Quiet... Jay's Talking (Jackson Hole Preview)

All eyes are watching Jerome Powell as he sets the tone for interest rates at this year's meeting. We look into the possible outcomes and market effects.

Jackson Hole. It’s a significant date in the economic calendar. The Federal Reserve's economic symposium is a three-day annual international conference by the Federal Reserve Bank of Kansas City at Jackson Hole in the United States. The event is attended by central bank leaders worldwide, who discuss world events and financial trends as investors and news reporters listen in on the action.

This year’s meeting has one specific topic that many will be paying close attention to — global interest rates.

Where we stand

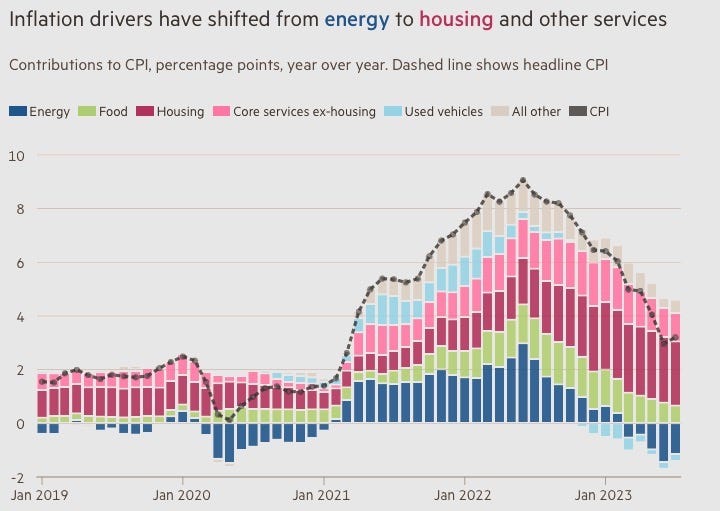

The US central bank just published minutes of its July policy meeting, and the record showed that, at the time, most Fed officials saw significant upside risk to inflation, which in turn may require even more tightening. Although inflation has decreased over the last months, policymakers will be cautious to call a victory just yet.

Key data points since that meeting have demonstrated that price and wage pressures continue to diminish, which should support the argument for ceasing rate rises. Although consumer expenditure and labour-market activity indices have continued to improve, experts may be concerned about the likelihood of an ongoing inflationary decline.

A crucial question is how Powell might be considering those developments. Additionally, any hints as to how the central bank might formulate a strategy for rate decreases in 2024 will be closely watched. Participants will also enjoy stimulating conversations regarding "Structural Shifts in the Global Economy," the retreat's theme for this year.

What to expect from Fed Powell

Most investors expect a hawkish tone by Fed Chair Jerome Powell on Friday as markets wake up to the reality of higher-for-longer interest rates. Over 80% of the 602 respondents said Powell's Jackson Hole speech would reinforce the message of a hawkish hold versus 10% who see him setting a narrative for rates to come down. Those surveyed seem to accept that the era of rock-bottom yields is over; 79% see interest rates and inflation higher for years to come, and two-thirds said the Fed hadn't conquered inflation

In the rest of this article, we’ll take a look at the two possible outcomes:

Market moves on a hawkish tone — long dollar, short equities

Market moves on a dovish tone — short dollar, long equities

Target levels for DXY and SPY