Porsche v Ferrari

‘Ford v Ferrari’ caught the big screens in 2019. But it has been Porsche v Ferrari that took the headlines in the stock market since.

‘Ford v Ferrari’ caught the big screens in 2019. But it has been Porsche v Ferrari that took the headlines in the stock market since.

Following Volkswagen AG's spin-off of Porsche AG in late 2022, investors hoped for the emergence of a supercar stock that could rival Ferrari. However, the anticipated success has yet to materialise, and some investors are now questioning whether it will ever come to fruition.

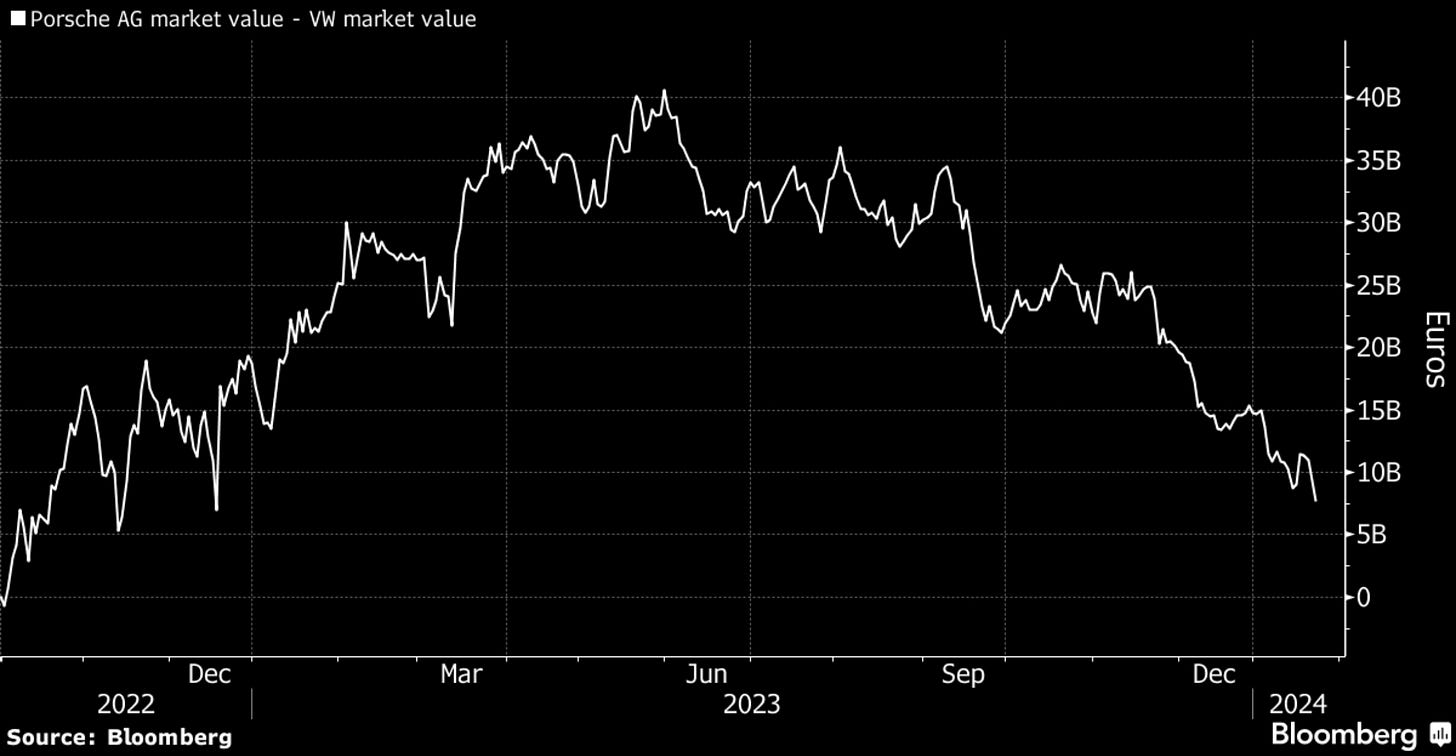

Meanwhile, Ferrari's shares have experienced a significant increase of over 50%. Porsche's shares have told another story, decreasing by approximately 20%. As a result, Porsche's market value has decreased to a level that is nearly on par with that of its former parent company. This marks a significant shift from the gap that once stood at €40 billion between Porsche and Volkswagen.

What’s Gone Wrong For Porsche?

The pricing and initial surge in the stock price were driven by VW holders trading their VW shares for Porsche, as well as automobile investors looking for similar profits to those achieved with Ferrari. However, the subsequent decline was primarily due to Porsche's own actions rather than external factors.

The German car manufacturer has faced challenging times. Its price-to-earnings ratio has dropped to less than a quarter of Ferrari's, mainly due to a decline in the Chinese market, which has been Porsche's biggest market for a long time. Additionally, Porsche has experienced some production issues that have affected the rollout of some key models, such as the electric version of its popular Macan SUV. These problems have had a significant impact on the company's performance and have caused concerns among analysts.

Prospects for 2024 are not looking up either. The company's management recently told analysts that sales volumes are likely to remain flat. This has led to questions about when the company will start upgrading numbers. Jefferies analyst Philippe Houchois commented on the situation, saying, “You thought you were buying into a business that was stable and improving, and it turns out that's not the case.”

The most recent research note from the Jefferies analyst reiterated his Neutral rating. However, the target price has been revised downwards from €90 to €80.

Porsche is facing a challenging time. It will require significant efforts to overcome these issues and restore its performance.