. In G10 FX, this played out via a weaker dollar, with higher beta currencies such as AUD and GBP gaining from this.

With Jackson Hole giving Powell the opportunity to all but cement a September rate cut, the only real point of contention heading into September is whether it’ll be a 25bps or 50bps move from the Fed.

In our view, the coming month is very important the greenback. If it can’t hold 100.00 and 99.50, more weakness beckons. Fundamentally, this could be driven by a more dovish Fed than currently priced, or via another bout of US specific risk-off movement.

On the other hand, over 100bps worth of cuts are priced in for the remainder of 2024. The downside risk here is somewhat limited. We don’t see the Fed coming out with 50/50/25bps cuts. If anything, 25/25/25 is more plausible. More on rates later.

We also flag up the role of the dollar in the event of a more general risk-off mood. The USD smile shows us that when risk-off is more of a global nature, the dollar usually strengthens:

Aside from the USD, for the month ahead we’re also watching EUR/GBP carefully. After a sharp rally in early August, the pair is rolling lower, and has retested the 0.8400 level late in the month. Below 0.8375 and we have to look back to the summer of 2022 for new levels.

We’re cautious to chase this move lower, but it’s true that the UK economy has really been outperforming the Eurozone over the past month.

If the BoE are happy to continue to pushback on the need for steeper cuts and the data holds up, there’s not much stopping the pair accelerating lower to sub 0.8300.

Lastly, we cut out the USD leg and compare safe havens with CHF/JPY. Over the past couple of weeks, the pair has resumed the uptrend following the unwind of the carry trades primarily involving Yen. This tells us that even though the Yen could remain bid if we get another bout of risk-off in September, the Franc is the favoured play during normal trading conditions.

In our view, this provides a lower risk play of shorting the Yen again without having to take on a USD view or another high beta option. In buying CHF, there is some benefit to pick up yield, but it’s more of a play of getting back short JPY in the lowest risk way possible.

If we do see another drawdown, the move vs CHF will be shallower than vs USD, GBP, EUR etc. Only a break below 166.60 would give us reason to change our view here:

Equities

For August, the top-performing S&P 500 sector was Consumer Staples (5.78%). This was closely followed by Real Estate (5.64%). On the other hand, the worst sector to be in for the month was Energy (-2.32%).

Let’s start with energy. A key input here was oil, and the sharp move lower in the black gold which weighed down oil related stocks.

There was a significant oversupply in the global oil market due to higher-than-expected production levels from key oil-producing countries. Countries like Saudi Arabia and Russia increased their output, contributing to an excess supply that pressured prices downward.

Continued back and forth in tensions in the Middle East saw elevated volatility too. The progress made regarding a potential six week ceasefire deal helped to push oil lower, although news out late this week around Houthi rebels releasing footage of them bombing an oil tanker won’t help to start September.

Consumer staple outperformance is a really telling theme that has been developing as part of a broader rotation in the equity market. U.S consumer discretionary stocks fell by just over 1% for the month (at a sector level). In fact, the iShares Con Staples ETF outperformed the Con Disc version for the entire month:

It’s clear that even though the dip in the equity market has been bought following the start of the month tree shake, investors are becoming more cautious about where to allocate funds.

The fact that consumer staples is the place right now where money is flowing in tells us that investors are wanting to position defensively while still maintaining equity exposure.

The outperformance in real estate is splitting the crowd as we head into the new month. On the one hand, the increase in pricing for Fed cuts has naturally been a positive tailwind for real estate investment trusts (REITs). Cheaper funding for new projects and the ability to refinance existing deals at lower rates should ultimately flow through to a higher level of profit for the trusts, boosting dividend payouts.

Further, REITs often provide attractive dividend payments, which historically have outpaced inflation, providing a real net yield. With some inflation concerns persisting in August, we feel this could have been another factor that supported inflows.

Yet not everyone is convinced that this is going to be a theme that will endure over the coming year. For example, Wells Fargo put out a note earlier in August flagging up three reasons why one of their desks is underweight.

First, low rates don’t always correlate to gains in real estate. Despite a favorable interest-rate environment from 2020 to 2022, the relative performance of REITs remained underwhelming. We personally flag this up as an isolated case, but let’s keep going.

Next they mention that REITs have shown poor relative strength for years, and they are not convinced that this long-term trend has change.

Finally, they have a gloomy outlook for the US economy next year and feel real estate will be sensitive to this.

Part of the focus for September will be investors getting their portfolios positioned for the first US rate cut and the beginning of the cycle. Bloomberg Intelligence strategists Gina Adams and Michael Casper wrote earlier this month about what we can learn from past rate-cut cycles.

A couple of the key points noted were:

Defensive sectors have had the edge over cyclicals. Measuring Fed rate cut cycles from the date of the first cut to that of the last one shows large-cap value posting a median 2.4% drop versus a 24.5% decline for growth — though the latter led in four of five instances.

When you turn to the small-cap space, value posted a median 2.7% gain to growth’s 21.5% drop, again with the latter ahead in three of five cut cycles.

Staples, health care and communications have the most consistent performance within the S&P 500 during cutting cycles. Energy and industrials struggled most often. Russell 2000 communications and health care fared best while real estate and energy struggled.