“Gentlemen, when the enemy is committed to a mistake, we must not interrupt him too soon.”—Horatio Nelson

Welcome to the monthly market update, a rundown of global markets for the coming weeks in around ten minutes.

Here’s what you need to know…

If you are not yet a premium subscriber to AP Research, you can manage your account here.

Macro

September begins with the data that matters most for markets: jobs and inflation. Together, they will set the tone for the Fed’s September meeting and shape expectations for the path of easing into year-end. With the FOMC entering blackout after this week, investors are left to interpret the last signals before Powell’s delivery of what is now a fully priced cut. One cut is not in question—the market is confident, and the Fed has no incentive to spring a surprise—but the manner of that cut will matter. Powell’s communication will need to balance easing financial conditions with a cautious nod to inflation’s persistence.

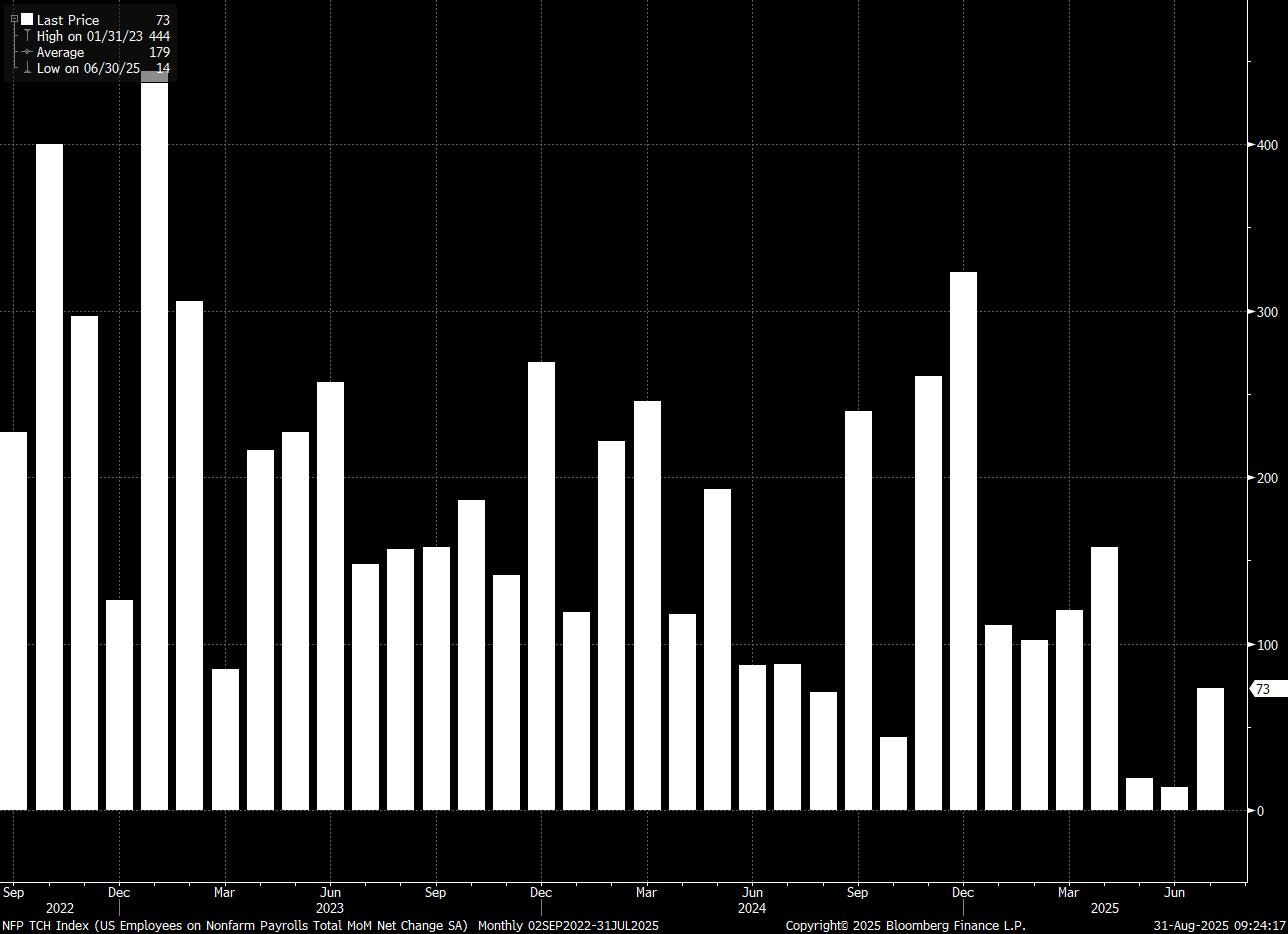

Labour market dynamics are softening. Consensus expects payrolls to rise by around 75–90k in August, extending a four-month streak of sub-100k prints—the weakest run since 2020. The unemployment rate is projected to tick up to 4.3%, a near four-year high. Hiring appetite has cooled as firms grapple with higher import duties and margin pressures, with job openings slipping toward the lowest levels since 2021. Fed officials are split: some, like Waller, argue the slowdown is reason enough to start cutting; others warn against moving too fast with inflation still inching higher. The August jobs report will likely cement which side carries the debate, but the near-term implication is clear: the Fed wants to deliver this first cut smoothly, without destabilising markets.

Beyond the payrolls, the ISM surveys and trade balance data will test the durability of US momentum. Manufacturing indicators are showing tentative signs of life—PMI readings suggest activity may be turning, and capital goods orders have surprised on the upside. Yet trade flows remain distorted by tariff front-loading, with the July deficit set to widen sharply. The tariff regime itself remains in flux after a federal appeals court ruled Trump’s global levies illegal but allowed them to remain in place pending further review. That legal overhang ensures trade policy risk will stay a front-and-centre driver of market sentiment.

