Quickly Forgotten and Suddenly Back

A weekly look at what matters and how to trade it. (December 1st)

A new month. The final stretch.

US equities snapped back this week, helped by holiday-thinned liquidity and a rotation back into the Mag7. Alphabet and Meta led from the front, each up more than 6%. With liquidity light and positioning still skewed toward mega-cap growth, the rebound carried easily across the tape.

The week’s defining storyline came from that Alphabet news. Reports that Meta is in talks to spend billions on Google’s Tensor Processing Units (TPUs) shifted market psychology sharply. Nvidia slumped 7% at one point while Alphabet powered to fresh highs, pushing closer to a $4 trillion valuation (now up 90% over the last year, who said there’s no alpha in large caps?). For months, Google had been characterised as trailing the AI frontrunners; the TPU momentum and new software stack are now forcing a rethink on competitive positioning.

Outside of that driving narrative, all eleven sectors finished in the green as a dovish pivot from the New York Fed’s Williams firmed expectations for a December cut. Communication Services and Consumer Discretionary posted outsized gains on the prospect of stimulus, while Energy lagged early after crude sold off on signs of progress in Ukraine peace discussions. Volatility bled out, with the VIX settling below 17, another reminder of how quickly the market reverts to “calm until further notice” when macro shocks fade from view.

Bubble chatter resurfaced but did little to slow momentum. The historical pattern remains stubborn. The Mag7 tend to snap back quickly after multi-week drawdowns, and the longer-run gains following such resets have been anything but subdued. Into year-end, the durability of this leadership remains the central debate, but for now, the burden of proof still lies with the sceptics.

Regarding economic data and Fedspeak, delayed data finally began to drip through, and the tone was lacklustre. September retail sales missed on both headline and control-group metrics, pointing to cooling momentum under the surface. The key swing factor was NY Fed’s Williams, who broke with the more cautious tone from Powell and others by saying he sees room for a near-term cut. That shift filtered quickly into asset prices as markets interpreted the language as a sign that the Committee is “on board” with easing, despite internal dissent and lingering concerns over inflation persistence.

Elsewhere in markets, the USD drifted lower through the week in quiet, holiday-thinned trading. A softer dollar narrative was helped along by reports that NEC director Kevin Hassett is the frontrunner for Fed Chair, read dovishly by FX desks. Month-end flows slowed the move but didn’t reverse it, and outside of UK budget-related swings in GBP/USD, price action was orderly. Not much to report.

Treasuries followed a similar path: calm, shallow range, modest rally. The 10-year yield slipped ~5bps with the curve little changed in what amounted to another parallel shift, consistent with recent weeks. Expectations of the December cut anchored the front end and stabilised duration after several volatile weeks.

The Week Ahead

Before we get started with ideas, commentary, and portfolio changes for the week ahead, it is worth resharing our recent primer for those who may not have read it yet. This market segment is becoming increasingly important and remains the core risk to the AI narrative.

It is also Cyber Monday. Unfortunately, Bloomberg isn’t great at offering discounts on its terminal and still commands the $30,000 annual fee, but we’re happy to offer something out to readers: one month free to close out the year. Make use of full research articles, macro monitors, and chat updates (available only on the app or website).

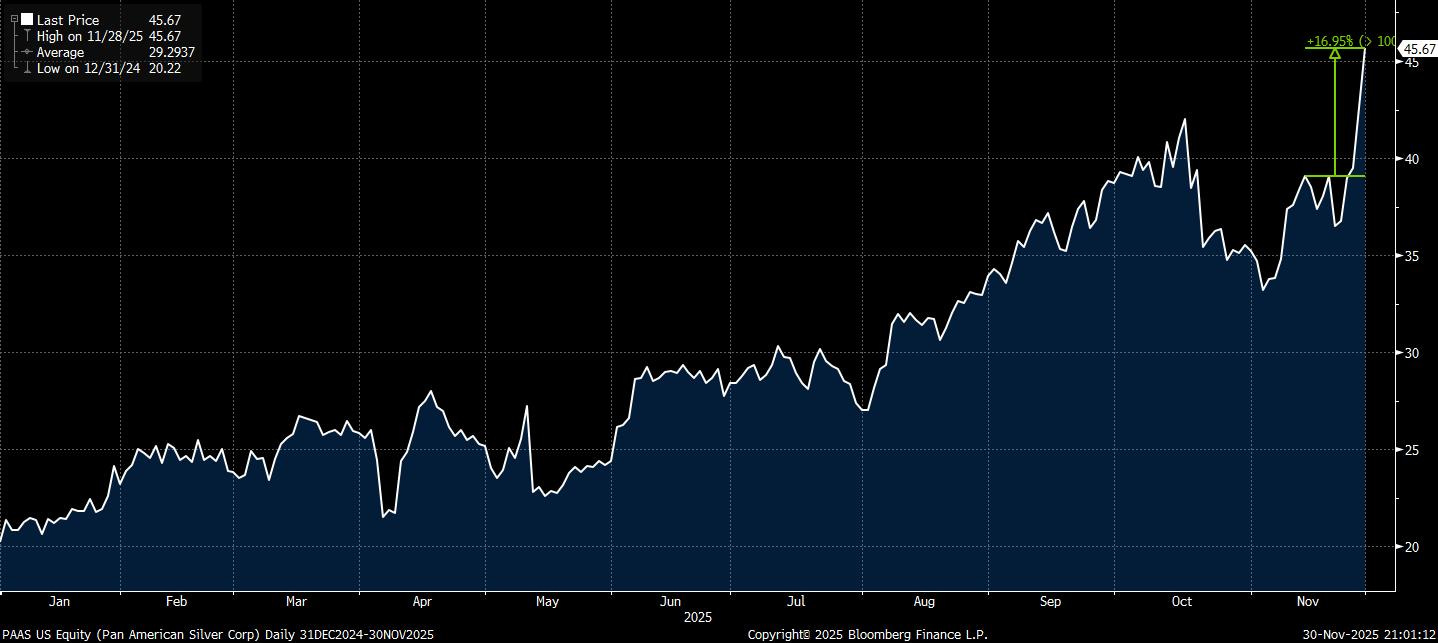

It may be best to start off in the commodity space this week, revisiting a mid-week note from Nov. 13, Signals From the Commodity Curve.

In this note, we discussed XAU building a base after its strong selloff, following momentum-chasing traders catching the late stage of the cycle. We laid out the case for some upside, but targeted this exposure towards a mining name. The chart below shows the performance of GLD vs. DGX in November.

Miners as a whole did well last month. But in particular, our upside exposure name, PAAS, did very well from our initiated long, +17%.