Prolonged Plateau For Powell's Policies

But the ECB seem set to cut in June.

As this year got underway, there was one hot topic that had markets fixed: Rate cuts.

Investors were expecting to see six quarter-point cuts from the Federal Reserve through the year, and they were set to start in March. But as we get underway in the second quarter, the theme has changed from rate cuts to questioning if we’ll even see one cut at all… at least, that’s the story in the US.

The dynamic of the major central banks has changed swiftly in recent weeks. Traders have held firm on bets that the ECB will cut rates in June while paring the outlook for the Fed.

Both sides of the pond continue to reiterate that they will remain data-dependent in making decisions. So, what’s causing the disparity between the two?

The Fed and it’s data

Fed rate cuts took another hit last week after the latest blockbuster jobs report on Friday showed continuing strength in the economy. The US witnessed a surge in job additions, surpassing economists’ expectations. This was attributed to enhanced worker productivity and the steady influx of immigrants contributing to employment growth.

Later today, investors can expect to gain fresh insights into the future trajectory of interest rates with the release of the consumer-price index. Despite inflation having subsided from its peak in the last 40 years, the past two months have seen readings that exceeded expectations, thereby reinforcing the Federal Reserve's cautious stance on implementing cuts.

Both of these measures have been a key factor in the Fed’s stance so far in this cycle.

The ECB and it’s data

Though Federal Reserve officials have expressed reluctance to reduce interest rates, their counterparts in Europe appear more enthusiastic about commencing the rate-cutting process.

There are three key factors that differentiate the monetary policy approaches of the US and Europe. Firstly, inflation rates are descending at a rapid pace in the Euro area, while in the US, the Fed's preferred inflation measure indicates persistent price growth. Secondly, some policymakers in Europe are increasingly vocal about advocating for earlier policy moves. Lastly, the economic forecast on this side of the pond (Europe) is comparatively weaker, and hence, there is an added incentive for central banks to provide support for growth, which means lowering rates.

Implications of two different stances

One result of the ECB moving before the Fed will be seen in the currency markets. Higher interest rates tend to attract foreign investment, increasing the demand for and value of the home country's currency. Conversely, lower interest rates tend to be unattractive for foreign investment and decrease the currency's relative value.

Therefore, such a move could reinforce the dollar's strength. The Dollar Index, a measure of the dollar’s value against the currencies of most of America’s key trading partners, has already gained 3.5% this year. The Euro has a 57.6% weight in the Dollar Index.

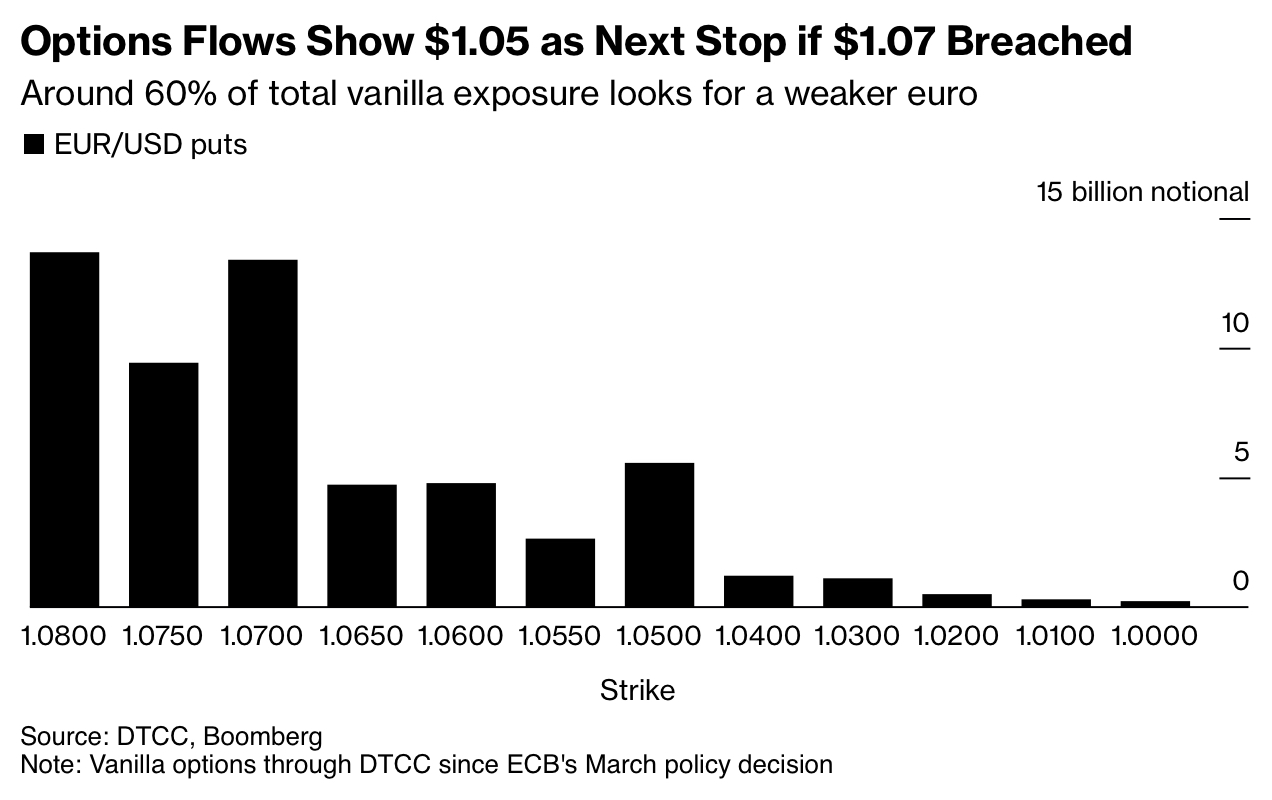

Could we see the Euro touching parity with the dollar? With the surprise decline in 2022 still fresh in traders’ minds, many are not willing to ignore the possibility of a similar decline, especially with the potential of a Donald Trump presidency that could bring inflation-stoking tax cuts and trade barriers.

As the world’s largest economy, the US tend to have an immediate effect on financing conditions, exchange rates, and other metrics in other regions. Policymakers elsewhere can't escape the impact of the Fed's actions when evaluating their own economies. This means that the ECB officials, who will gather this week to discuss how quickly, when, and how much to reduce their aggressive monetary tightening, will need to keep an eye on the US to chart their own path, even if they are publicly stressing their independence.

So yes, the ECB can move first, but we think policies diverging for longer will be unlikely. But some economists are predicting a divergence to last, estimating 2025 rates for the EU to be 2.65 compared to 3.50 in the US.