The month ahead is therefore less about whether the Fed cuts—that decision is effectively locked in—and more about the narrative that follows. A cut framed as pre-emptive support could extend risk appetite, while one justified by labour market deterioration could be seen as an early capitulation. Markets will parse Powell’s language as much as the rate move itself.

Equities

The summer’s easy stretch for equities looks to be behind us, but that doesn’t mean the move higher can’t continue. With tariffs set to shape September’s narrative, the question for investors is whether the rally can extend beyond a narrow cohort of megacap tech and into the broader market. The past month showed the first signs of fatigue: Nvidia wobbled, Europe diverged, and earnings cleared a low bar rather than set a new standard. Now comes the harder part—absorbing tariff impacts on margins and revenues while keeping risk appetite alive.

In the US, the S&P 500 closed August with fresh all-time highs, supported by improving breadth. Nearly 70% of constituents now trade above their 50- and 200-day averages, suggesting the advance is healthier than the narrow leadership that defined the first half of the year. Still, the sustainability of that breadth depends on cyclical participation. Recent manufacturing PMI strength and capital goods orders hint at a potential turn, which could support small caps and industrials in September.

History suggests that once ISM manufacturing turns back into expansion, small caps outperform over the next 12 months—a dynamic to watch if the recovery takes hold.

Large-cap tech remains the earnings engine, but its dominance is already showing signs of waning. Nvidia delivered another beat, yet its contribution to S&P growth is declining from the peaks of 2023–24. Consensus still expects big tech to carry index EPS in the back half of the year.

