The Value-Carry Trade For 2024

Using PPP and one year yields, we present the FX trade that we feel ticks all the right boxes.

Over the past few months, there have been a couple of key observations from the FX market. Firstly, volatility has been dying. This was the topic of an article we wrote a few weeks back in more detail.

Secondly, G10 central banks are mostly moving in unison with regards to pivots in interest rates. The hiking process has now all but finished for most, with the market being guided for the first cuts coming through later this summer.

Even though some traders might think this present a lack of any tangible trading options within FX, we disagree. Rather, we present a value carry trade that we feel could perform well over the next year, especially if the two above factors continue to play out.

Oh, and before we get into the article, here’s a deal for you: 14 days free, so you can read all the alpha we publish along with our weekly trade plans (and access the results and actions of our portfolio, but don’t tell anyone else that yet. Q1 performance report dropping shortly)

Understanding PPP

Before we get onto the trade specifics, we need to explain purchasing power parity (PPP).

PPP is an economic theory and a method used to compare the relative value of currencies in different countries. It suggests that in the absence of transaction costs and other barriers, exchange rates between two currencies should adjust in such a way that a basket of goods and services should cost the same in both countries when expressed in a common currency.

In simpler terms, PPP implies that a unit of currency in one country should buy the same amount of goods and services as a unit of currency in another country, once adjustments are made for the exchange rate.

The concept of PPP is often used to make international comparisons of living standards and economic performance. Economists use various measures, such as the Consumer Price Index (CPI), to compare the cost of a bundle of goods and services across different countries. By comparing these measures across countries and adjusting for exchange rates, analysts can assess whether a currency is overvalued or undervalued relative to another currency.

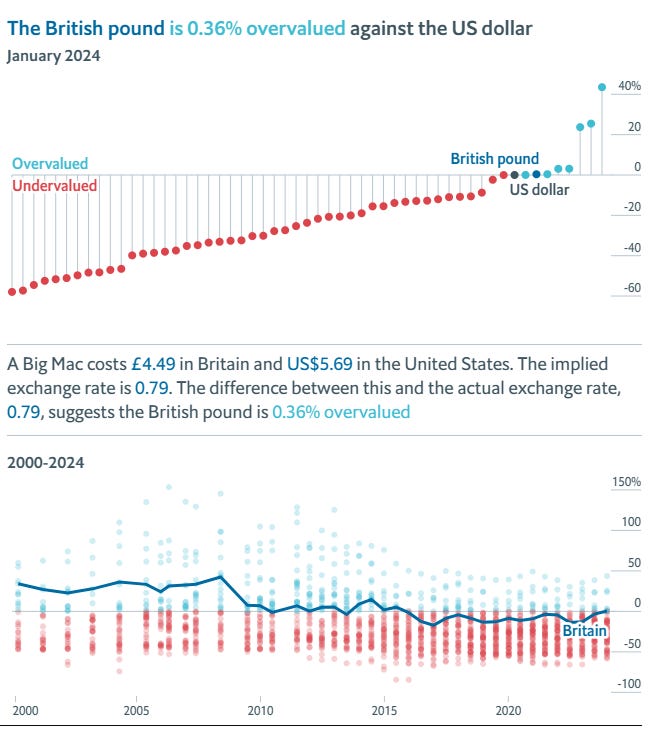

There are several methods to estimate PPP, including the Big Mac Index (which compares the price of a McDonald's Big Mac burger across countries) and the Relative Purchasing Power Parity (which compares inflation rates between countries).

For example, the below shows the Big Mac index for GBP as of the start of this year:

However, it's essential to note that PPP is a theoretical concept and doesn't always hold true in practice due to factors like trade barriers, transportation costs, taxes, and differences in quality and availability of goods and services between countries. Nonetheless, PPP remains a valuable tool for understanding exchange rate movements and making international comparisons.

Understanding the carry trade

The other key component of our trade idea revolves around a carry trade.

A carry trade is a strategy in which an investor borrows money in a currency with low interest rates and invests it in another currency with higher interest rates. The aim of a carry trade is to profit from the difference, or "carry," between the interest rates of the two currencies.

Of course, one of the biggest risks with a carry trade is the fact that you might pick up the positive carry, but it could be eroded by negative FX price movements.

But what if you combined the PPP to find undervalued currencies that have a high current yield and sell low yielding funders that are overvalued?

Bringing it all together

Below we share the data we’ve pulled together for G10 currencies using the US Dollar as a base:

As a couple of notes, we’ve chosen to use the one year deposit rate instead of one week or one month, as time is needed for the trades to play out. With interest rates cuts coming, using a shorter timeframe would distort the yield.

Further, we use the PPP Big Mac variation as of 28/03.

To interpret the chart, bottom left is low yielding undervalued currencies, with top right being overvalued high yielding currencies. Here are our observations and ultimate value-carry trade idea: