“One of Our Greatest Assets is Our Ability to Not Sell”

Running a multi-billion dollar fund out of Virginia, we take a look at the legend Chuck Akre.

This Sunday we provide another investor special, looking at Chuck Akre. His name might not be that familiar to some, especially as he doesn’t fit the Wall Street hedge fund titan template.

Yet his firm, Akre Capital Management, has generated annual returns of over 15% since inception several decades ago, providing more than enough clout to compare him to the other heavy hitters in the fund management space.

Before we get going, a friendly reminder that you can become a premium subscriber with us for just £10 a month. This provides you full access to our weekly articles without a paywall, including our flagship Monday trade ideas and access to what we are buying and selling in our Global Asset Portfolio.

Who is he?

Chuck Akre was born in 1941. He graduated from the American University in Washington, D.C., with a degree in English literature, an unusual path for someone destined to become a prominent figure in the financial world.

After completing his education, Akre began his career in the investment industry, initially working for Mutual Benefit Life Insurance Company. After having other similar roles in finance, a pivotal moment in his career came when he joined FBR Fund Advisers in 1989. During his time there, Akre managed the FBR Focus Fund, which gained significant attention due to its remarkable performance.

Under Akre's guidance, the fund achieved outstanding returns, outperforming its benchmark index.

In 1997, Chuck Akre founded his own investment firm, Akre Capital Management, with a focus on long-term investing and a concentrated portfolio approach. His investment philosophy revolves around identifying exceptional businesses with sustainable competitive advantages and holding onto them for the long haul.

This is based around his investment metaphor of the three legged stool, which we write about below.

Akre gained further acclaim for his investment prowess through the successful management of the Akre Focus Fund, which consistently delivered impressive returns to investors. As of the latest reporting, the fund manages $13.7bn worth of assets.

The Famous Three Legged Stool

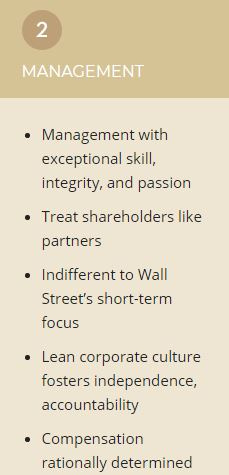

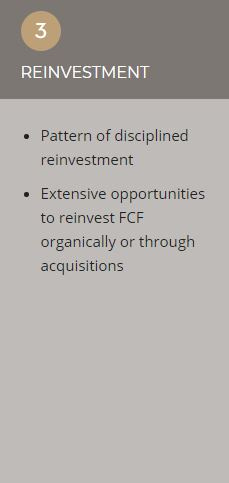

Akre’s investment approach has been referred to as a metaphoric three legged stool. Each leg describes what he looks for in an investment namely:

(1) An extraordinary business

(2) Have talented management

(3) Have great reinvestment opportunities

“I have an old three-legged milking stool in our conference room and it is clear by looking at it that it is sturdy and durable.” - Akre

More details of what each leg encapsulates can be found from snippets from the company website:

Best Investments

American Tower Corporation (AMT)

American Tower Corporation is a leading real estate investment trust (REIT) that owns and operates a vast portfolio of wireless and broadcast communication towers globally.

Chuck Akre has long been bullish on American Tower ever since he added it to his portfolio in the first quarter of 2015. At that point it was the second-most valuable stake in his portfolio, just behind MasterCard.

He said he liked the stock due to its dominant market position, recurring revenue streams, and the secular growth trends in the telecommunications industry. This ties in to the first leg of his stool.

Further, the company has a strong ability to generate steady cash flows and its track record of strategic acquisitions have made it a cornerstone holding in Akre's portfolio.

On top of the quarterly dividend payments, the REIT has also almost doubled in value during the investment period.

Mastercard (MA)

Mastercard is a well-known global payments technology company.

Akre has been bullish on Mastercard for a long time and has held the stock over the course of many years. He flags it up for its strong competitive position in the payments industry, driven by its extensive network, brand recognition, technological innovation, and the secular shift towards electronic payments.

As of the latest 13F filing, it ranks as his largest current holding;

Markel Corporation (MKL)

Akre has been a long-term fan of financial services stocks, which makes his investment in Markel not that surprising. It’s a diverse financial holding company with operations in insurance, reinsurance, and investment management.

He has been a long-time investor in Markel, attracted to its unique combination of insurance underwriting expertise and investment management capabilities. This ties in with the second leg of his metaphorical stool.

Additionally, Akre appreciates Markel's shareholder-friendly corporate culture, which emphasizes transparency, alignment of interests, and a focus on creating long-term shareholder value.

Quotes To Live By

“Our business model is to compound our capital. Wall Street’s business model, generically, is to create transactions. What is the best way to create transactions? Create false expectations, they are earnings estimates. We call it ‘beat by a penny and miss by a penny’. That gives us opportunities periodically.”

“You only need to be right in your investment decisions once or twice in a career.”

“If we own exceptional businesses, one of the hardest things in the world is to not sell them. Not selling maybe is one of the hardest things to do. Maybe one of our greatest assets is our ability to not sell.”

"We’re not really interested in things that go up and down like a yo-yo. We like things that go up, but don’t come back down, and if they come down, they don’t come down very much."

"Imagination and curiosity are what's hugely important. And we've discovered things over the years, purely by being curious and continuing to keep involved in the search process to find these exceptional businesses."

“The bottom line of every investing is the rate of return. We use that as our key tool for everything.“