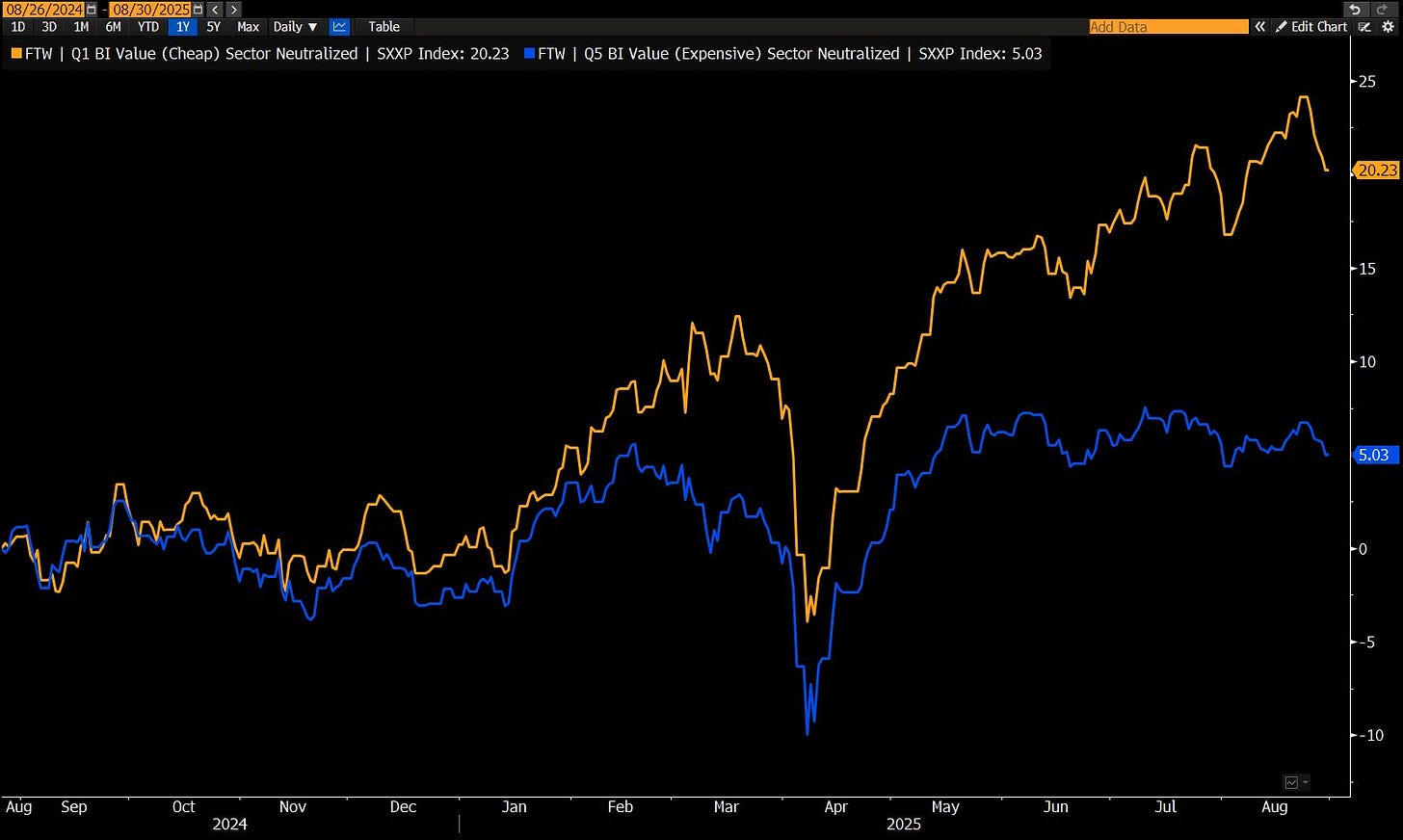

In Europe, the tariff story is already creating fractures. Major indices have diverged sharply over the past month, with correlations dropping to decade lows. This reflects more country-specific dynamics, from energy resilience in the UK to industrial vulnerability in Germany. The European value factor has also been a standout, materially outperforming its US counterpart over the past year. That may continue if the region’s domestic rotation persists, but it leaves benchmarks more vulnerable to idiosyncratic shocks and uneven policy responses as trade pressures escalate.

China has quietly built momentum, with its tech sector stringing together three straight weeks of gains while global peers faltered. For investors, the key question is whether this rally can extend beyond a tactical bounce. Earnings trends remain fragile and policy support has been hesitant, but relative performance is improving versus other EMs. A broadening of Asia’s momentum would mark a meaningful shift in flows after years of underperformance.

Within EM, India deserves particular focus. Benchmark resilience since April masks underlying weakness: the median BSE 500 stock is down more than 20%, with small- and midcaps faring worse. That fragility is colliding with geopolitical risk as Modi navigates a tense trade dynamic with Trump. For global allocators, India’s headline indexes remain attractive but are increasingly disconnected from the broader corporate earnings picture. Any escalation in tariff rhetoric would raise the risk of further decoupling between benchmarks and underlying fundamentals.

Taken together, September presents a more fragmented equity landscape than the synchronised rallies of earlier in the year. Tariffs and trade policy will be the decisive catalysts, testing whether breadth in the US holds, whether Europe can sustain value-led resilience, and whether China’s rebound can extend. The next leg higher, if it comes, will require broader participation across sectors and regions rather than another round of narrow gains at the top.

FX

For once, the US Dollar wasn’t the main focus in the FX space. During the month of August, it traded mostly sideways. Although some of this can be put down to summer liquidity, it highlighted the push-and-pull factors at work in the greenback right now.