Navigating India-Pakistan Fallout

Analysing the potential for escalating tensions.

Over the past week, we’ve seen the most serious military confrontation between India and Pakistan in over two decades. The two nuclear-armed neighbours have experienced raised tensions since the terrorist attack on April 22 in Kashmir, with reciprocal actions since then causing increasing concern amongst the international community.

In financial markets, there has been a knee-jerk reaction in related asset prices already, but some second-order moves based on the assumption of further problems in the region developing haven’t yet materially played out.

Whether it’s trying to hedge existing exposure or looking to express a view for the coming months, here are a few ways we feel are worth noting down.

The Rough Backstory

The attack, which occurred on April 22 in Pahalgam and killed 28 civilians—mostly Hindu tourists—was blamed by India on Pakistan-based militant groups. Pakistan denied any involvement. In retaliation, India launched “Operation Sindoor” on May 6, targeting nine alleged militant sites across Pakistan and Pakistan-administered Kashmir. India claimed the strikes eliminated over 100 militants, although Pakistan said the strikes hit civilian areas.

Pakistan responded militarily, claiming to have shot down five Indian jets and launching retaliatory artillery strikes across the Line of Control, which reportedly killed one Indian soldier and 15 Indian civilians.

On Thursday, Pakistan also reported that 25 Indian drones had entered its airspace over major cities, including Karachi and Lahore, with some targeting air defence systems. Debris from the drones killed at least one civilian.

Amid this military escalation, Pakistan’s Defence Minister Khawaja Asif issued a warning, calling the threat of nuclear war with India a “clear and present danger. Flights and trains in Pakistan have been cancelled, and air travel disruptions are being felt in northern India.

Knee-Jerk Moves

India

The immediate aftermath of the military escalation saw only a modest decline in equity markets. The Sensex dropped circa 1.7% when Indian and Pakistan armies exchanged fire across the Line of Control on the 25th, but the dip was bought in the following trading sessions. We saw another circa 1% drop based on the shooting down of the jets.

In the FX space, the Indian rupee experienced volatility, with a significant increase in options trading volume. The notional value of dollar-rupee options traded in the U.S. rose to nearly $4 billion, about three times the daily average.

When we look at three-month USDINR 25d risk reversals, there’s a clear spike, with Calls being more in demand than Puts. This gives us a clear indication that, over time, people have been trying to protect against further INR weakness.

Pakistan

Pakistan’s markets responded more sharply to the geopolitical tensions. The Pakistan Stock Exchange’s KSE-100 index experienced significant losses, with almost 12% shed in the past three trading days alone:

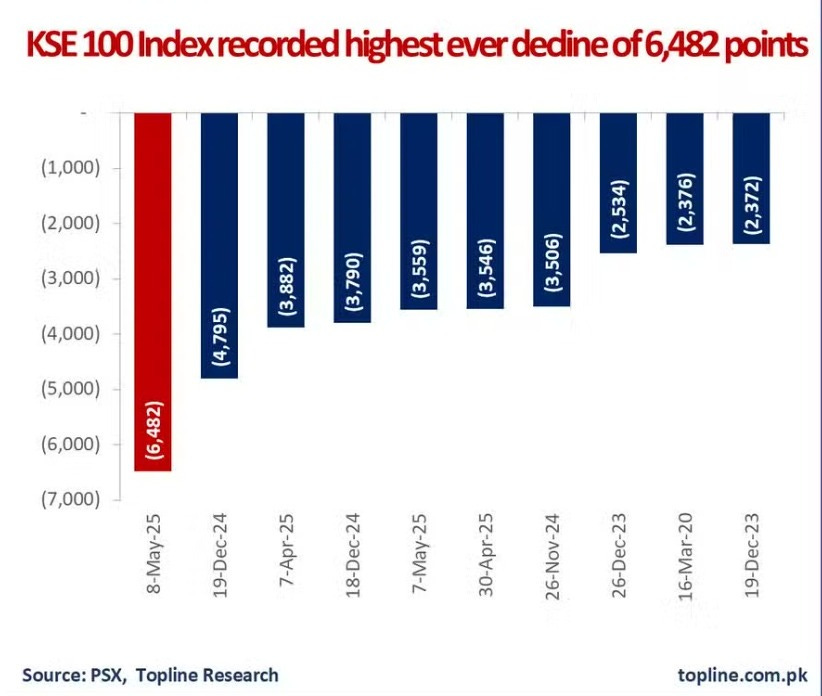

The latest 6.26% fall over the previous closing was the KSE-100 index’s biggest ever single-day decline (in terms of points), highlighting the seriousness of the tensions:

Trading Themes

Border Infrastructure